BANK Negara Malaysia (BNM) is likely to raise the interest rate by another 25 basis points (bps) during its Monetary Policy Committee (MPC) meeting slated for Jan 18-19 next year with core inflation having reached a new peak of 4.2% year-on-year (yoy) in November.

TA Securities Research which made such assumption further expects another rate hike at March’s meeting, thus pushing the overnight policy rate (OPR) to settle at 3.25%.

“This could lead to Malaysians having tighter budgets, reduced demand for goods, and eventually lower pricing. As a result, prices could drop by around 3.0% next year,” projected economist Farid Burhanuddin in an economic update.

“The expectation that fuel subsidies will continue along with strengthening of the ringgit (forecast: RM4.35/US$; 2022E: RM4.40/US$) and normalising commodity prices will also contribute to the moderate annual growth.”

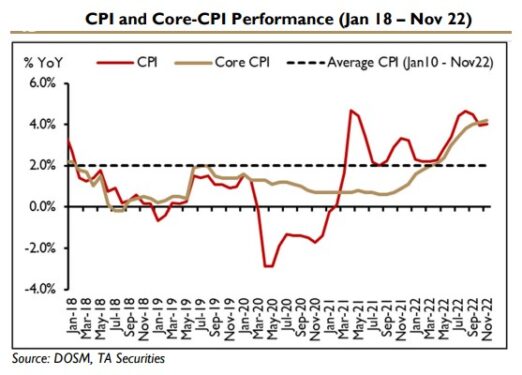

Malaysia’s headline consumer price index (CPI) rose by 4.0% year-on-year (yoy) to 129 points in November 2022 – the same rate seen in the previous month – with food prices continuing to be the leading cause of the increasing inflation rate, followed by the higher cost of transport segment.

Trend-wise, November’s inflation marked the 12th consecutive month of Malaysia surpassing its average inflation of 2.00% yoy from January 2010 to November 2022.

Despite the sustaining headline CPI, core inflation (excluding volatile items of fresh food and goods controlled by the government) accelerated further to record 4.2% yoy during the month – the fastest gain ever recorded. It was up by 0.1 percentage points from October’s reading previously.

At the same time, CPI without fuel rose at a more rapid pace of 4.2% yoy during the month compared with a 4.0% annual gain in the prior month. This segment covers all goods and services except unleaded petrol RON95, RON97 and diesel.

Against the backdrop of rising prices of goods, TA Securities Research has raised its CPI figure to 3.4% for 2022 as “our projection of 3.1% for this year is unlikely to come true”.

Elsewhere, Kenanga Research also expects BNM to raise the OPR by another 25bps in January 2023 to further realign with the global monetary tightening trend and to curb the persistently high core inflation.

“However, we currently assign only a 50% probability of another similar sized rate hike in March due to growing global economic uncertainty and a potential domestic slowdown later in the year,” reckoned its head of economic research Wan Suhaimie Wan Mohd Saidie and team.

“As such, we reckon that the terminal rate would be around 3.00%-3.25% in line with the long term OPR average after which we expect BNM to keep it unchanged for the rest of 2023.”

Despite its expectation that core prices may start to trend lower in the next few months due to a drop in prices of imported inputs amid strengthening ringgit and slowing global demand, Kenanga Research is wary that risks remain skewed to the downside due to elevated economic uncertainties.

“Nevertheless, inflation may start to ease in 2Q 2023 as the new government made tackling the rising cost of living its priority while maintaining subsidies till at least end-2Q 2023,” opined the research house.

“This, coupled with the eventual re-opening of China and the normalisation of supply chain may bring the CPI down to 2.5% on average in 2023.” – Dec 27, 2022