MAIN-BOARD listed PWF Corp Bhd, a leading integrated poultry player in Malaysia, has been accorded a target price of RM1.22 or a 38.6% premium over its closing price of 88 sen yesterday (Aug 7).

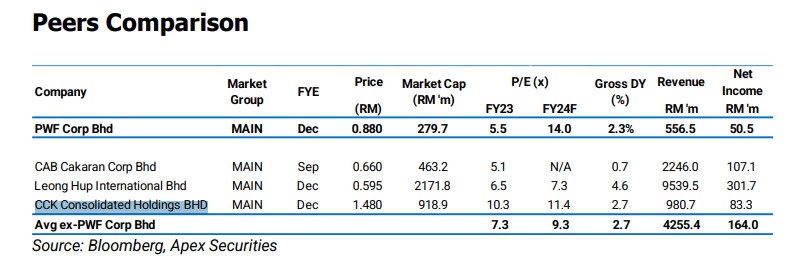

Derived by applying a P/E (price-to-earnings) multiple of 8.0 times to the group’s FY2025F core EPS (earnings per share) of 15.2 sen, PWF Corp’s assigned P/E is in line with the forward PER (price-to-earnings ratio) of its peer, according to Apex Securities Bhd,

“We favour PWF for its position as a pure-play integrated poultry company supported by in-house feed mill plant, hence, positioning the group as a direct beneficiary of low commodity prices and higher chicken prices,” analyst Jayden Tan pointed out in a non-rated assessment of the mainland-Penang-headquartered PWF Corp.

“Our earnings valuation excludes the forecasted subsidies expected to be received from the government. The assigned PER also reflects our positive outlook on PWF with anticipation of strong earnings growth in the coming quarters driven by improving margins.”

PWF’s Corp current listed competitors include CAB Cakaran Corp Bhd, Leong Hup International Bhd and CCK Consolidated Holdings Bhd.

The Apex Securities’ report further projected a robust acceleration in PWF’s core earnings which is attributed to a favourable cost environment and resilient chicken prices.

“The reduction in feed mill costs, mainly due to lower soybean and corn prices, positions PWF to achieve improved margins and enhanced profitability.,” contended the research house.

“Additionally, the ringgit’s strengthening against the US dollar further supports a favourable forex environment by reducing the cost of imported feed ingredients and contributing to stronger earnings.”

Moreover, the Malaysian government’s recent removal of price controls and subsidies for chicken is also deemed a positive development for PWF Corp.

This is because this policy change allows for greater flexibility in pricing, hence enabling producers to better respond to market dynamics.

As a result, PWF is poised to benefit from the upward trend in chicken prices which have shown significant increases from RM5.90/kg in 4Q 2023 to RM7.00/kg in 2Q 2024.

“PWF has consistently maintained a strong dividend payout ratio, averaging 30-40% of net profit over the years,” observed Apex Securities.

“With the anticipated improvement in earnings and cash inflows from government egg subsidies, PWF is forecasted to offer an attractive dividend yield of 5.1% in FY2024 and 5.7% in FY2025, thus providing substantial returns to shareholders.”

Above all else, PWF Corp’s vertically integrated business model which encompasses feed production, breeding, broiler and layer farming also positions the group as a major player in the Malaysian poultry industry.

In this regard, Apex Securities highlights PWF’s capacity to leverage its extensive operations and modern farming practices to meet the growing demand for poultry products while ensuring sustainable growth and market leadership.

At the close of today’s trading, PWF Corp was up 1.5 sen or 1.7% to 89.5 sen with 1.05 million shares traded, thus valuing the company at RM285 mil. – Aug 8, 2024