Letter to editor

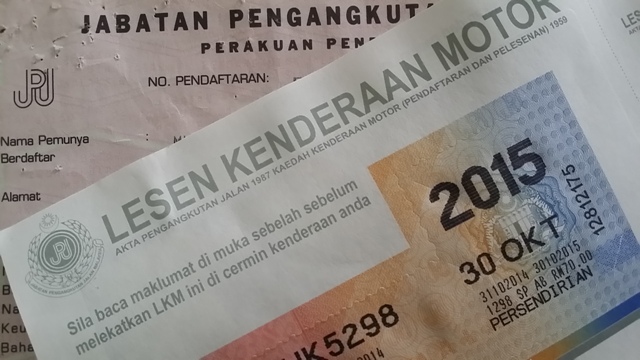

During the 55th anniversary dinner of Kuala Lumpur and Selangor Car Dealers and Credit Companies Association on Jan 13, Transport Minister Anthony Loke Siew Fook disclosed that road tax will be digitalised to replace the current practice of displaying stickers on front windscreens.

In one fell swoop, many problems associated with physical road tax printed on stickers that break easily will be relegated to history. Digitalisation should also be extended to commercial vehicle permits that are printed on paper and kept in rental cars, taxis, buses, lorries and others.

But no system can be fool proof especially given that Malaysians do not lack ingenuity in beating the system.

In time to come, many identical vehicles could be fitted with same registration number plates and used in different states. And these vehicles could belong to the same or different owners.

The ruse would only be exposed when a police report is made after a motor accident – or innocent owners protested and proved they were not in the state when a summons was issued for driving or parking offences. However, fail-safe methods are also likely to be incorporated.

Vehicle weight vs engine size

In any case, the archaic system of calculating road tax should be discarded and replaced by a fairer method using plain common sense which is becoming increasingly rare. If tax is based on usage of public roads, then rates should be based on vehicle weight on the road – not engine size.

This is more so when small engines of today – when turbocharged – are more powerful than naturally aspirated engines that are twice the size. And what will be the rate for power generated by batteries as used in hybrid and fully electric vehicles or hydrogen-powered fuel cells?

Basing on total power generated by internal combustion engines (ICE) and batteries would certainly be fairer than just the cubic centimetre sizes of ICE. But the most equitable method is to base road tax on vehicle weight that has a direct impact on the wear and tear of our roads.

This is far from rocket science, but our Road Transport Department (RTD) had been sitting pretty with little urgency to change things for the better. And this is not the first time that I have been calling for road tax to be based on vehicle weight. Many of my articles were published earlier.

They include “Road tax should be based on vehicle weight” on Jul 20, 2017; “Let’s base road tax on vehicles’ weight” (Jun 8, 2018); “Base road tax on vehicle weight” (Feb 2, 2021); and “High time a fairer system to calculate road tax was introduced” (Dec 15, 2021).

Hopefully this time, not only road tax will be digitalised but the rates would also be based on vehicle weight. Instead of waiting for ages to take incremental steps, our RTD ought to make quantum leap in all fronts, and not be bogged down by legacy issues. – Jan 16, 2023

YS Chan

Kuala Lumpur

YS Chan is master trainer for Mesra Malaysia and Travel and Tours Enhancement Course and an ASEAN Tourism Master Trainer. He is also a tourism and transport business consultant.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.