IN effort to further protect customers from financial scams, member banks of the Association of Banks in Malaysia (ABM) and the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) have commenced the implementation of malware shielding technology on their mobile banking apps to provide further protection to banking customers.

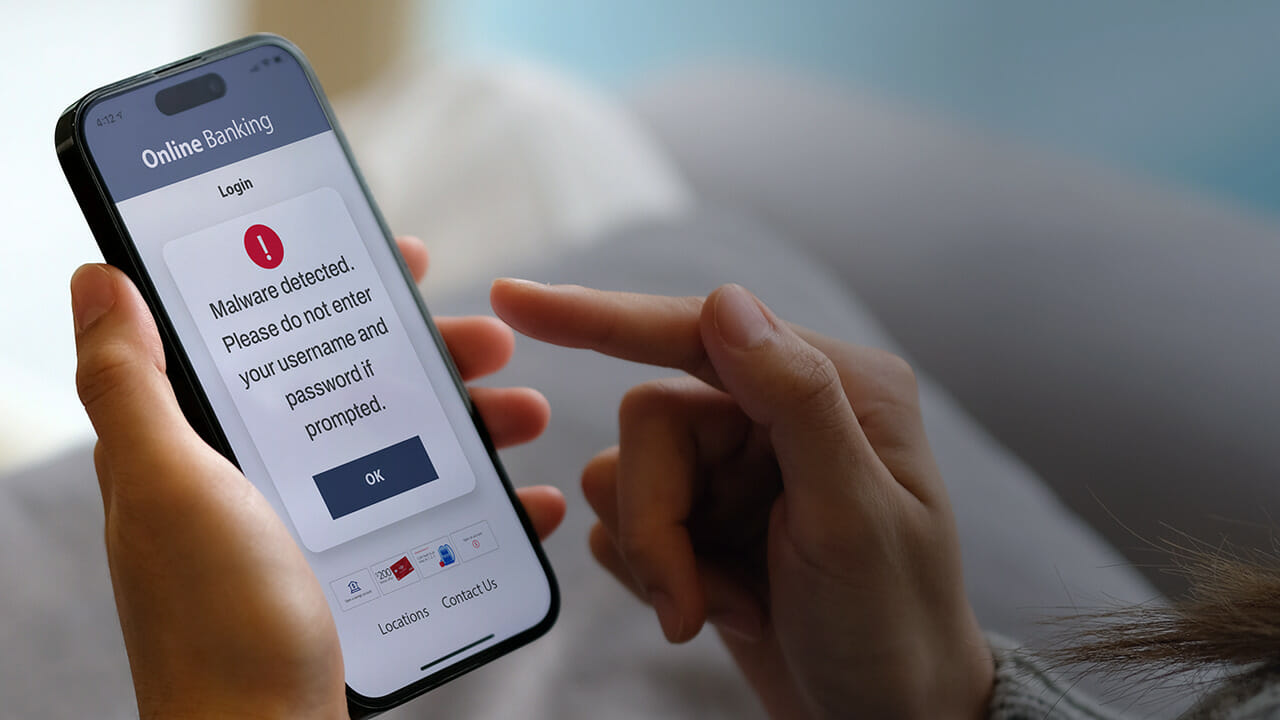

The new malware shielding technology is a preventive security measure embedded within the banks’ native mobile banking apps with the capacity to detect high-risk malware in scenarios such as malicious APK files and suspicious remote monitoring access on customers’ devices.

“The fight against online scams is a shared responsibility. We welcome this effort by the banks to enhance their online banking apps with malware-shielding technology to curb malware-related scams,” commented Bank Negara Malaysia (BNM) governor Datuk Seri Abdul Rasheed Ghaffour.

“This helps to create a more secure banking environment for all Malaysians. We also urge members of the public to remain vigilant against requests to download apps from unofficial sources.

Meanwhile, ABM chairman Datuk Khairussaleh Ramli said the implementation of the malware shielding technology marks a significant step forward in their collaborative efforts in line with advice from BNM, who had been instrumental in driving this industry-wide initiative.

“Emphasising customer privacy, malware shielding is only activated upon the customer launching the mobile banking app, and does not run in the background 24/7,” he added.

“We would like to assure our customers that their banking information and personal data remain confidential and protected.”

In instances where a customer’s device is identified as potentially compromised by malware app shielding protocols, temporary restrictions on using the bank’s mobile app might be implemented.

This technology helps identify potential vulnerabilities that could be exploited by malicious actors. Coupled with customers’ own vigilance, the feature could help prevent unauthorised transactions and protect customers’ funds.

While the implementation of malware shielding by banks helps to reinforce safeguards and increase resistance against malware scams on end-point devices, customers are urged to continue to protect themselves by observing good cyber hygiene rules and mobile banking habits, such as the following:

- Never download any APK file from links, especially on messaging apps such as Telegram and WhatsApp. Only download apps from official app stores such as Apple App Store and Google Play Store;

- Never allow third-party app permissions to monitor or control your device, application and gestures, which can compromise your banking details; and

- Never use unsecured or public Wi-Fi networks to deter attackers from sneaking malware into your device

In July 2023, the banking industry implemented five key measures to combat financial scams, including replacing the SMS OTP with a more secure authentication method; tightening fraud detection rules; performing cooling-off period for first-time registration of online banking access; allowing only a single mobile device or secure device to be registered; and enabling a 24/7 dedicated complaint channel for customers.

To raise fraud literacy levels in the country, banks in Malaysia also launched the #JanganKenaScam national awareness campaign in Oct 2023 to equip customers with the knowledge to identify red flags associated with various scam tactics.

To find out more about the campaign, visit www.JanganKenaScam.com. – Aug 9, 2024