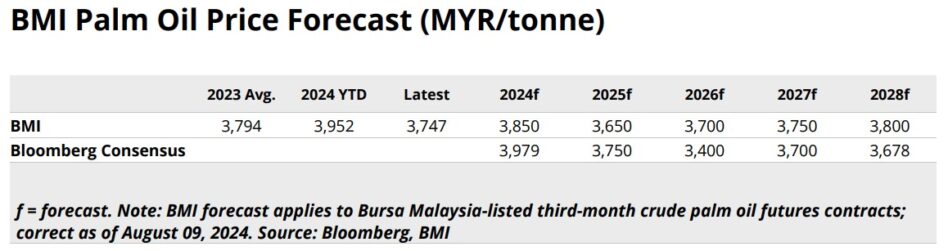

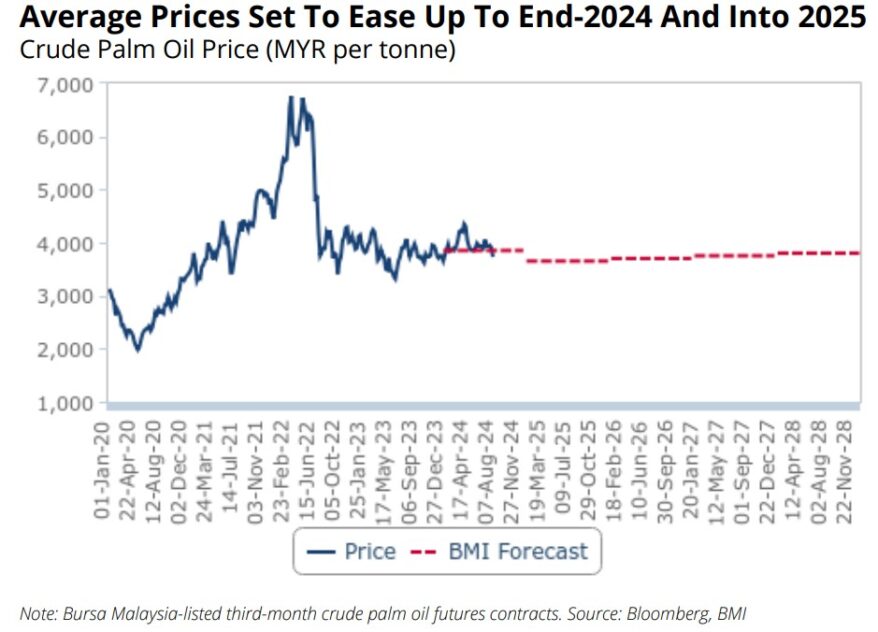

BMI Country Risk and Industry Research has made an upward revision of 2.7% to its average price of Bursa Malaysia-listed third-month crude palm oil futures contracts in 2024 to RM3,850/metric tonne (MT) from RM3,750/MT.

While this upward revision indicates that its earlier view that prices would ease throughout 2H 2024 has not occurred to the extent that it expected, the research house remains below consensus and is of the view that prices will face bearish headwinds into 2025 with an average price of RM3,700/MT up to end-2024.

“On Aug 7, palm oil prices sank to an end-of-session price of RM3,697/MT, a seven-month low,” observed BMI in a commodity price forecast note.

“During the fortnight prior, an appreciation of the Malaysian ringgit against the US dollar saw the price of ringgit-denominated palm oil contracts fall while the recent crude oil sell-off weighed on demand for biofuel feedstocks.”

According to BMI, the United States Department of Agriculture’s (USDA) latest World Agricultural Supply and Demand Estimates (WASDE) report on Aug 12 has reinforced bearish sentiment in soybean markets with Chicago Board of Trade (CBOT)-listed soy oil futures contracts losing ground over the trading session.

Throughout the remainder of 2024 and into 2025, the research house expects ample supplies, competition from alternative edible oils and unsure import demand to weigh on the palm oil market while the expected onset of a La Niña event in 4Q 2024 and the coming into force of the EU Deforestation Regulation at the start of 2025 to further compound pressures.

“In the near term, increased tension in the Middle East which could see fuel prices and biofuel feedstock demand increase represents the principal upside risk to our outlook,” projected BMI.

The research house further expects world palm oil production surplus to narrow from an estimated 1.9 million MT in 2023/2024 to 1.3 million MT in 2024/2025 which would mark a four-season low.

“Global palm oil consumption growth will drive this trend with the uprating of the Indonesian biodiesel blending mandate a significant factor,” projected the research house.

“Nonetheless, we expect that prices will trend lower on fundamentals throughout 2025 and forecast an average price of RM3,650/MT which remains elevated when compared to pre-pandemic levels” – Aug 21, 2024