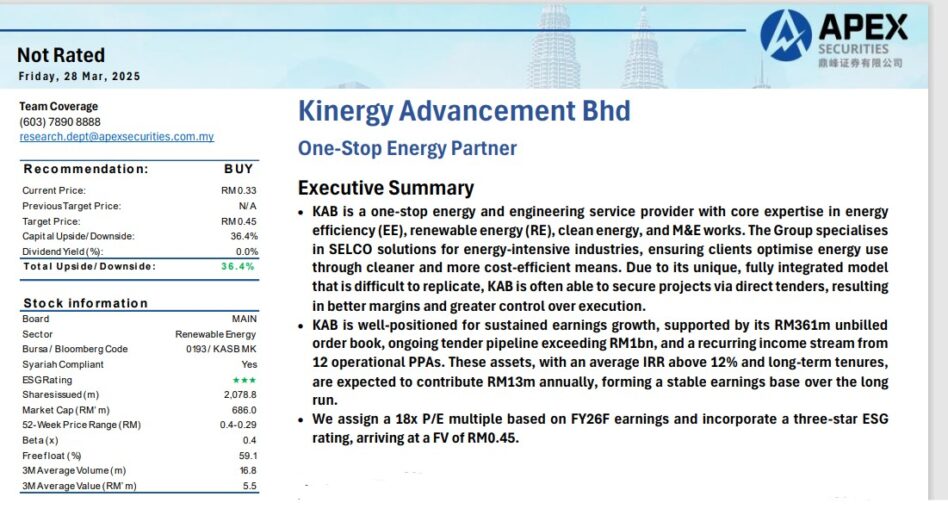

SUSTAINABLE energy & engineering solutions specialist Kinergy Advancement Bhd (KAB) has been recently assigned a “buy” rating by Apex Securities Research with a fair value of.45 sen which implies an upside potential of about 36.4% from its current share price of 33 sen.

Since pivoting its business strategy in 2018, KAB which was previously Kejuruteraan Asastera Bhd has evolved into an integrated sustainable energy provider, distinguishing itself from conventional renewable energy (RE) contractors.

Its offerings now span across energy efficiency solutions, renewable and clean energy generation as well as specialised mechanical and electrical engineering services.

The Apex Securities Research’s report highlighted KAB’s substantial order book valued at RM361 mil which is poised to provide earnings visibility through 2026.

Approximately 71% of this order book stems from the group’s sustainable energy solutions (SES) segment, reflecting the success of KAB’s strategic shift toward RE.

Its diversified SES portfolio comprises solar projects, hydroelectric power, biogas and waste-to-energy initiatives, all contributing to stable and recurring revenue.

Additionally, Apex pointed out KAB’s competitive advantage derived from its integrated service offerings which allows it to secure projects through direct negotiations – a capability that few competitors can easily match.

This model translates into improved profitability and consistent revenue performance.

Another significant driver of future earnings is KAB’s recent partnership with Perbadanan Kemajuan Negeri Perak (PKNPk) by focusing on developing 29 RE projects in Perak.

These initiatives are expected to produce a combined capacity exceeding 1,800 megawatts (MW) by featuring large-scale floating and ground-mounted solar installations as well as small-scale hydropower projects.

This strategic collaboration positions KAB favourably to benefit from the rising demand for RE solutions from sectors such as data centres and manufacturing facilities.

Moreover, KAB’s strategic acquisition of a 47.5% stake in Jati Cakerawala Sdn Bhd back in February this year provides an effective 38% indirect ownership in Teknologi Tenaga Perlis Consortium (TTPC), thus enhancing KAB’s potential to participate significantly in the power generation sector.

The acquisition involving a site that previously hosted a 650MW combined-cycle gas turbine power plant offers a substantial repowering potential. This asset presents an attractive opportunity for KAB to strengthen its footprint within Malaysia’s energy infrastructure.

Financially, KAB reported a record revenue of RM244.8 mil for FY2024 which itself representing a 22.8% growth from the previous year, primarily driven by expansion within the SES segment.

As such, Apex Securities Research has projected compound annual growth rate (CAGR) of 21.3% in core net profit over the next three years, supported by a diversified portfolio and a robust project pipeline.

At 4-36pm, KAB was up 0.5 sen or 1.54% at 32.5 sen with 6.89 million shares traded, thus valuing the company at RM702 mil. – May 2, 2025