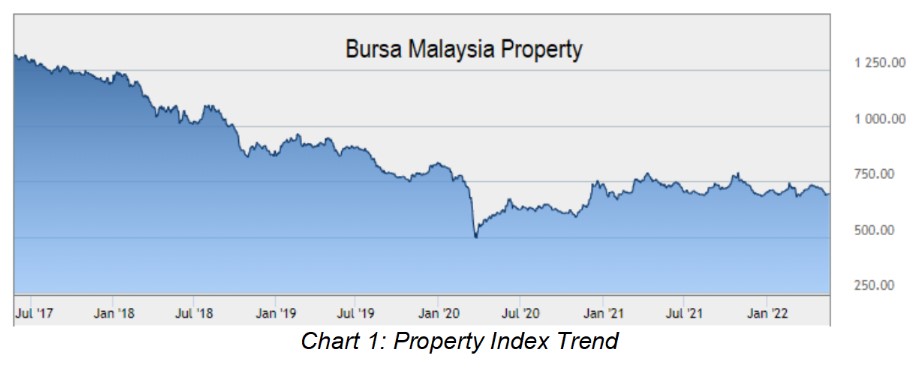

THE Bursa Malaysia Property Index fell from 1,024 in September 2018 to 722 in March 2022 – a circa 30 % drop. You would be forgiven for thinking that property companies are now cheap relative to their prices four years ago.

You can see from Chart 1 that the index had been declining even before September 2018 and it reached its lowest point in March 2020. While it has recovered from that low point, it seemed to be hovering around the 700 index level for the past two years.

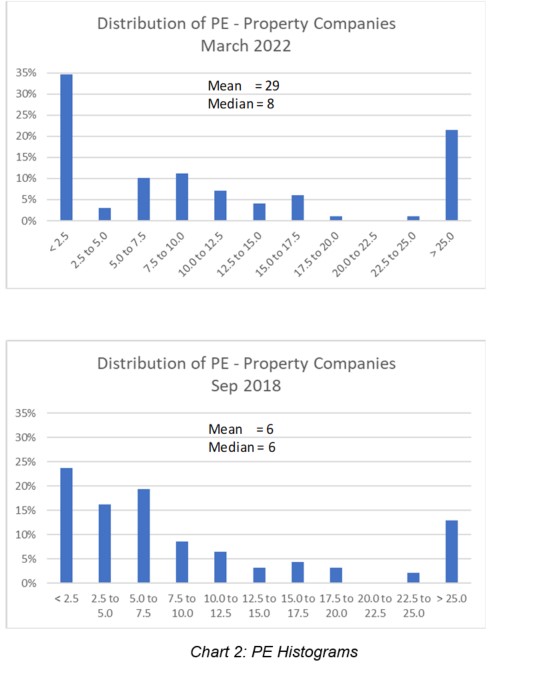

Many investors rely on the price earnings ratio (PER) as one way to assess whether a company is cheap or expensive. Referring to Chart 2, you can see that the median PER at eight for March 2022 is higher than that of six for September 2018.

The median is the middle number in a sorted list of numbers. In situations where there are outliers, the median is a better measure of the central tendency than the mean or average. You can see the presence of outliers in Chart 2 where there is a significant number of companies at both ends of the distribution.

If you compare the means for both periods, you will find that it is very much higher for March 2022 compared to that for September 2018. This is because there were more outliers in 2022.

A higher multiple does not mean that the sector is cheap. The PE multiple has two parameters – price as the numerator and earnings as the denominator.

We know that prices as reflected by the property index have declined. One explanation for a higher PER with falling prices is that earnings have declined faster than prices.

Going by the PER, the sector cannot be considered cheap.

