INDONESIA’s change in crude palm oil (CPO) and refined palm oil export tax policy from a graduated scale to a flat 7.5% and 4.5% is expected to benefit all planters in Indonesia and make Indonesia more competitive than Malaysia.

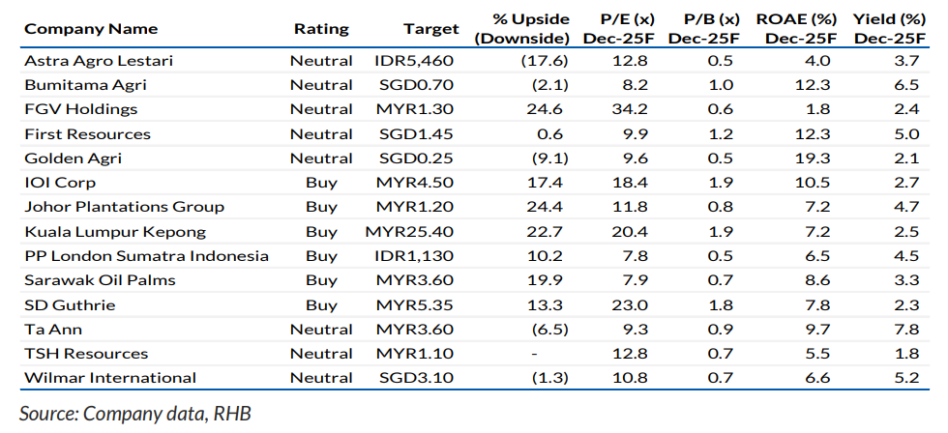

“Overall, we remain NEUTRAL on the sector,” said RHB in the recent Regional Sector Update Report.

The Indonesian government has, with effect from 21 Sep 2024, abolished export tax rates based on a graduated scale, and put into place a fixed 7.5% export tax rate for CPO, to increase the competitiveness of palm oil prices in Indonesia and provide added value to the price of fresh fruit bunch at the farmer level.

Prior to this change, Indonesia had imposed a levy of between USD55 to USD240per tonne for CPO exports, depending on a set of price brackets for the monthly reference price.

The export tax rates for refined palm oil products and biodiesel are now also at flat rates of 4.5% and 3%.

As an example (excluding all other costs), at RM4,000 per tonne, a CPO exporter in Indonesia will now receive RM3,371 per tonne versus RM3,248 per tonne previously.

While the edge that downstream refiners in Indonesia have would widen further, and Malaysia’s competitiveness for downstream products would decrease.

Using the same example, the advantage downstream refiners would have in Indonesia, at a CPO price of RM4,000 per tonne, should increase to USD84 per tonne.

In general, all Indonesia planters should benefit from this change in tax structure, given the higher effective CPO prices achievable with the lower export duties, and the wider tax advantage downstream planters would have.

This, together with the revision in Domestic Market Obligation or DMO ceiling prices by 12% to IDR15,700 per litre from IDR14,000 in mid-August would help Indonesia planters record higher effective average selling price.

The estimated increase in effective CPO price ranges RM20-137 per tonne, based on a CPO price range of RM3,000-4,500 per tonne.

“For 2025, based on our estimated RM3,800 per tonne CPO price assumption, this change would improve earnings of the Indonesia and SGX-listed planters by RM116 per tonne,” said RHB.

Hence, the earnings impact is likely to be in the range of 6-12% per annum, depending on forward sales strategies and percentage of local sales.

“We make no changes to our earnings forecasts, for now. Our Top Pick in Indonesia is LSIP while, in Malaysia, we continue to like stocks like SDG, IOI Corp, JPG, and SOP,” said RHB. – Sept 23, 2024

Main image: nationalgeographic