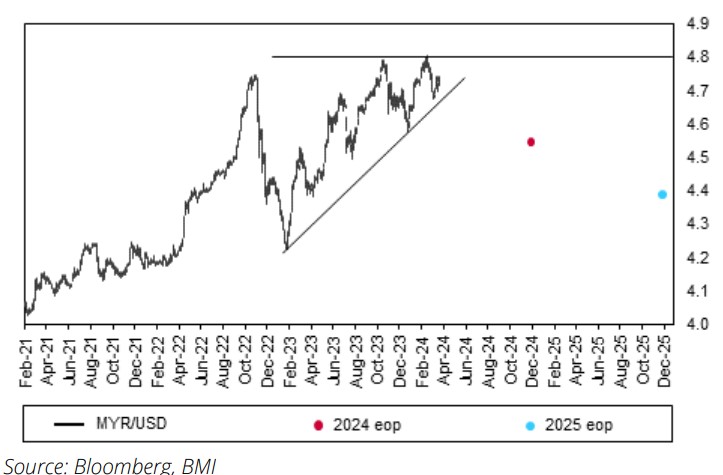

BMI Country Risk & Industry Research – a Fitch Solutions research house which is independent of credit ration agency Fitch Ratings – has revised downward its end-2024 ringgit forecast to a weaker RM4.55/US$ from RM4.40/US$ to account for the currency’s performance in 1Q 2024.

Recall that the local currency’s short-term outlook (three-to-six months) has revealed a broad weakening trend since the start of the year by having touched the support level of RM4.80/US$ in February.

While it has since regained some lost ground, the ringgit is down 2.9% against the greenback year-to-date (YTD), ranking it among the poorest-performing emerging market currencies in Asia.

“Despite this revision, our view for the ringgit is positive and we expect the unit to trade sideways to stronger and to touch trendline support around the RM4.67/US$ level by 1H 2024,” BMI pointed out in its latest ringgit outlook commentary.

Looking beyond the six-month horizon to its long-term outlook (six-to-24 months), the research house expects the ringgit to continue to strengthen in 2H 2024 and early 2025 to reach RM4.40/US$ by end-2025.

“The key driver will be further policy loosening worth 150 basis points which will take the Fed (US Federal Reserve) funds rate down to 3.00% by December 2025. But other factors will also provide underlying support to the ringgit,” opined BMI.

“We expect Malaysia’s external position to strengthen in 2024. Our commodities team forecasts that oil prices will average US$85/barrel in 2024, a touch above the US$82.18/barrel in 2023.”

In addition to oil which accounts for nearly 20% of total outbound shipments, hence a crucial commodity to sustain Malaysia’s exports, BMI further expects services exports to continue picking up pace.

The latest figures from the Tourism, Arts and Culture Ministry showed that total tourist arrivals in 2023 amounted to 20.1 million which surpassed the government’s upwardly revised target of 19 million although this still remains about 77% of pre-pandemic levels.

“Nevertheless, we expect the recently implemented 30-day-visa-free entry for Indian and Chinese tourists will help achieve the government’s target of 27.3 million tourist arrivals this year,” projected the research house.

“All told, this feeds into our forecast for Malaysia’s current account surplus to widen from 1.2% of GDP (gross domestic product) in 2023 to 2.6% in 2024.”

Elsewhere, BMI also expects resilient foreign direct investment (FDI) inflows to remain supportive of the ringgit.

“Malaysia boasts bright long-term economic prospects aided by a rapidly growing working-age population which will allow it to remain an attractive destination for foreign investment over the coming years,” noted the research house.

“As a share of GDP, net FDI inflows into Malaysia have consistently surpassed that of its regional peers such as the Philippines and Thailand.”

Nevertheless, BMI cautioned that risks to its currency forecasts are skewed towards a weaker ringgit.

“A slower than expected improvement in the electronics& electrical sector amid a prolonged delay in Mainland China’s recovery could leave the ringgit vulnerable to further weakness,” warned the research house.

“Additionally, should the government decide to scale back on existing subsidies and price control measures, this would lead to a renewed uptick in headline inflation.” – April 8, 2024

Main image credit: Revolut (US$/RM exchange rate f0r April 8, 2024)