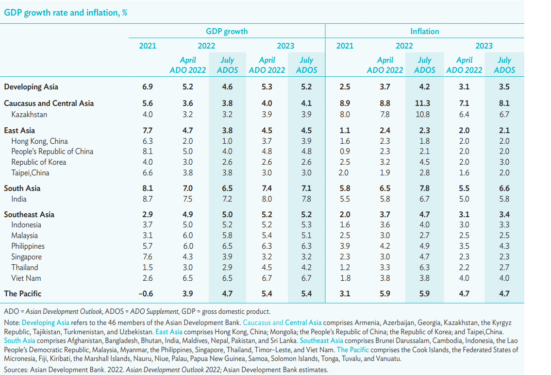

THE Asian Development Bank (ADB) has lowered its economic growth forecast for developing Asia and the Pacific to 4.6% this year (from 5.2% in April) due to slower expansion in China, more aggressive monetary tightening in advanced economies, and fall-out from the continued Russian invasion of Ukraine.

Likewise, ADB also revised downward its growth projection for 2023 to 5.2% from 5.35% previously.

Moreover, it also revised up its inflation forecast for both years – mainly on higher fuel and food prices – from 3.7% to 4.2% for 2022 and from 3.1% to 3.5% for 2023.

“Risks to developing Asia’s economic outlook remain elevated and mainly associated with external factors,” ADB pointed out in its most recent Asian Development Outlook (ADO) 2022 Supplement report.

“A substantial slowdown in global growth could hurt exports, manufacturing activity and employment prospects, and cause turbulence in financial markets.”

The aggressive monetary tightening by the Fed and other major central banks – even if largely anticipated – could damage growth and rattle financial markets in the region, according to ADB.

“A worsening fall-out from the war in Ukraine could lead to a further surge in global energy and commodity prices with likely knock-on effects on growth and inflation in developing Asia,” it cautioned.

“Rising food prices and shortages, in particular, could threaten food security and heighten social tensions in some economies.”

From within the region, downside risks could arise from the potentially lingering effects on supply chains from China’s latest round of lockdowns and the country’s growth slowdown which could hinder developing Asia’s growth momentum.

Specifically for Malaysia, ADB expects increased uncertainty and weaker global growth to dampen Malaysia’s prospects.

“Growth of 5% in 1Q 2022 was underpinned by strong private consumption and increased government assistance through the Bantuan Keluarga Malaysia family assistance programme,” opined ADB.

“But business confidence and the PMI (Purchasing Managers’ Index) continue to soften in step with weaker global prospects and supply disruptions from cities in China that were locked down to tackle COVID-19 outbreaks.”

Meanwhile, Malaysia’s agriculture growth remained marginal in 1Q 2022 due to adverse weather conditions and input cost shocks from the war in Ukraine while tourism is making a slow recovery.

“Arrivals this year are expected to be only a third of the pre-pandemic level despite the country re-opening its borders to international visitors in April,” cautioned ADB. “The growth forecast is revised down to 5.8% for 2022 and 5.1% for 2023.”

Nevertheless, ADB expects lower headline inflation for Malaysia with price controls and subsidies on oil and basic food products to prompt a downward revision in 2022’s inflation forecast from 3.0% to 2.7% while the 2023 forecast is maintained at 2.5%.

This is in contrast to Southeast Asia’s inflation forecast for 2022 which has been raised significantly to 4.7% from 3.7% while that of next year is revised upward to 3.45% from 3.1%. The higher rates for both years are due to rising energy and food prices as well as supply chain disruptions. – July 21, 2022