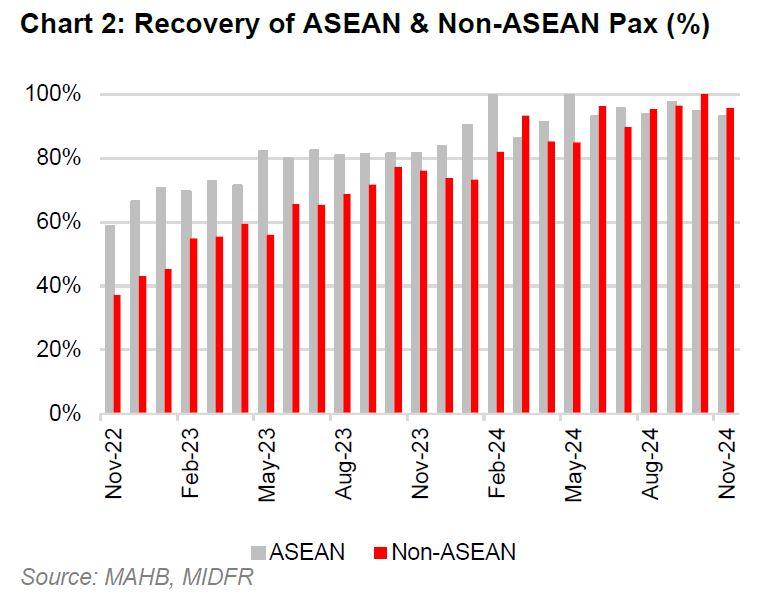

AS THE year draws to a close, total passenger traffic in Nov-24 achieved an 89% recovery (domestic: 83%, international: 94%), matching the 89% recovery recorded for the 11 months of calendar year 2024 (11MCY24).

Demand remained robust despite seat capacity recovering to only 83%, as reflected by the strong load factor of 79% in Nov-24, which is +5.4 percentage points higher than pre-pandemic levels.

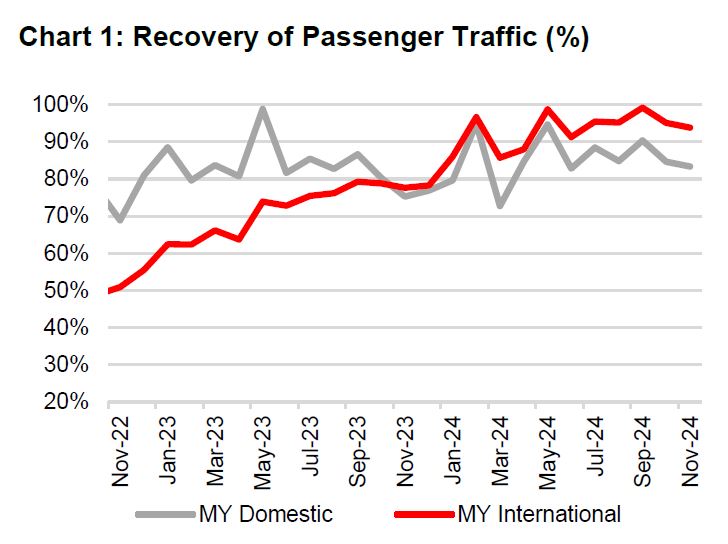

“The international sector’s recovery has consistently outpaced the domestic sector over the past year. 13 new airlines launched services to Malaysia, exceeding MAHB’s annual target of 12,” said MIDF Research (MIDF) in the recent Sector Update Report.

Notably, 8 out of these 13 are Chinese airlines, with passenger traffic from China fully recovering from Jul-24 onwards, driven by the restoration of network connectivity.

That said, the recovery was also bolstered by existing airlines, which have launched 52 new services as of Sep-24.

MAHB continues to report new services departing from Malaysia’s major international airports each month, along with increased flight frequencies, reflecting a positive trend.

“MAVCOM projects passenger traffic for CY24 to range between 95.4mil and 97.6mil, slightly below our estimate of 98.7mil,” said MIDF.

MIDF anticipated this month’s passenger traffic to range between 8.5mil and 10mil, supported by the year-end holiday season, bringing the full-year figure to between 93.6mil and 95.1mil, which they still deem to be in line with expectations.

Over the long term, MAHB stated that they are actively pursuing over 25 new airlines, and they are expected to commence operations within the next two years.

To note, British Airways’ commencement has been delayed to Apr 25 due to challenges with aircraft availability.

“We anticipate a preliminary full recovery next year, with projected growth of +4.0% compared to CY19 levels. We currently do not have a top pick for the sector,” said MIDF.

However, this is subject to a few key downside risks, including delays in AirAsia Malaysia’s fleet reactivation, further disruptions in aircraft deliveries, and ongoing supply chain challenges. —Dec 20, 2024

Main image: wns.com