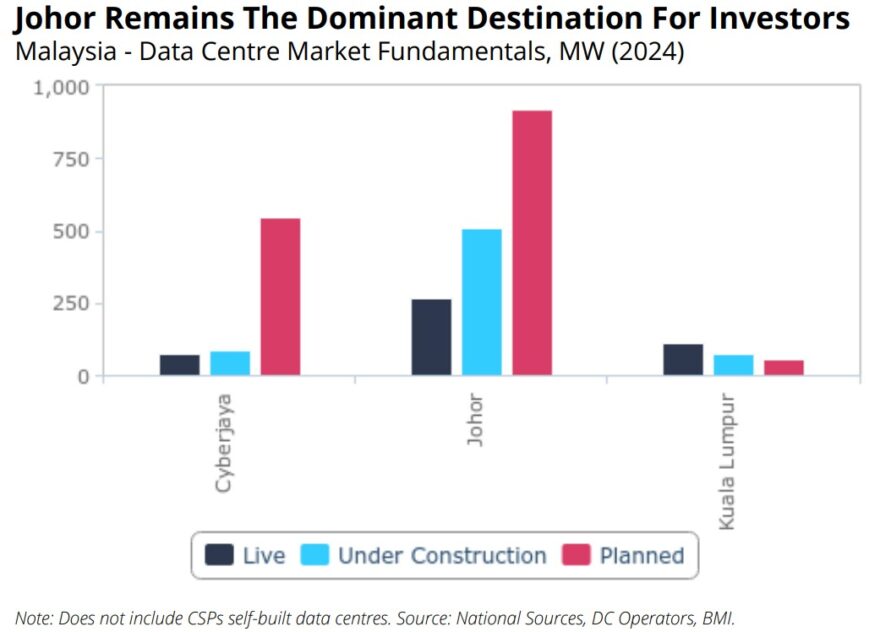

BMI Country Risk and Industry Research has revised its estimates and forecasts of prospects of Malaysia’s data centre (DC) industry although Johor continues to be the leader in terms of upcoming IT (information technology) load with 268.5MW (megawatt) of live capacity.

As it is, the research house reckoned that there are about 507MW of capacity under construction with another 921MW planned for delivery over the long term.

“The imposition of a sustainability-linked regulatory framework could catalyse further developments in regions outside of Cyberjaya and Johor, including Kedah, with investment looking to capture new regions to become a digital hub,” observed BMI in its latest DC-related commentary.

“As an equity investor, this creates a dynamic where these developments become a portfolio bet on which market is likely to experience demand spill-over from major markets or become a new hub.”

Consequently, BMI which is a Fitch Solutions company but independent of Big Three credit ratings agency Fitch Ratings stressed the need for higher risk tolerance in an effort to position the capital “to crystalise on the demand even in instances where the demand may materialise elsewhere”.

“While uncertainty rises in these areas, expected returns are as a result, elevated. Ultimately, depending on the portfolio strategy, this could result in outsized returns compared to the most saturated markets,’ projected the research house.

BMI’s latest outlook came about as real estate private equity firm Area Group has begun constructing a data centre campus in Kedah with the 156-acre campus being valued at US$15 bil (US$64.87 bil).

Investment into this area comes amid above market average power, water and connectivity infrastructure presence, notably hedging against the potential introduction of regulation aimed at enforcing sustainability-linked standards for the domestic data centre industry.

“These are likely to be contributing factors to the movement of investment away from saturated domestic sub-markets such as Johor,” suggested BMI.

“This development aligns with our prior conviction that sustainability-linked standards would distort competitive dynamics, followed with flows away from the primary Malaysian markets.”

According to the research house, Kedah shares key characteristics of the major Malaysian markets before they were saturated with activity such that the PAS-ruled state looks to be a region of interest for investors.

“Kedah’s strategic location enables it to capitalise on the submarine cables that run in Southern Thailand with data centres potentially utilising this connectivity source,” envisages BMI.

“However, one key environmental risk relates to flooding posing a threat to the timeliness and cost implications of projects within the region.”

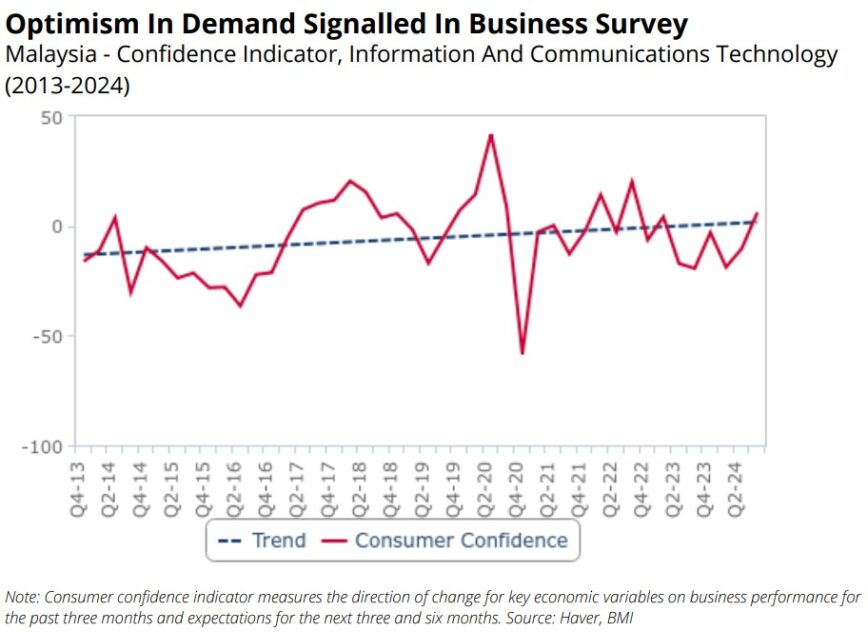

Nevertheless, BMI pointed that business tendency surveys in the information and communications technology (ICT) sector indicate rising satisfaction with past performance and optimism regarding key economic variables for business performance in the next three to six months.

“With the trend line signalling increasing satisfaction and optimism, business confidence has returned to pre-pandemic levels within the region,” asserted the research house.

“While expectations on future macroeconomic variables are baked into these responses, it is noteworthy that the establishment of local secondary markets could be an indication of these expectations, feeding into investor confidence within the region.” – Oct 22, 2024