MALAYSIA’s exports experienced a significant surge of 12.3% year-on-year in July 2024. This growth exceeded market expectations of 9% and marked a notable recovery from the 1.7% increase seen in the previous month.

“It represented the most robust export expansion since November 2022, driven by further strengthening foreign demand. Shipments of manufactured goods rose by 10.6% year-on-year, with a notable boost coming from electrical and electronic products at 2.6% year-on-year,” said AM Bank group (AMB) in the latest Daily Market Snapshot report.

Malaysia’s exports to major trade partners, including the US (30.9%), Singapore (18.1%), Japan (11.6%), the EU (14.2%), and ASEAN countries (16.0%), showed growth, while exports to China (- 11.4%) and Hong Kong (-10.0%) declined during the same period.

Imports into Malaysia surged by 25.4% year-on-year, surpassing market expectations of 15.3%, driven by solid demand.

Imports of intermediate goods increased by 41.2% year-on-year, while capital goods surged by 44.4% year-on-year to RM15.1 bil.

Additionally, imports of consumption goods grew by 25.5% year-on-year. In terms of sectors, manufacturing saw a significant increase of 28.1% year-on-year, supported by growth in electrical and electronics products (52.7% year-on-year), machinery, equipment (52.4% year-on-year), and manufacture of metal (24.4% year-on-year).

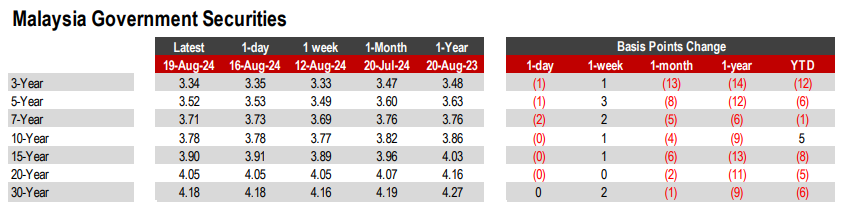

MYR Government Bonds

The government bonds market strengthened, with yields down 1-3 basis points on Monday as the ringgit appreciated near the 4.3850 level.

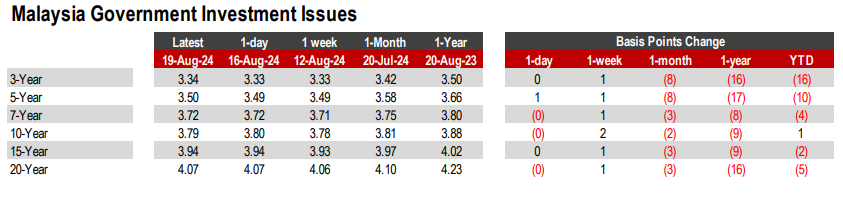

The reopening of 5Y Government Investment Issue 07/29 was announced with an amount of RM4bil, which was lower than AMB’s expectation of RM5bil.

MYR Corporate Bonds

“Trading interest in the ringgit corporate bond market was subdued as we began the week despite the firmer govvies performance. We think the market could be awaiting further pointers on where the govvies are headed at this point,” said AMB.

Meanwhile, flows were led by higher-rated AAA and AA1 papers. These include AAA-rated PASB 06/26, which fell 13 basis points to 3.70%, and AAA PSEP 02/30, which shed 3 basis points to close at 3.83%. – Aug 20, 2024

Main image: India Briefing