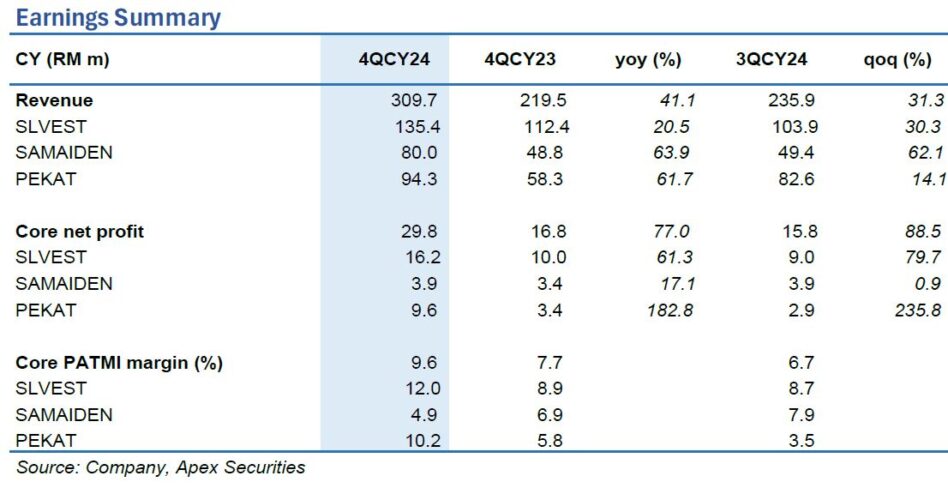

TWO companies under APEX Securities (APEX) core coverage, SLVEST and SAMAIDEN, delivered quarter four calendar year 2024 (4QCY24) results in line with expectations, while PEKAT exceeded forecasts from better margins arising from lower-than-expected operating costs.

“Sector’s core earnings expanded by 88.5% quarter-on-quarter (qoq) and 83.5% year-on-year (yoy), primarily driven by cost savings from lower solar module prices,” said APEX in the recent Earnings Wrap Report.

For SLVEST and SAMAIDEN, the strong performance was mainly attributed to robust progress billings from CGPP EPCC projects and higher contributions from electricity sales from solar plants.

PEKAT’s outperformance was driven by a reduction in administrative costs, increased project execution from ELP solutions, and new contribution from its recently acquired power distribution division.

“Over the near term, we reckon earnings growth will be driven primarily by project billings from CGPP projects, with solar plants set to achieve COD by the end-2025,” said APEX.

APEX also expect rollout of EPCC jobs from LSS5 with an estimated orderbook replenishment of RM5.8 bil, will keep Solar EPCC contractors busy until 2027.

Overall, sector prospects remain bright, supported by key solar initiatives:

1/ A 450MW quota under NEM.

2/ An extended RM4,000 per kWac rebate under SolaRIS.

3/ The CREAM rooftop lease program, LSS5+.

4/ The BESS program, BESS requirement waived under SELCO programme.

5/ Planned rollout of LSS6.

“We maintain our OVERWEIGHT recommendation on the RE sector, supported by the consistent rollout of strong RE initiatives and robust growth potential,” said APEX.

APEX maintains BUY recommendations for SAMAIDEN (Target Price: RM1.71) and SLVEST (Target Price: RM2.00).

They have also upgraded PEKAT to BUY (from HOLD) with a higher target price of RM1.43 (previously RM1.17) following the rollover of their valuation metrics to the financial year 2026 forecast. —Mar 4, 2025

Main image: Republic Of Solar