ACCELERATION of loans on a sequential month basis was led by faster monthly pace of business loans growth. Retail loans increased 6.9% year-on-year; robust loans for purchasing residential and passenger cars. It is, however, slightly lower year-on-year (yoy).

“Also, business loans went up by 3.9%, the higher growth pace being attributed to construction and working capital loans,” said MIDF.

Deposits showed an increment of +3.3% yoy whereby fixed deposit growth came in slightly higher.

Asset quality in the banking system continues to improve. This is the lowest since Apr 21. Improvements seen across board with personal use and construction are the most notable.

Improvement in asset quality continued for another month. This indicates that asset quality remains stable.

“We believe that this is possibly due to the robust economic performance and stable labour market conditions. Hence, we are not concerned about asset quality of the banking sector at the current juncture,” said MIDF.

MIDF added that deposits continue to grow led by FD growth. While this may be a cause for concern, they are allayed by the fall in FD rates across the majority of maturities for conventional.

Furthermore, current account, savings account ratio remains stable at 31.4%. As such, MIDF expects any net interest margin compression will be manageable.

The research house added that asset-liability-ratio is being compressed. This has been on a downtrend since May 24. Residential mortgages and small, medium enterprise segments remain highly competitive.

“We continue to be positive on the sector as loan growth continues to be robust while asset quality remains stable. Furthermore, good dividend yields should moderate any downside risk,” said MIDF.

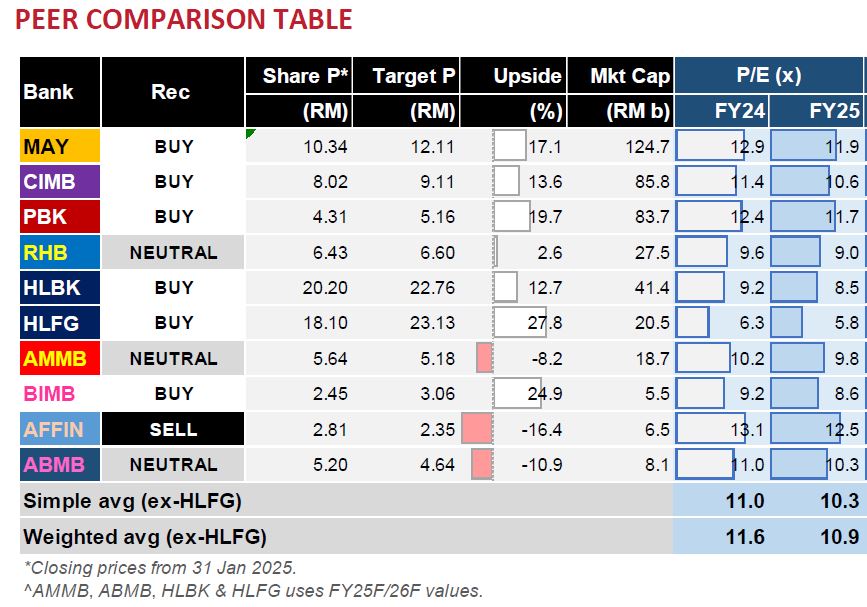

Top downside risks include weak economic activity which causes a slowdown in credit growth, Asset quality issues resurfacing and deposit competition which would lead to net interest margin compression. Top picks by MIDF include Maybank and Public Bank. —Feb 3, 2025

Main image: The Star