AEON Credit Service (M) Bhd celebrated the launch of its associated company, AEON Bank (M) Bhd, on May 26, marking the latter’s establishment as Malaysia’s first Islamic digital bank.

This is a significant milestone in re-affirming AEON Credit’s commitment towards financial inclusivity through AEON Bank.

The journey began in June 2021 when AEON Financial Service Co Ltd (Japan) and AEON Credit Service Malaysia submitted an application to Bank Negara Malaysia (BNM) for an Islamic digital banking license.

Subsequently, AEON Bank received a license from the central bank and the Finance Minister on Jan 8 this year to commence its digital banking operations that centre on digital financial solutions that adhere to Shariah banking principles.

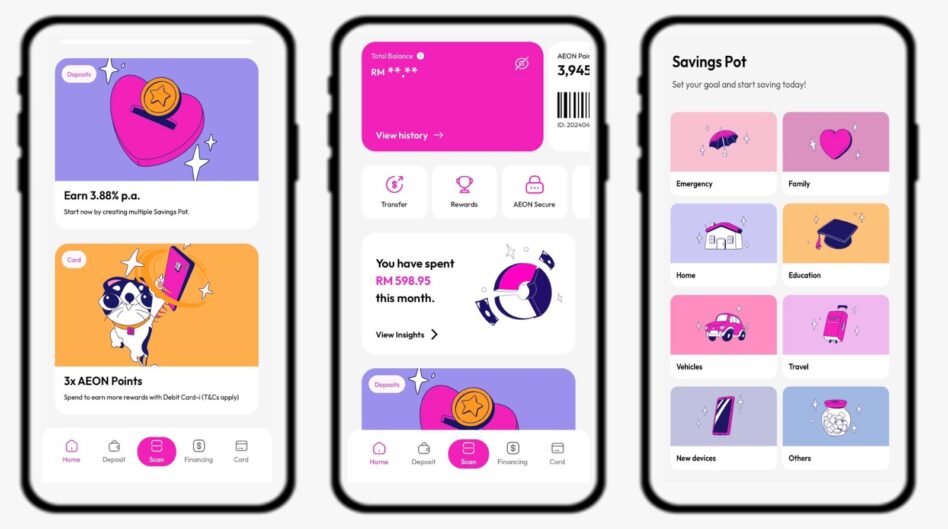

Currently, AEON Bank offers digital banking products such as the savings account-i, savings pots with customisable optimisation features, budgeting tools and more.

A grand launch of AEON Bank was held at AEON Mall Shah Alam which began with a video address by Japan’s ambassador to Malaysia Katsuhiko Takahashi.

AEON Bank CEO Raja Teh Maimunah Raja Abdul Aziz described the trust placed by BNM and the Finance Ministry (MOF) in AEON Bank to build Malaysia’s first fully Islamic digital bank as a significant milestone for the AEON Group after 40 years of presence in Malaysia.

“Our mission is to offer safe, simplified and inclusive Shariah compliant digital banking solutions to all Malaysians.,” Raja Teh Maimunah pointed out.

“AEON Credit has a long and established track record of promoting financial inclusion by providing access to financing to individuals who have traditionally not been able to access funding.”

Added Raja Teh Maimunah: “We thank Malaysians for the overwhelming response thus far. We are in the early phase of our product roll-out and will continue to introduce more products and features for our personal banking customers. Over time, we will expand our products and services to small businesses.”

Meanwhile, AEON Credit’s managing director Daisuke Maeda assured Malaysians that the group has a long and established track record of promoting financial inclusion by providing access to financing to individuals who have traditionally not been able to access funding.

“AEON Bank will play a critical role in facilitating our commitment to ‘Bring Finance Closer to Everyone’ by enabling even more Malaysians, especially the underserved segments, to access banking services that may have been previously unavailable with traditional banks,” he enthused. – May 30, 2024