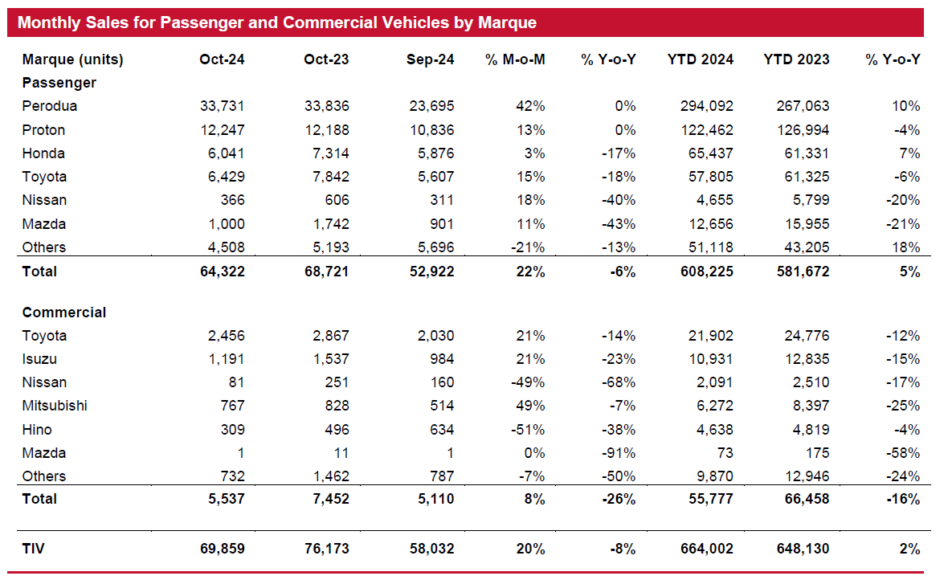

Total industry volume (TIV) soared 20% month-on-month (MoM) to 69,859 units in October 2024 in the absence of major plant closure as seen in the previous month as well as driven by the attractive year-end promotional campaigns.

“With the 10 months calendar year 2024 (CY2024) TIV making up 83% of our full-year projection of 800k units, we consider the number meeting our expectation,” said Kenanga Research (Kenanga) in the recent Sector Update report.

Kenanga’s CY24 TIV projection looks set to surpass forecast of 765k (-4%) by Malaysia Automotive Association.

This is backed by strong sustained demand in the affordable segment, attractive new launches, softer-than-expected impact from e-invoicing, and a downtrading trend by mid-market buyers.

Looking ahead, Kenanga believes November 2024 TIV will be around the same level as October 2024 TIV driven by year-end promotional campaigns as automakers rush to clear this year’s inventories.

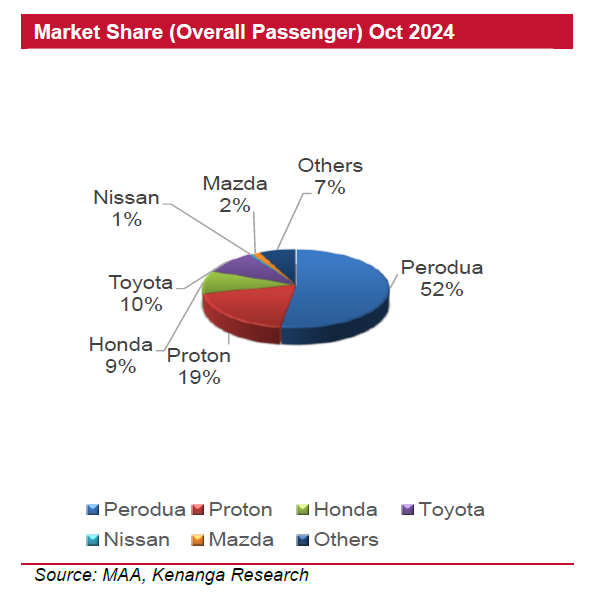

A detailed analysis of the passenger vehicle segment in October 2024 showed it at 64,322 units.

In general, the industry’s earnings visibility is still good, backed by a booking backlog of 160k units as at end-October 2024, unchanged from a month ago.

More than half of the backlog is made up of new models, alluding to the appeal of new models to car buyers. This trend is likely to persist throughout CY24 given a strong line-up of new launches.

Vehicle sales will also be supported by new battery electric vehicles (BEVs) that enjoy SST exemption and other EV facilities incentives up until CY25 for complete built-up and CY27 for complete knockdown.

The new registration for BEVs leapt from 274 units in CY21 to over 3,400 units in CY22, 10,159 units in CY23, and almost 16,000 units for the nine months of CY24 (based on Ministry of Transport press release), or 3% of TIV.

“ We expect more favourable incentive from the government which has set a national target for EVs and hybrid vehicles of 15% of TIV by CY30 and 38% by CY40,” said Kenanga.

Meanwhile, the government will speed up the approval for charging stations. The number of proposed charging stations currently at 4,225 (3,354 built as of to-date) should almost triple to 10,000 by end-CY25.

Kenanga’s sector top pick is MBMR for its strong earnings visibility backed by an order backlog of Perodua vehicles of more than 100k units, being a good proxy to the mass-market Perodua brand given that it is the largest dealer of Perodua vehicles in Malaysia.

Then there is its 23% stake in Perusahaan Otomobil Kedua Sdn Bhd, the producer of Perodua vehicles, and its attractive dividend yield of about 7%.

“We also expect MBMR to benefit from the slew of new launches planned for Perodua, expansion of its dealership offerings through Jaecoo brands and downtrading trend by mid-market buyers could drive a better demand for its affordable Perodua brand and value-for-money Jaecoo brand,” said Kenanga. —Nov 19, 2024

Main image: asianinsiders