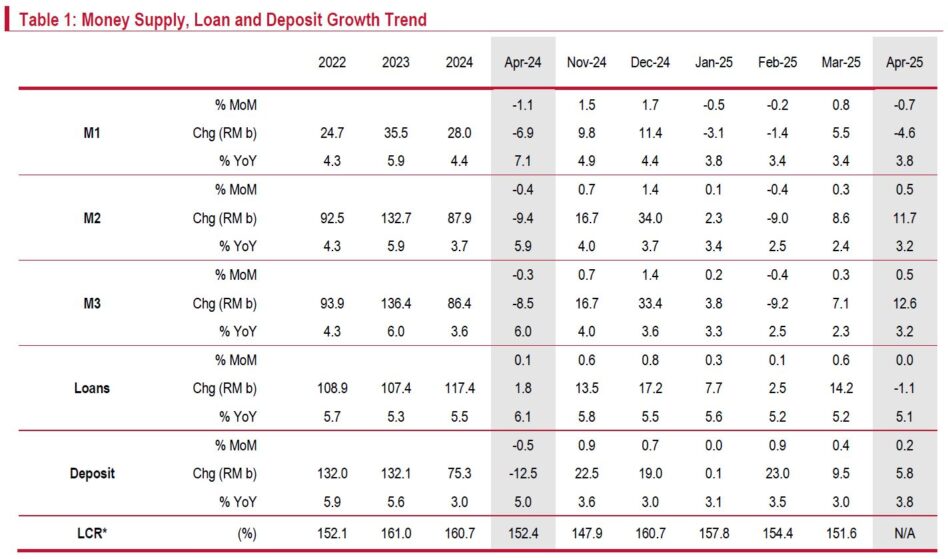

BROAD money growth accelerated to 3.2% year-on-year (YoY) a three-month high. The growth expansion was contributed by higher foreign currency deposits, followed by demand and fixed deposits.

Higher net claims in the private sector offset weaker government activity.

“Net claims on government declined for the third straight month, due to a slowdown in government deposits, though government claims rebounded marginally,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

Claims in the private sector expanded to a nine-month high, amid sustained loans and expansion in securities. Net foreign assets rebounded marginally after a contraction in the previous month, thanks to a sharp rebound in net foreign assets held by the banking system.

Also, loan growth edged down to 5.1% YoY, a 17-month low. By sector, there was a notable slowdown in wholesale and retail trade. Weakness persisted in agriculture, mining & quarrying, construction and education, health and other sectors.

On the other hand, deposit growth expanded sharply to 3.8% YoY, a nine-month high. This is driven by surges in foreign currency and demand deposits. But growth was capped by slower saving deposits.

Kenanga’s 2025 loan growth forecast was maintained at 5.5% – 6.0%.

Loan growth will be supported by Bank Negara Malaysia (BNM)’s recent SRR cut, injecting about RM19 bil in liquidity into the banking system.

Loan demand should remain resilient, backed by stable domestic consumption, a solid labour market, and rising household incomes, despite heightened global economic uncertainty from Trump’s tariffs. Momentum is expected to build towards year-end as base effects ease.

“Despite market expectations for a 25 basis points cut, we continue to expect BNM to keep the overnight policy rate at 3.00% through 2025,” said Kenanga.

Domestic economy is likely to remain stable amid steady domestic demand. This is reflected in the latest core inflation which rose to 2.0% in April, signalling firm underlying demand despite low and stable headline inflation at 1.4%. —June 3, 2025

Main image: Rumah-i