THE Monetary Policy Committee (MPC) of Bank Negara Malaysia (BNM) announced its decision to maintain the overnight policy rate (OPR) at 3.00%, reflecting the central bank’s commitment to supporting economic stability in the face of global economic challenges.

The global economy continues to expand, primarily driven by domestic demand despite challenges faced in various sectors. While signs of recovery are emerging in the electrical and electronics (E&E) sector, global trade remains soft due to shifting consumer preferences from goods to services and ongoing trade restrictions.

“Global growth remains weighed down by persistently elevated inflation and higher interest rates, with several major economies experiencing slowing growth momentum. There are early signs of improvement in China’s growth, though its property market remained weak,” BNM stated in a statement.

For Malaysia, the advance gross domestic product (GDP) estimate for the third quarter suggests an improvement in economic activity.

The growth in 2024 is expected to be driven by resilient domestic expenditure with support from the recovery in E&E exports. Continued employment and wage growth along with increased tourist arrivals and spending are anticipated to bolster household spending.

Moreover, investments will be supported by infrastructure projects and initiatives outlined in the national master plans and Budget 2024.

Both headline and core inflation have moderated averaging at 2.0% and 2.5%, respectively, in the third quarter.

Inflation is expected to remain modest in 2024, subject to changes in domestic policy on subsidies and price controls as well as global commodity prices and financial market developments.

The persistently strong US dollar influenced by global factors has impacted major and emerging market currencies, including the ringgit. However, these developments are not anticipated to significantly affect Malaysia’s growth prospects.

Furthermore, BNM reassured that it will continue to manage risks of heightened volatility, ensuring the orderly functioning of the domestic foreign exchange market by providing liquidity.

Domestic financial conditions remain conducive to sustain credit growth, with financial institutions operating with strong capital and liquidity buffers. The current OPR level is deemed supportive of the economy aligning with the assessment of inflation and growth prospects.

The MPC remains vigilant, closely monitoring ongoing developments to assess the outlook for domestic inflation and growth. The committee is committed to maintaining a conducive monetary policy stance to support sustainable economic growth while ensuring price stability.

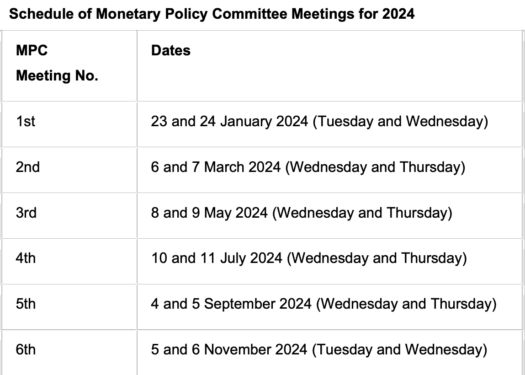

In accordance with the Central Bank of Malaysia Act 2009, the MPC will convene six times in 2024. The Monetary Policy Statements will be released at 3pm on the final day of each MPC meeting, providing valuable insights into the nation’s economic trajectory.

Main photo credit: Borneo Post Online