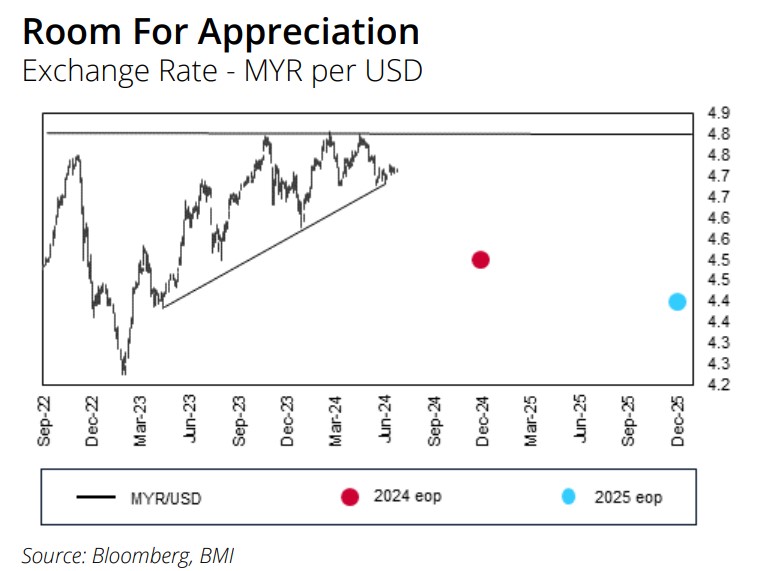

BMI Country Risk and Industry Research has retained its 2024 forecast that the ringgit will appreciate against the greenback later this year, rising from RM4.70/US$ currently to RM4.55/US$ by end-2024.

Over the short-term (three-to-six months), however, the local currency has been on a broad weakening trend since the start of 2024 and having touched multi-year support of RM4.80/US$ on April 16 (see chart below).

“While it has since regained some lost ground, the unit is down 2.5% against the US dollar year-to-date (YTD), ranking it among the better performing currencies in Asia,” observed BMI in its ringgit outlook.

“However, as the exchange rate has remained largely unchanged since our previous update in April, we retain our forecast (for the ringgit) to touch RM4.55/US$ by end-2024 – implying that the ringgit will likely appreciate more substantially in 4Q 2024.”

BMI further expects the narrowing interest rate differential yield between the US and Malaysia to be supportive of the ringgit in the medium term, particularly if the research house “is right in expecting Bank Negara Malaysia (BNM) to leave its overnight policy rate (OPR) on hold at 3.00% through end-2024”.

Long term

Looking beyond the six-month horizon, BMI expects the ringgit to strengthen by 3.3% next year, reaching RM4.40/US$ by end-2025.

“Our forecast is slightly more optimistic than Bloomberg consensus forecast of RM4.45/US$,” projected the research house.

“The primary driver will be further policy loosening worth 200 basis points (150 bps in our April update) which will take the US Federal Reserve funds rate down to 3.00% by December 2025, Meanwhile, we expect BNM to remain on hold at 3.00% through end-2025.”

BMI attributed its somehow bullish outlook to Malaysia’s relatively strong real GDP (gross domestic product) growth outlook vis-à-vis the US which will bode well for investor sentiment by providing a favourable backdrop for the ringgit.

“We expect real GDP growth to accelerate from 3.7% in 2023 to 4.4% and 4.5% in 2024 and 2025 respectively. Meanwhile, we expect growth in the US to slow from 3.6% in 2023 to 2.1% and 1.4% during the same period.”

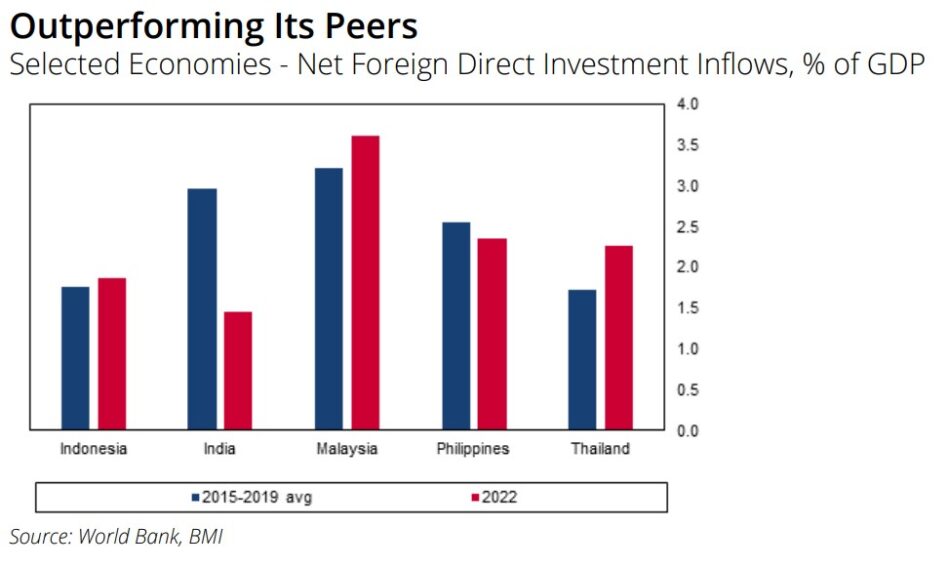

Moreover, BMI also expects resilient foreign direct investment (FDI) inflows to continue to be supportive of the ringgit.

As a share of GDP, net FDI inflows into Malaysia have consistently surpassed that of its regional peers such as the Philippines and Thailand.

More recently in May, Prime Minister Datuk Seri Anwar Ibrahim is also seeking to attract RM500 bil in investments as part of the initial phase of the National Semiconductor Strategy, particularly in the water fabrication and manufacturing equipment aspects.

“Additionally, at the 50th anniversary celebration of China-Malaysia diplomatic ties, Chinese Premier Li Qiang has opened the possibility of connecting Malaysia’s East Coast Rail Link (ERL) to other Chinese-backed railway initiatives in Laos and Thailand,” suggested BMI.

“While little has been finalised as of June, we expect Malaysia’s FDI to benefit from the improved regional connectivity should these plans come into fruition.” – July 2, 2024

Main image credit: Revolut.com