THE unity government has no imminent intentions to restore the disputed goods and services tax (GST) due to its regressive nature, according to Prime Minister (PM) Datuk Seri Anwar Ibrahim.

The Tambun MP noted that in addition to dealing with the rising expense of living, Malaysians are also still going through the post-COVID-19 pandemic recovery phase.

“Food inflation in 2022 was at 5.8%, and this affects the lower-income group more. At the same time, GST is also a tax that is regressive in nature,” he said in a written parliamentary reply to Bagan Serai MP Datuk Idris Ahmad (PN-PAS) yesterday (March 21).

Anwar stated that any proposal to reinstate the tax system would only be taken into consideration after the government had improved its system for minimising negative effects on the lower-income group.

Moreover, the implementation of GST also hinges on how well the Malaysian economy recovers and when the nation is in on a more solid footing.

“Any policy change pertaining to taxes will take into account its impact on the economy and the people’s cost of living. As such, the government will consistently monitor the current economic position and consider fiscal measures that are suitable with short and medium-term needs.”

Anwar also reiterated that the unity government had in its revised Budget 2023 taken a more progressive approach that would see the rich get taxed more.

This includes increasing the income tax rate for individuals with taxable income of more than RM230,000 a year as well as introducing a luxury goods tax and capital gains tax on the sale of unlisted shares.

“The government will continue to conduct engagements with all stakeholders to review the study of further reforms to the tax system,” noted Anwar. “This doesn’t necessarily have to involve GST. There is also space to improve the existing sales and services tax (SST).”

Anwar had previously stated in an interview with Bloomberg that GST will only be considered for re-introduction if the income levels of Malaysians have increased.

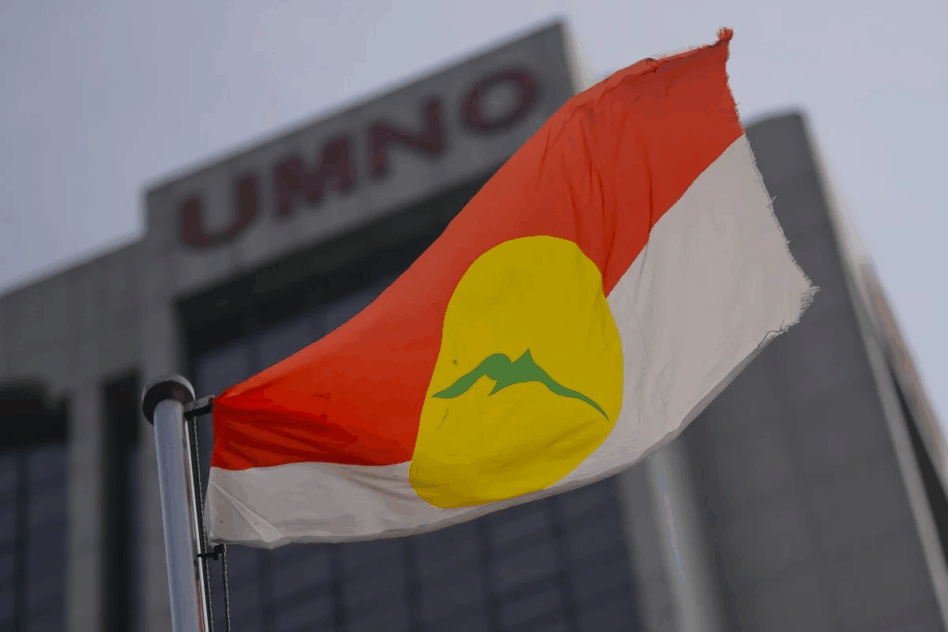

One of the electoral promises made by Pakatan Harapan (PH) prior to the 14th General Election was to abolish the GST which was instituted by Datuk Seri Najib Razak’s Barisan Nasional (BN) administration in April 2015 at a rate of 6% to replace the then sale and service tax (SST) regime.

Recall that following its victory on May 9, 2018, the PH government swiftly declared GST to be zero-rated before totally eliminating the system and replacing it with SST in September of the same year.

Since then, there have been increasing calls for the GST to be reinstated in order to enable a quicker reduction in the budget deficit and lower the national debt from a variety of sources, including industry players. — March 22, 2023

Main photo credit: The Edge Market