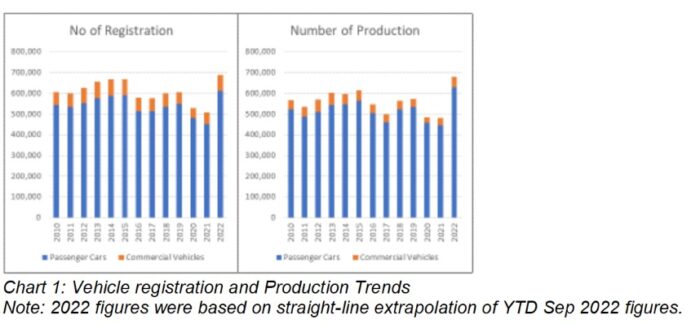

ACCORDING to the Malaysian Automotive Association (MAA), the total number of vehicles registered in the first nine months of 2022 was 62 % higher than that for the same period last year.

Assuming the same rate for the rest of the year, the total number this year would be a record compared to the past 12 years. This holds for both the number of vehicles registered as well as the number of vehicles produced and assembled (refer to Chart 1).

Given this picture, would there be light at the end of the tunnel for Bursa Malaysia’s auto sector? There are two sub-sectors here – the auto parts companies and the auto companies. This article focuses on the latter which covered 12 companies (panel) covering the period from 2010 to 2022. The 2022 values were based on the Sept 2022 LTM (last 12 months) values.

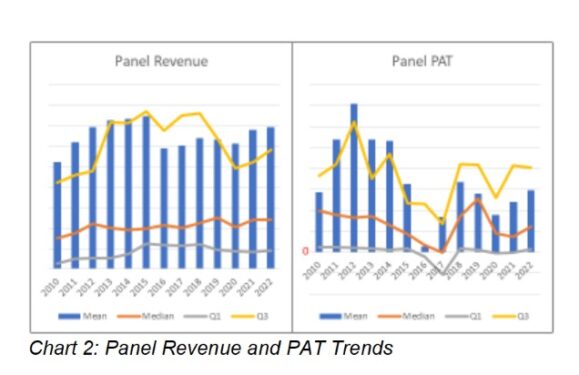

The panel had a very challenging performance over the past 12 years. The panel median revenue only grew at 3.9 % CAGR (compound annual growth rate) while the mean profit after tax (PAT) declined at a compounded 3.9% per annum. This decline began during the pre-COVID period (refer to Chart 2).

Note that the decline in revenue in 2016/2017 was partly due to the restructuring of two major players – UMW Holdings Bhd and Sime Darby Bhd. As such, looking at the median is more representative of the panel performance.

The positive news is that the revenue and PAT for the past two to three years seems to be on an uptrend.

The other unusual characteristics of the profile can be seen in Chart 2. In many sectors, the mean values would lie somewhere in the middle of the interquartile ranges. But in the case of the auto sector, the mean is very near the third quartile values. It is skewed in this manner because of the relatively large revenues of a few big companies.

For those statistically inclined, there is a 0.35 correlation between the panel median PAT and the number of vehicles produced for 2010 to 2022. Not exactly significant, and it shows that there are other factors affecting the panel profitability other than the number of vehicles produced.

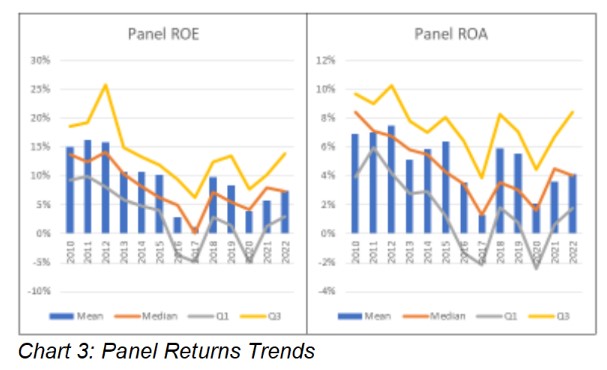

Given the PAT results, you should not be surprised to see the declining panel returns over the past 12 years (refer to Chart 3). The panel median ROE (return of equity) and median ROA (return on assets) had declined at a compounded annual rate of 5.2% and 5.9% respectively from 2010 to 2022. Again, note the uptrend in the returns for the past two to three years.

From 2010 to 2022, the median ROE ranged from 0.1% to 13.7% with an average of 7.9%. If you are a long-term fundamental investor, you would be disappointed with the performance.

Given the record number of vehicle registrations and productions, would the future be better?

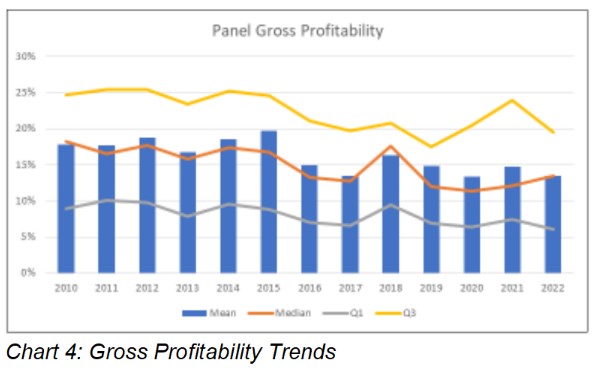

One clue is to look at gross profitability. This is defined as gross profits/total assets. Prof Novy-Marx of the University of Rochester had done considerable research into this metric. According to him, this has the same power as the price book value (PBV) ratio in predicting cross-section returns.

As can be seen from Chart 4, the panel’s gross profitability declined from 2010 to 2022. This is irrespective of whether you are looking at the mean, median or quartiles. But there is a silver lining – the median and mean gross profitability for the past few years have been “stable”.

No doubt they are still lower than those for 2010 to 2012. But it does point out that the panel performance seemed to have reached the bottom.

I of course do not have a crystal ball. But if you accept Prof Novy-Max’s concept, then this is a sector worth having a look at as a long-term fundamental investor. Now if you couple this with the uptrends over the past two to three years for the revenue, PAT and returns, you will have a favourable picture.

A self-taught value investor and has been investing in Bursa Malaysia and SGX companies from a value investment perspective for more than 15 years, Datuk Eu Hong Chew was re-appointed to the board of i-Bhd as non-independent non-executive director on Jan 1, 2022.

The data for this article was extracted from “Are there opportunities in the Bursa auto sector?” published on i4value.asia. Refer to the article for further details on the list of panel companies and methods.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.