GLOBAL investors were on edge as voting in the US election entered its final stretch on Tuesday (Nov 5), drawing to a close a dramatic campaign that has moved bonds, stocks and other assets in recent months and could further sway markets as results become clearer.

One of the most unusual – and tightest – presidential elections in modern US history could have starkly different outcomes for tax and trade policy as well as for US legal and democratic institutions, depending on whether Republican candidate Donald Trump or Democratic candidate Kamala Harris prevails.

The results which were due to start trickling in later on Tuesday evening could rattle assets globally and determine the outlook for US debt, the strength of the greenback and a host of industries that make up the backbone of Corporate America.

“This is the most significant election that I have seen in my career,” said Mike Mullaney, director of global markets research at Boston Partners who has worked in investment management for over 40 years. “It’s going to be very bifurcated.”

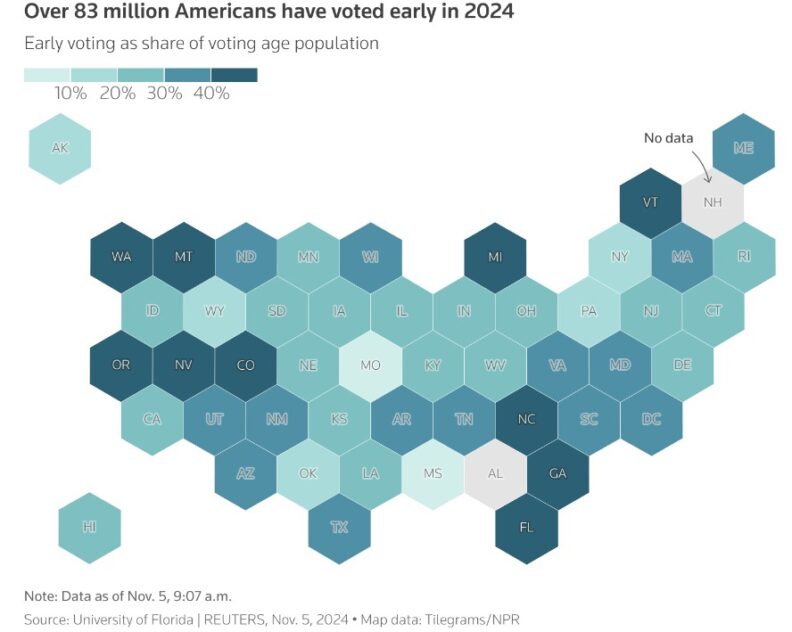

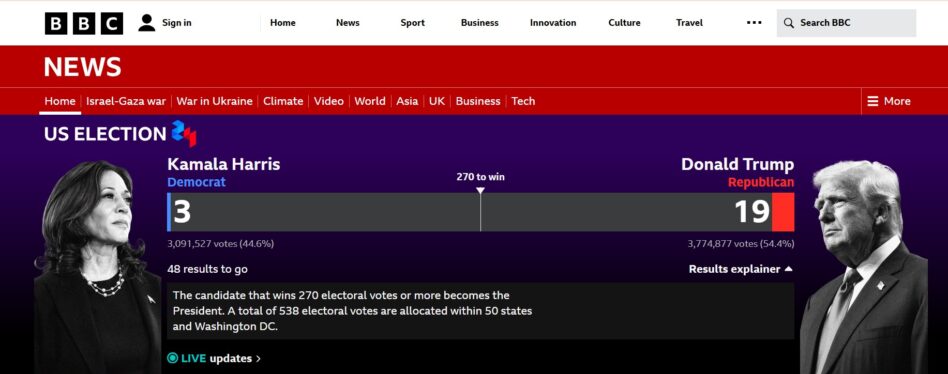

With polls showing a dead heat between the former president and the current vice-president, and control of the US Congress also to be decided by wafer-thin margins, investors are wary of prolonged vote counts and contested results that could fuel volatility.

The final outcome for both the presidency and Congress could take days to be revealed, according to analysts.

Stock market uptrend

As votes start to be reported, investors will focus on tallies from a handful of bellwether counties that could indicate early clues about the winner. But many of the seven battleground states that will decide the race may not have meaningful results until later in the night.

Despite election-year uncertainty, a rally in US stocks has pushed the S&P 500 to record highs in 2024 with a 21% year-to-date (YTD) run, driven by a robust economy, strong corporate profits and interest rate cuts from the US Federal Reserve.

On Tuesday, the S&P 500 closed up 1.2% on strong economic data while assets whose recent price swings have been linked to Trump’s standing in polls and betting markets put in a mixed performance.

Several measures of demand for protection against outsized currency market movements rose to their highest levels since the November 2016 election.

Joe Mazzola, head of derivatives and options trading at Charles Schwab, said the real test for markets would likely come on Wednesday (Nov 6) morning as traders began to digest the results, adding that Tuesday was “the calm before the storm.”

JPMorgan Chase, Bank of America, Citigroup and Wells Fargo gave employees several hours of paid time off to vote while some lenders underscored the need to work across political lines following a divisive election cycle.

“Soon it will be time for all of us to unite behind our President elect and all of our national leaders,” JPMorgan CEO Jamie Dimon said in a statement on Tuesday. “We must begin the work of bringing our nation together and focusing on the pressing economic and global issues before us.”

Trump trades

Bets on the election outcome have had a hand in swaying markets. Spurred on by Trump’s gains in polls and popular betting markets, some traders have taken positions in assets that could be influenced by the former president’s pledges to raise tariffs, cut taxes and decrease regulations.

Those so-called Trump trades include tumbles in the Mexican peso which could be hit by tariffs, wild swings in the shares of Trump Media and Technology Group and rallies in industries that could benefit from looser regulation such as regional banks and bitcoin.

Yields on Treasuries – which move inversely to bond prices – have also risen as investors price in potentially higher inflation, another projected consequence of Trump’s policies.

“The market is getting pulled and pushed in different directions here as investors try to price in a lot of unknowns,” said Matt Miskin, co-chief investment strategist at John Hancock Investment Management.

Trump Media shares ended down about 1% after surging as much as 19% in a volatile session while bitcoin was up nearly 4% as betting markets leaned in favour of Trump despite the absence of new catalysts.

“People who back the former president tend to be quite enthusiastic,” said Steve Sosnick, market strategist at Interactive Brokers. “This is their last opportunity to express that enthusiasm in the market.”

A Harris presidency, meanwhile, is expected to result in tougher regulations, more support for clean energy and potentially higher taxes on companies and wealthier individuals.

Both candidates, though, would likely need their respective parties to win control of Congress in order to alter tax rates.

Contested results

Historic data shows that stocks tend to perform well at the end of election years regardless of which party wins, as investors embrace clarity about the political situation.

This year, however, some investors are concerned that the result will be too close to call, increasing uncertainty for markets. Another worry is that the election will be contested, in a move similar to Trump’s efforts to overturn his loss to President Joe Biden in 2020.

Investors are also mindful of 2000 when the race between George W. Bush and Al Gore was undecided for more than a month due to a vote recount in Florida.

During that period, the S&P 500 slumped 5% although sentiment was also weighed down by unease about technology shares and the broader economy.

Though the S&P 500 is only about 1.4% down from its record high, stocks have grown more turbulent in the past week following mixed earnings reports from megacap tech companies and increased election anxiety.

The CBOE Volatility Index a.k.a. Wall Street’s fear gauge has risen to above 20 after falling below 15 in late September.

An unclear election “is a big problem,” according to Matt Maley, chief market strategist at Miller Tabak. “What is it going to do this time when you have so much going on in the geopolitical arena?” – Nov 6, 2024

Main image credit: Reuters