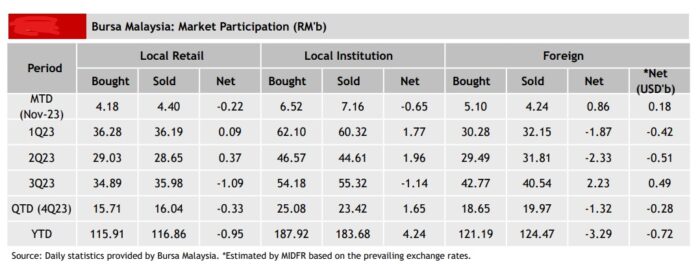

FOREIGN investors maintained their status as net buyers on Bursa Malaysia for the second consecutive week with net inflow totalling RM676.7 mil which is nearly four times the amount purchased in the previous week.

Every trading session of the week recorded net buying with Monday (Nov 6) registering the highest inflow at RM359.2 mil, according to MIDF Research.

“The top three sectors with net foreign inflows for the week were financial services (RM194.4 mil), utilities (RM123.1 mil) and healthcare (RM111.3 mil),” the research house pointed out in its weekly fund flow report.

“(On the reverse), the only three sectors that recorded net foreign outflows were energy (-RM23.8 mil), consumer products & services (-RM23.1 mil) and REITs (-RM1.5 mil).”

Meanwhile, local institutions recorded net outflow of -RM551.2 mil last week, marking the second consecutive week of net selling. Every session of the week witnessed net selling with the highest outflow occurring on Monday (Nov 6) at RM226.9 mil.

Local retailers, too, extended their net selling streak for the fifth consecutive week with net sales amounting to RM125.5 mil.

Outflows were observed from Monday (Nov 6) to Wednesday (Nov 8) while Thursday (Nov 9) and Friday (Nov 10) recorded inflows of RM13.0 mil and RM29.7 mil respectively.

In terms of participation, there were increases in average daily trading volume (ADTV) among foreign investors by +8.5%, local retailers (+10.1%) and local institutions (+11.2%).

In comparison with another four Southeast Asian markets tracked by MIDF Research, only Malaysia and the Philippines reported net foreign inflow with the latter recorded US$1.5 mil after 13 consecutive weeks of net outflows.

Thailand experienced its fourth consecutive week of net foreign outflows amounting to -US$261.9 mil followed by Indonesia (-US$130.9 mil) and Vietnam (-US$50.0 mil).

The top three stocks with the highest net money inflow from foreign investors last week were Malayan Banking Bhd (RM92.3 mil), CIMB Group Holdings Bhd (RM56.7 mil) and MISC Bhd (RM48.3 mil). – Nov 14, 2023