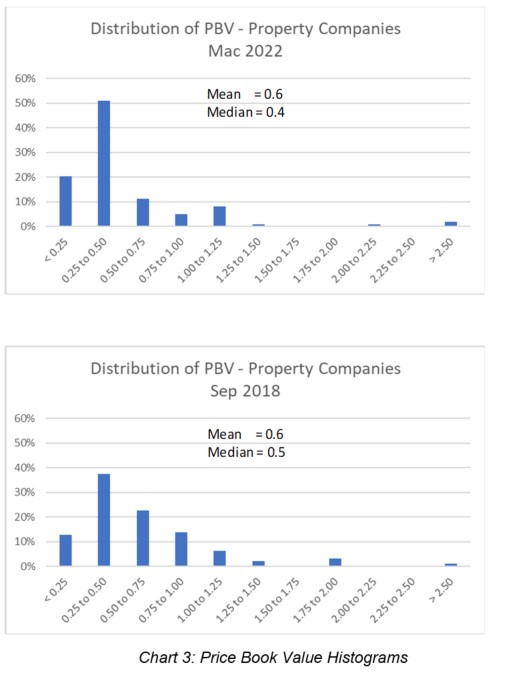

You may argue that looking at earnings does not reflect the nature of the property sector where a lot of the values are in hard assets, notably properties. Accordingly, the price-to-book value (PBV) multiple is a better measure of the value of such companies.

Chart 3 shows the distribution of the PBV multiples for the sector for March 2022 and September 2018. You can see that the median PBV of 0.4 for March 2022 is lower than 0.5 for September 2018. The means for both periods is about the same.

Unlike the PE multiple, the distribution of the PBV multiple is skewed towards the low end. You can also see that the largest contributor for both periods is from companies with PBV of 0.25 to 0.5.

I want to highlight that in March 2022, the market was pricing 88% of the companies below their respective book values. This was 87 % in 2018.

Are Bursa Malaysia property companies much cheaper today compared to the pre-COVID-19 situation? If you look at the PBV evidence, it does not seem so.

But the more important question is whether the market is logical in this pricing. In other words, why would the market price the companies below the book value?

One insight comes from valuation theory. There are of course many valuation models. For this article, I will cover a simple one assuming that there is no growth as shown by the following equation:

Value = Book Value X (ROE / Discount rate)

You can see how the value of a company is linked to the book value, returns, and the discount rate. The discount rate is generally taken as the cost of funds.

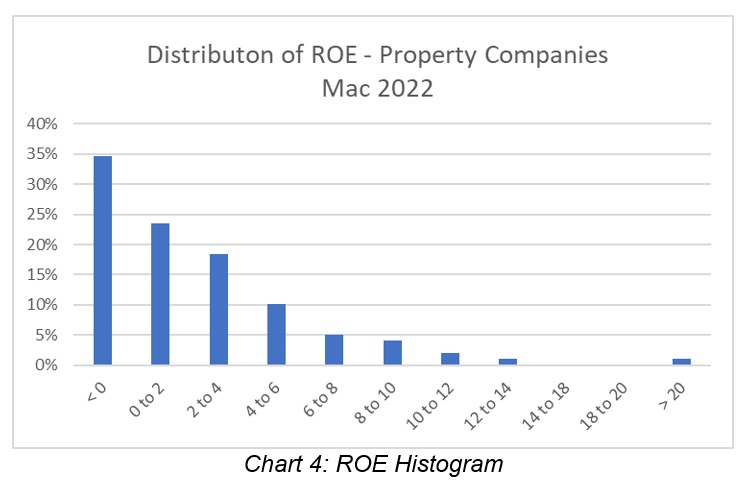

Chart 4 shows the distribution of the return on equity (ROE) for March 2022. You can see that 35 % of the companies had negative ROE.

We can debate the current cost of funds. But if I take it as between 8% and 10%, you can see that 92% of the companies have ROE less than the cost of funds.

Based on the valuation formula, if the ROE is less than the cost of funds, the value of the company would be less than the book value.

This is of course a simple analysis. But it shows that when the PBV is less than one, it does not necessarily mean that the stock is cheap. You have to dig deeper.

The market is not irrational. It is pricing many of the property companies below their book value because they have not been able to generate the necessary returns. – May 26, 2022

A self-taught value investor who has been investing in Bursa Malaysia and SGX companies from a value investment perspective for more than 15 years, Datuk Eu Hong Chew was re-appointed to the board of i-Bhd as non-independent non-executive director on Jan 1, 2022.

The data for this article was extracted from “Valuing property companies through a house valuation lens” on i4value.asia. Refer to the article for the methodology and further analysis.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.