MULTIPLE threats to the banking sector’s bottom line have emerged, all of which are linked to the weaker global economic outlook.

“Still, the banking sector retains some level of attractiveness due to exceptional dividend yields and other defensive qualities,” said MIDF Research (MIDF) in the recent Sector Report.

Valuations are cheap but are unlikely to stage a meaningful rebound unless convincing signs of an improvement in the global economic and geopolitical arena are flagged.

Core Themes:

1/ Dividend yields remain especially attractive. Most banks are already well-capitalised, hence dividend certainty is very high. Be wary of possible DRP programmes.

2/ Mixed view on retail loans: Hire purchase and unsecured loans may take centre stage, but their viability may be limited.

3/ Non-Interest Income (NOII), once a highlight of financial year 2025, has a much more muted outlook. It is dragged by weaker fee income.

4/ Net interest margin (NIM) outlook is also less optimistic than before. While Confirmation of Funds (COF) situation remains healthy, we see threats to loan yields.

5/ Geopolitical risks and poor economic outlook will likely keep banks’ valuations depressed in the near future.

6/ Expect higher provisioning costs and lower likelihood of overlay writebacks.

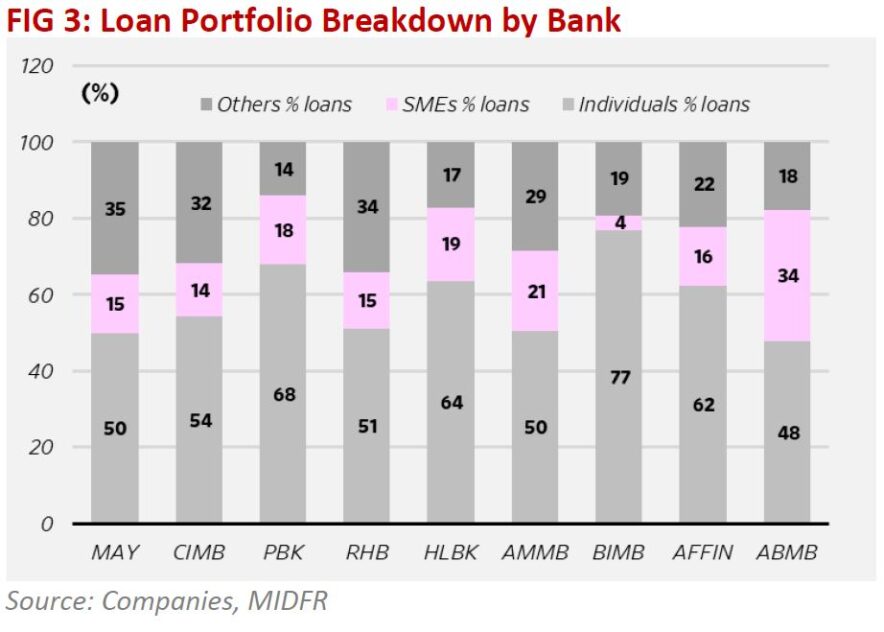

7/ Poor business loan growth outlook, especially when the SME/Commercial segment was already overcompetitive.

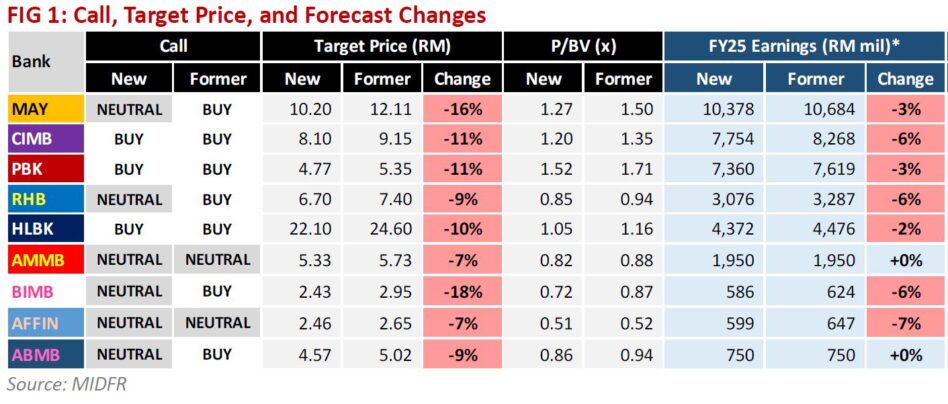

MIDF expects most banks should cut their return on equity forecasts, facing both topline compression and higher provisioning costs. They see two main means of preventing ROE from dipping any further:

1/ Strict cost management.

2/ Not overspending on liquidity for loan acquisition. On a brighter note, dividend certainty should be maintained.

“We may see some focus shift to domestic non-residential mortgage retail loans, namely hire purchase and unsecured loans,” said MIDF.

Weaker regional economic conditions could severely dent overseas loan growth prospects, especially for banks grappling with pre-existing asset quality issues.

“We think the likelihood of an overnight policy rate (OPR) cut is slim, but we see the danger in possible overseas interest rate cuts, which could affect some of the large-to-mid-sized banks,” said MIDF.

They are also wary of possible further loan yield compression on a local front. The heavy take-up of business loans originally aimed to combat falling loan yields.

Regardless, the liquidity situation has become better, with there being less incentive to compete for loans.

Weaker economic and market conditions bode poorly for the fee income, especially when several banks were gunning for their investment banking franchise to capitalise on 2025’s much brighter initial outlook.

MIDF is slightly worried about the outlook of loan segments that previously had asset quality issues, namely overseas segments.

The likelihood of sizeable macroeconomic provisions is very high, especially since the light of the end of the tunnel seems very far away.

They note some degree of difficulty with stock selection. Smaller banks are too sensitive to OPR movements and are usually more dependent on business loans.

Larger banks, on the other hand, have larger exposure to overseas markets, which are far likelier to be subject to interest rate cuts and more adverse asset quality conditions as compared to the local front.

MIDF has since downgraded the banking sector to neutral, further identifying top downside risks such as weaker-than-expected loan growth, and higher-than-expected National Coordination Committee allocations. —Apr 22, 2025

Main image: The Malaysian Reserve