BMI Country Risk and Industry Research has revised upward its end-2024 forecast for the ringgit from RM4.55/US$1 to RM4.00/US$1 to reflect the local currency’s robust performance in 3Q 2024.

The ringgit has reversed its broad weakening trend since the start of 2024 to gain 12.1% in 3Q 2024, thus positioning it to be the best performing emerging market currency in the region.

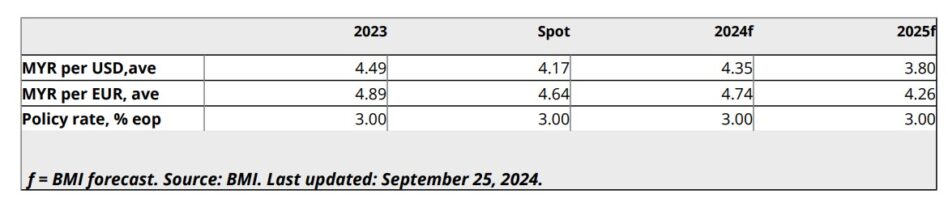

“To account for the stronger-than-expected performance in 3Q 2024, we have revised our forecast for the unit to average RM4.35/US$1 from RM4.55/US$1 previously (short-term outlook of three-to-six months),” projected BMI in its latest ringgit forecast.

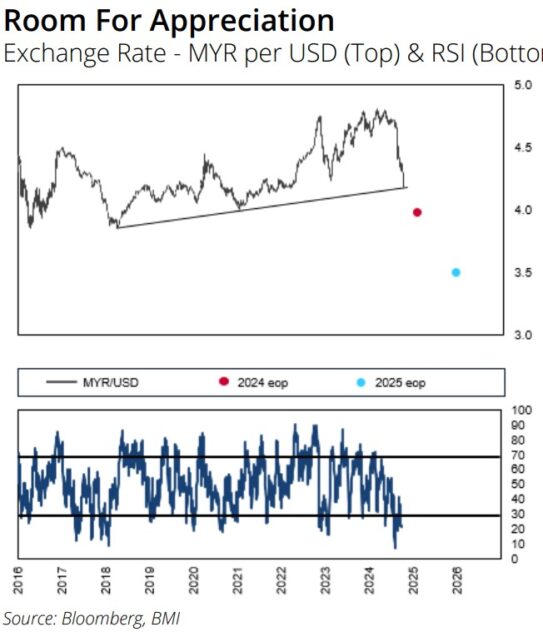

“From a technical perspective, the unit touched multi-year trendline resistance at RM4.20/US$1 level on Sept 23 (see chart below). Our forecast is somewhat more optimistic than Bloomberg consensus of RM4.30/USS1.

“We see scope for the ringgit to touch the next level of resistance at the RM4.00/US$1 level by end-2024 though the RSI which appears heavily oversold as things stand could point to short-term depreciation. “

BMI further expects interest rate differentials between the US and Malaysia to narrow in favour of the ringgit.

Whereas it previously expected the US Federal Reserve to kick off its easing cycle with a 25 basis points (bps) cut at its September meeting, the Fed had instead opted for a 50bps cut that took the funds rate down to 5.00%.

“As such, we now think the Fed will continue with its cutting cycle in the coming months, lowering its policy rate further by a further 75bps in 4Q 2024 from 50bps previously,” opined the research house.

“This implies that narrowing yield differentials will be supportive of the ringgit particularly if we are right in expecting the Bank Negara Malaysia (BNM) to leave its overnight policy rate on hold at 3.00% through end-2024.”

Looking beyond the six-month horizon, BMI forecast the ringgit to strengthen by 9.0% in 2025, reaching RM3.55/US$1 by end-2025.

“Accordingly, we have revised lower our forecast for the Malaysian ringgit to average RM3.80/US$1 compared to RM4.48/US$1 previously,” projected BMI.

“The primary driver will be further policy loosening worth 125bps in 2025 which will take the Fed Funds rate down to 3.00% by year end. In contrast, we expect the BNM to remain on hold at 3.00% through end-2025.”

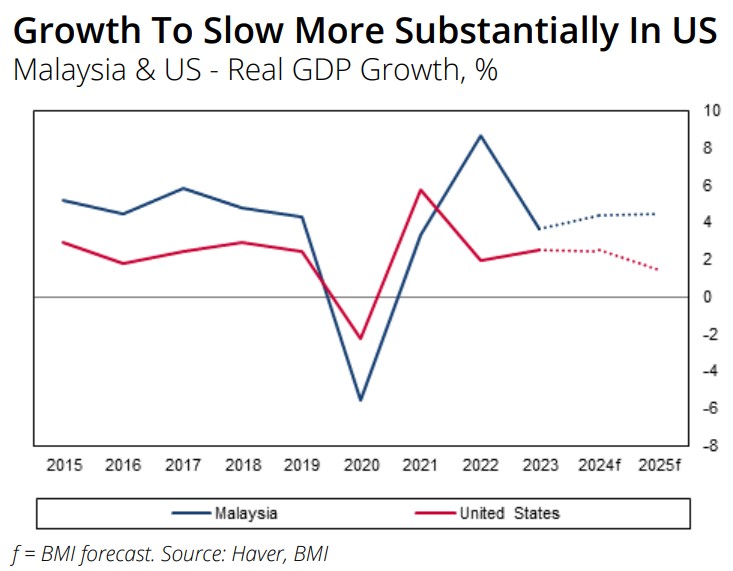

From a growth perspective, BMI expects Malaysia’s relatively resilient real GDP (gross domestic product) outlook vis-à-vis the US to bode favourably for investor sentiment, hence providing a favourable backdrop for the ringgit.

“We expect real GDP growth to slow marginally from an anticipated 4.7% in 2024 to 4.6% in 2025. Meanwhile, we project a more significant slowdown in US growth, from our forecast of 2.5% to 1.5% during the same period (see chart above).” – Sept 27, 2024