IN ASEAN, upstream remain resilient, buoyed by regional collaboration and co-investment in local and international assets.

Towards the local front, the initiatives on carbon capture and joint development areas continue to grow.

To reiterate from Petronas Activity Outlook 2025-2027, 73 development wells are expected to be drilled in 2025 with an estimated RM50 mil capital expenditure (capex) allocated for brownfield and greenfield developments.

For the sake of energy security, Petronas also expanded its footprint in Suriname, Angola, Brazil, UAE and Oman, while holding 15% stake in Indonesia’s Masela LNG project.

This signals that upstream would remain a long-term powerhouse, despite the convoluted environment in the oil market.

Likewise, LNG saw temporary interferences from maintenance works on LNG terminals, as well as certain LNGCs being adrift due to saturated LNGCs at sea.

“However, in our local front, investments in gas pipelines and LNG regasification terminals continue to support the division,” said MIDF Research (MIDF).

Additionally, MIDF noted that carbon transportation had seen a slight uptake in May 2025, with growing investments in CO2 pipeline networks and capture hubs in Canada and Europe.

In ASEAN, transboundary carbon transport and storage had also seen a higher prioritisation post-ASEAN summit, which includes the development of a regional carbon market and blending of infrastructure for renewable gas and hydrogen.

During this summit, Petronas, ADNOC and Storegga had signed a joint agreement to develop a CCS site in the Penyu Basin, targeting 5mT of CO2 per year by CY30.

In May 2025, the tanker market saw volatility due to the weakening oil demand and shifting trade flows, prompting lesser utilisation for tankers.

However, long term charters saw a stable rate, supported by:

(i) regional demand for refined petroleum products.

(ii) ongoing intra-ASEAN trades and trades with China and India.

(iii) sustainable shipping solutions such as dual-fuel tankers and green corridors.

Additionally, as of May 2025, the Mediterranean Sea was designated as an emission control area (ECA) which will require tankers to use low-sulphur fuel (0.1%).

While this may lead to increasing bunker cost for traders in the long run, marine companies could leverage on the ECAs from retrofits and EPCC contracts.

Malaysia had also shown interest in expanding ECA-compliant fuel availability, as part of its green shipping and sustainable fuel efforts.

Global refining margins had reached a 12-month high in late Apr 2025, and had remain strong in May, driven by:

(i) lower crude prices.

(ii) strong demand for refined products in non-OECD countries.

(iii) inventory build rising (>60mbl) in crude stocks.

(iv) minimal disruptions in refineries.

(v) energy efficiency and cost optimisation initiatives in refineries.

Refineries in Europe and North America had accelerated fuel-switching and hydrogen integration and increased investments in biofuels to meet tightening emissions regulations.

Likewise, ASEAN countries continue to modernise refining assets to meet clean fuel standards and carbon intensity targets, with emphasis on energy efficiency, carbon credit mechanism and renewables integration.

“In our local front, the downstream sector remained stable on retail fuels but was downcast by the bearish petrochemical subsector,” said MIDF.

While downstream would benefit on the cheaper import of crude oil for refineries, the downside risks remain on a broader picture, including weaker MYR against USD impacting feedstocks and crude purchasing, and higher competition with China and other ASEAN countries for petrochemicals.

While Petronas continue its aggressive E&P activities in the upstream despite the lower crude oil prices, midstream and downstream divisions are expected to turn towards sustainability and green energy solutions and integrating them into its operations.

In the ASEAN summit concluded in the end of May 2025, LNG and CCS transportation and logistics were put forth as strategic priorities within the region.

More focus was set on renewable energy and hydrogen projects to be integrated with the conventional oil and gas developments, providing a balanced and sound energy transition as highlighted in Malaysia’s National Energy Transition Roadmap (NETR).

Regional cooperation is likely to expand through energy security, carbon credit management, ECA compliance and CCS solutions.

“In addition, we opine that domestic demand and robust LNG exports will continue to locally support the sector,” said MIDF.

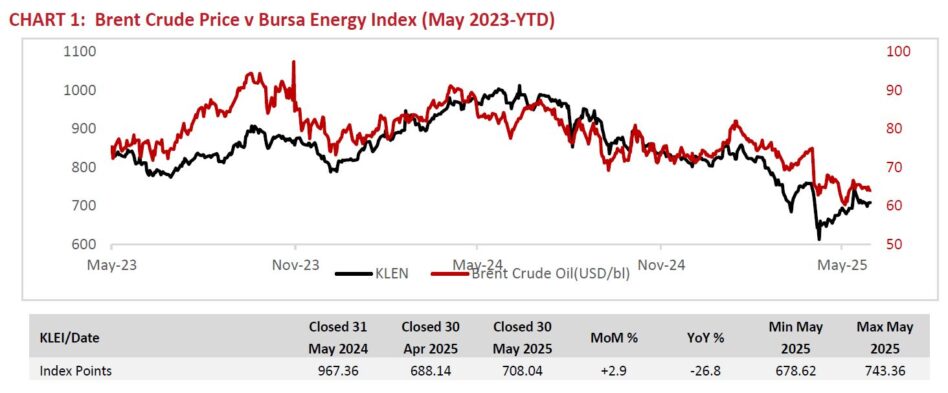

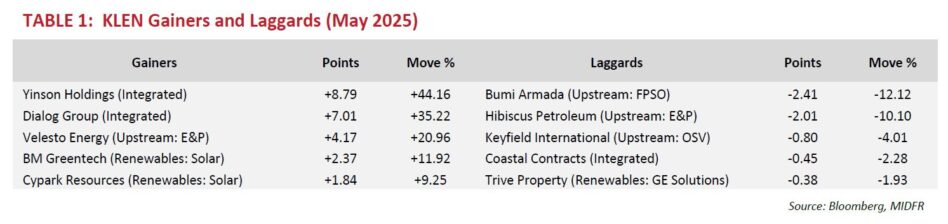

Overall, MIDF retains their neutral view on the oil and gas sector. The sector continues to face challenges, primarily from oil price volatility, driven by output hikes from OPEC+ and non-OPEC producers, and sluggish global demand due to tariff-related uncertainties.

The possibility of the lifting of sanctions from Iran also added into the unfavourable outlook on the oil price movement.

The mixed results in quarter one 2025 alongside more cautious capital spending, have further clouded the short-term global outlook.

“However, in our regional and local front, decarbonization and green energy projects are expected to put a floor on the downtrends in the sector, as the US trade tariffs are anticipated to encourage more intra-ASEAN and ASEAN-China collaborations in the sector,” said MIDF.

Nevertheless, downside risks remain on upcoming scheduled maintenance activities, lower production output, regulatory changes, and escalating cost pressures from increased feedstock and raw materials costs. —June 6, 2025

Main image: Vidya