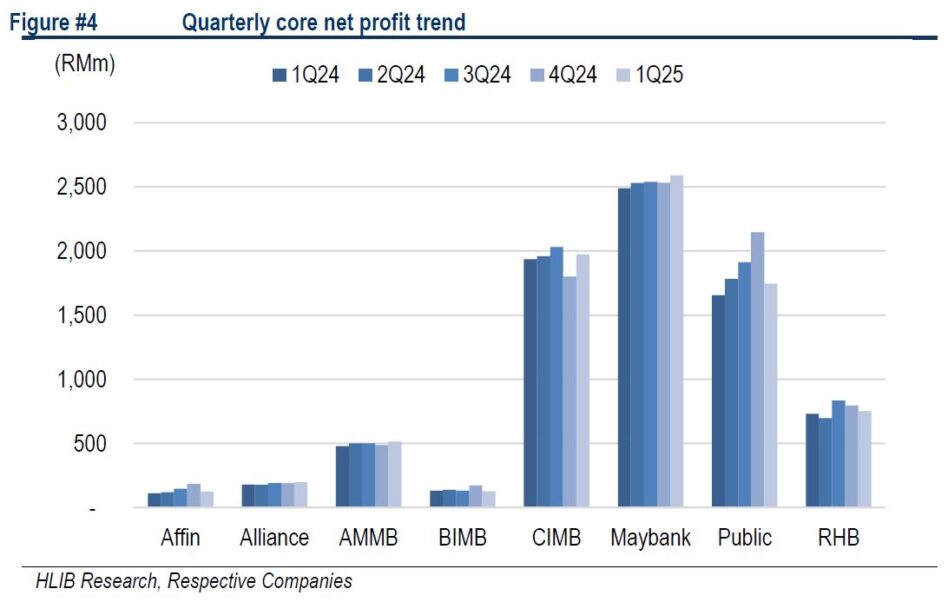

THE quarter one 2025 (1Q25) reporting season came in broadly within expectations.

Seven of the eight banks under Hong Leong Investment Bank’s coverage (Affin, Alliance, AMMB, CIMB, Maybank, Public Bank, and RHB) delivered results that tracked closely with their forecasts.

The lone exception was BIMB, which missed due to higher-than-anticipated credit costs.

“Stripping out non-recurring items from 4Q24, core earnings dipped 3.4% quarter-on-quarter (qoq),” said Hong Leong Investment Bank (HLIB).

This came despite a 3.6% rise in pre-impairment operating profit (PIOP), which was supported by positive JAWs (+0.3ppt) and robust non-interest income growth (NOII; +7%).

The drag came from higher loan loss provisions (+11.6%) and a weaker contribution from associates (-27.3%).

Net Interest Margins (NIM)s were broadly stable, with Affin standing out positively (+7 basis points).

Sector core earnings rose 4.1%, underpinned by lower loan loss provisions (-22.9%) and stronger associate contributions (+31.2%).

PIOP grew modestly by 1.1%, with net interest income (NII) up +3.4%, partially offset by a dip in NOII (-1.3%).

Cost control remained commendable, with operating expenses rising 2.9%. Top performers were Affin (+12.6%) and Alliance (+11.1%), with both delivering robust NII growth, alongside effective cost and provision management, respectively.

Both loan and deposit growth moderated, reflecting festive seasonality and FX volatility. Banks continued to pull back from expensive deposit campaigns to protect NIMs.

Meanwhile, Alliance was the only bank to post double-digit loan and deposit growth. Asset quality remained firm, with the sector gross impaired loan (GIL) ratio ticking up 1 basis point QoQ to 1.38%.

“Heading into 2Q25, we expect NIMs in 2Q25 to hold up reasonably well sequentially,” said HLIB.

HLIB sees three key forces at play: fresh liquidity from the recent SRR cut, easing deposit competition, and a sector-wide pivot to more disciplined loan expansion and funding strategies.

This proactive stance is already visible, with banks cutting promotional/campaign FD rates by 5-15 basis points in May, ahead of a potential overnight policy rate cut, though the full margin benefit may only materialize in the second half of 2025.

Beyond margins, the bedrock of asset quality is expected to remain solid, supported by resilient domestic economic conditions and minimal US trade exposure.

“While acknowledging risks from the secondary impacts of trade uncertainty, we believe any potential weakness will be well-contained,” said HLIB.

The sector is significantly more resilient than in previous downturns, primarily due to the formidable provision buffers accumulated over the past five years.

This “fortress of provisions” provides a robust defence, capable of absorbing any stress and cushioning the GIL ratio, which currently stands near historical lows.

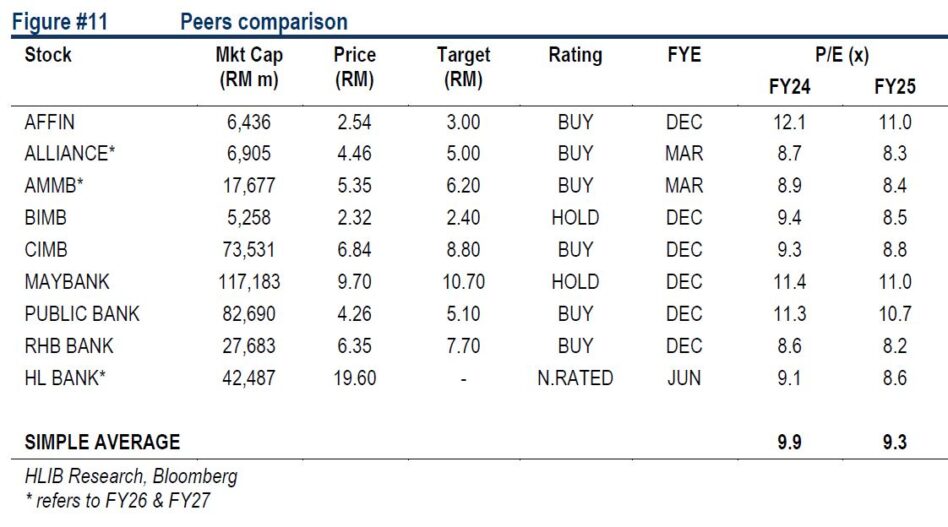

“We reiterate our overweight stance on the Malaysian banking sector, viewing the KLFIN Index’s 7% year to date decline as a strategic opportunity to build positions ahead of an anticipated market recovery in the latter half of 2025,” said HLIB. —June 9, 2025

Main image: European Commission