ANALYSTS forecast years of losses at Malaysia’s ATA IMS Bhd and challenges in winning new customers following forced labour revelations, which led to major client Dyson Ltd cutting ties with the company.

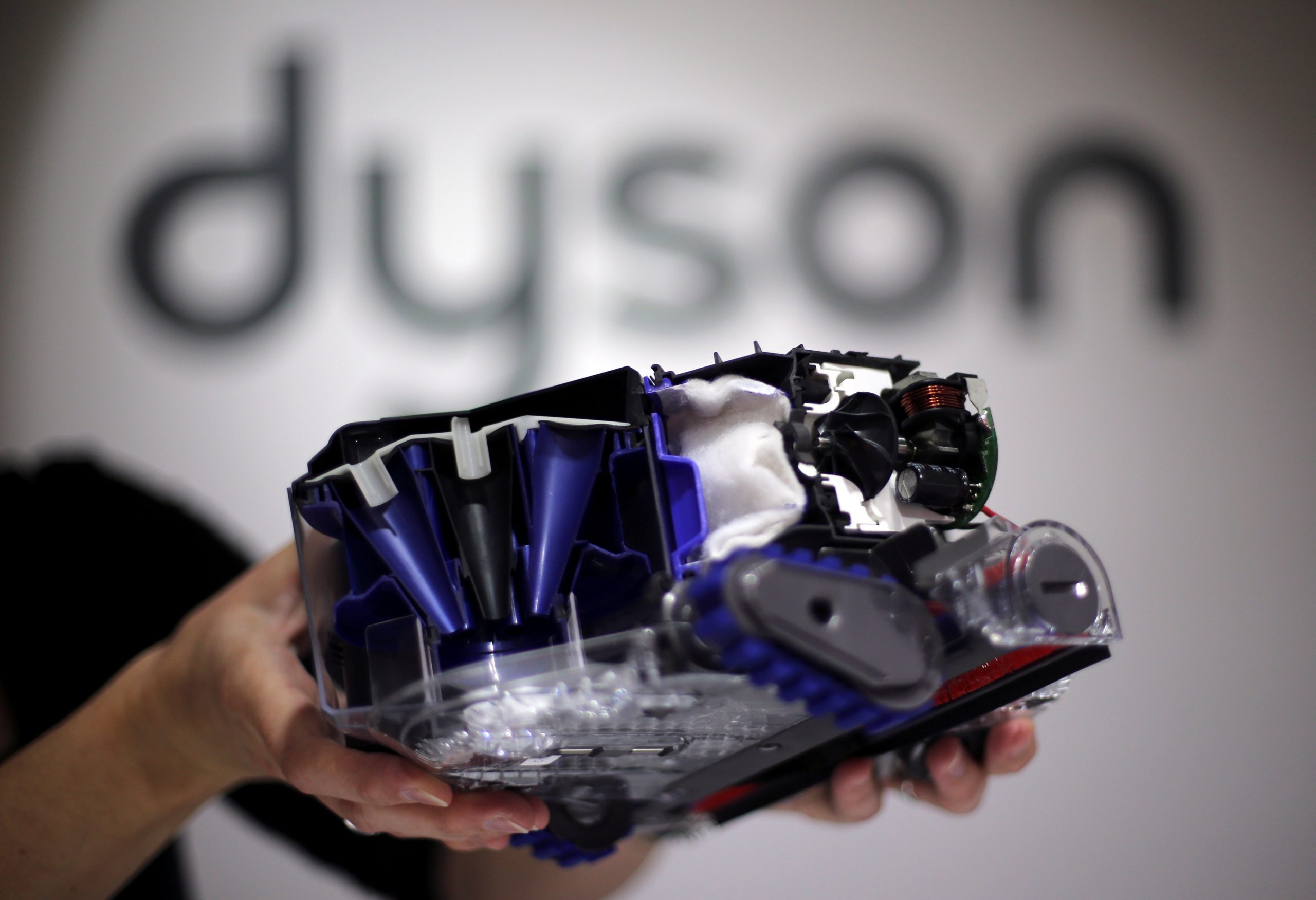

Shares in ATA, the company that make parts for Dyson’s vacuum cleaners and air purifiers, plunged a further 36.6% on Friday after Dyson told Reuters it had terminated contracts with the Malaysian supplier effective June 1 next year following an audit of the company’s labour practices and allegations by a whistleblower.

The stock has lost more than half its value since the report was published on Thursday (Dec 25).

AmInvestment Bank said in a note the full impact of Dyson’s withdrawal is expected in the 2023 financial year which would “severely impact” ATA’s earnings that year and beyond.

Dyson contributes to around 80% of ATA’s revenue.

“We also foresee challenges ahead … to secure new orders given its dented reputation and ongoing labour shortage crisis, which is being viewed as an operational risk until a concrete solution emerges,” the note said.

ATA may have enough time to replace some of its lost orders with other existing customers, AmInvestment added.

ATA did not respond to Reuters request for comment.

On Thursday, the company said it had taken steps to engage Dyson and advisers after it was notified of the summary of the labour audit. The company also said its board was looking into the validity of Dyson’s termination notice.

Another analyst covering the company also forecasts two-to-three years of losses and said ATA may face “quite a lot of obstacles” ramping up output for other customers given the allegations.

Rival electronics manufacturing services providers SKP Resources Bhd and VS Industry Bhd could benefit from Dyson’s withdrawal from ATA, the analyst said, declining to be named due to sensitivities.

Shares in SKP rose 10.6% while VS rose 8.5% after the news was reported on Thursday.

ATA may seek to pay down short-term debts during the notice period, the analyst said.

“The electronics manufacturing service business is lucrative. There are lots of products that they can look into especially with the rising Internet of Things trend. However, ATA might face difficulty getting new customers,” added the analyst. – Nov 26, 2021