THERE was a quarter-on-quarter (QoQ) spike in loans in most banks, likely due to household and business accounts frontloading their funding needs ahead of quarter one calendar year 2025 (1QCY25)’s seasonally dense quarter.

On the flipside, non interest income (NOII)s saw sharp drops in treasury and forex income owing to the correction in MYR strength which was previously uplifted by US Fed Rate and regional rate cuts in 3QCY24.

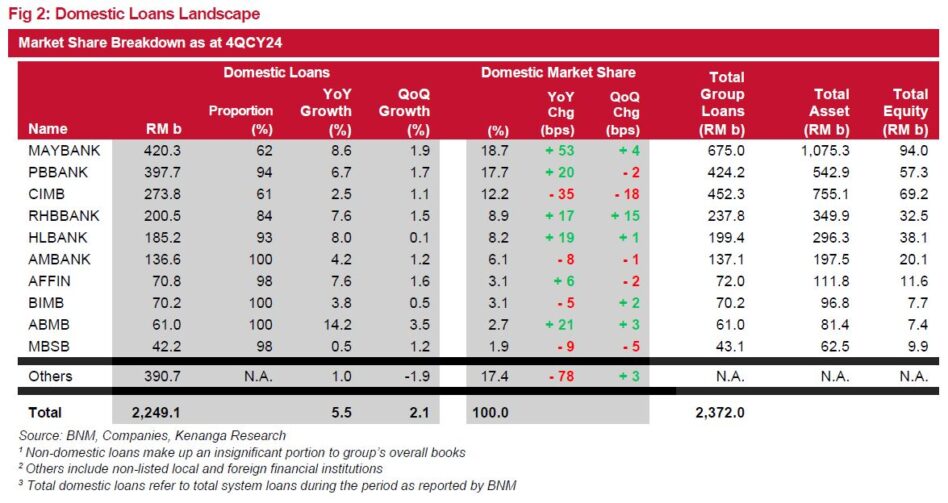

“Based on 4QCY24’s domestic market share breakdown, the combined market share of our 10 listed local banks came in at 82.6%,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

Market-wide, most banks have successfully contained the compression of net interest margin (NIM) as they step aside from overly competitive deposit rates, though with glimmers still seen in 4QCY24.

Going into CY25, there may be further subsiding of NIMs albeit with pressures now coming from asset yields to garner a larger loans share. Common targets include SMEs for better margins and higher-value mortgages for safety and access to a more affluent clientele.

“While we sense the banks are trying to minimise their exposure to less profitable wholesale accounts, this may not be entirely avoidable by the larger cap banks to maximise the deployment of their capital,” said Kenanga.

Post results, Kenanga continues to believe that the sector’s outlook remains intact, with loan growth being healthily supported by domestic sectors and well-managed interest margins able to offset higher operating expenses and credit costs.

Any weakness in share price within the sector presents opportunities to accumulate, particularly with dividend yield prospects returning to the 6%-7% range for certain names.

“Our projections are based on overnight policy rate to remain stable at 3% throughout CY25,” said Kenanga. —Mar 4, 2025

Main image: Dollar And Sense