THE bullish streak momentum in the ringgit is likely to continue into early 2023 as the sentiment towards the new administration’s policy framework will remain positive.

This is very much evidenced by the daily data for foreign inflows into the local currency bond market.

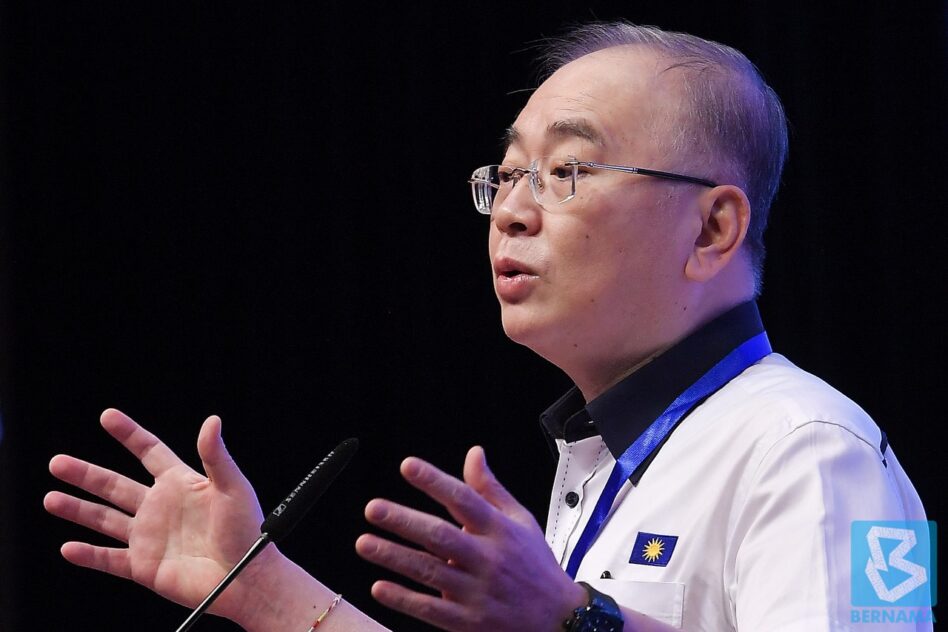

This has prompted the RHB Banking Group to revise its US$/RM forecast to RM4.25/US$ from RM4.60/US$, attributable to US$/RM positioning which is largely driven by the unwinding of positioning particularly among corporates, according to its chief economist Dr Sailesh Kumar Jha.

He said that the unwinding process is in its infancy and will continue into year-end to some degree. “Net capital inflows into the local currency bond market are positive for the short-term ringgit outlook against the greenback,” he pointed out in a report.

“Investor sentiment towards Malaysia is improving as reflected by a significant drop in five-year CDS (credit default swap).”

On the bond market, Jha expects the formation of the new Cabinet as likely to be well- received by foreign investors “whom we believe have already been increasing their exposure to the local currency government bond market over the past few weeks”.

In his projection, such trend would continue into early 2023 as Budget 2023 will likely focus on fiscal consolidation, subsidy reduction, and improvement in the implementation of large infrastructure projects along with a larger allocation to the health sector.

“In addition, Malaysia’s key sovereign debt metrics such as resilient growth, well-anchored inflation expectations, the resilient balance of payments position, central bank credibility, and political stability are attractive for foreign investors,” opined Jha.

He further noticed from the daily data of foreign inflows into the local currency bond market as well as anecdotal evidence, “a rising tide” and expects this trend to continue into early 2023 as sentiment towards the new administration’s policy framework will remain positive.

All-in-all, Jha remains “overweight” on bonds, “market-weight” on equities, and “underweight” on cash, a view that he held since April this year.

The general consensus among financial market analysts is that the appointment of Datuk Seri Anwar Ibrahim as Malaysia’s 10th Prime Minister has removed key market uncertainties as it allays fear of protracted feuding among the various coalition parties that would mire Malaysia into further economic uncertainty.

On the equity market, they added that some uncertainty continues to loom over the horizon given the uncharted territory that Malaysia is treading on following the formation of an unprecedented and untested unity government concept.

They add that clearer direction for the equity market would emerge once support for Anwar’s leadership by lawmakers can be established with tabling of motion of confidence on Dec 19 when the Parliament convenes. – Dec 9, 2022

Main photo credit: Bloomberg