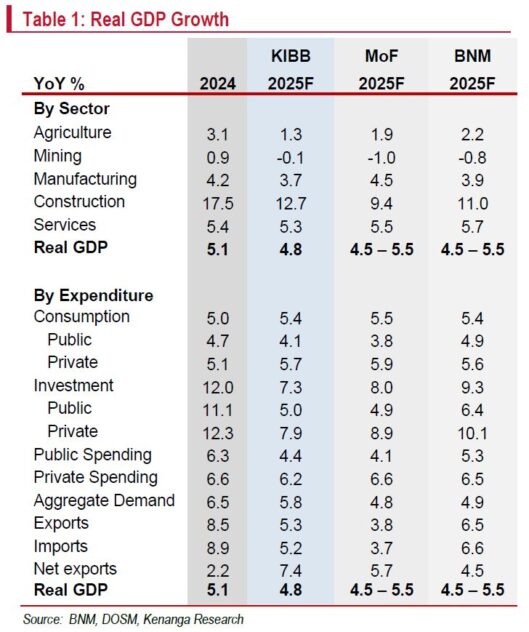

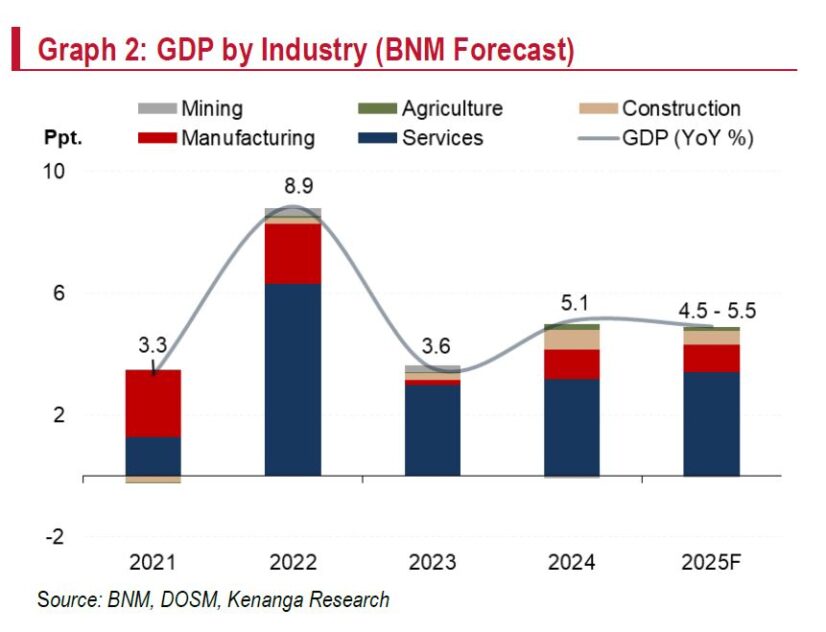

BANK Negara Malaysia (BNM) forecast Malaysia’s gross domestic product (GDP) growth to expand between 4.5% to 5.5% in 2025 (2024: 5.1%), in line with various institutions’ growth projections.

The projection matches the Ministry of Finance’s (MoF) 4.5% – 5.5% forecast. It also aligns with Kenanga Research (Kenanga)’s in-house forecast of 4.8%, the International Monetary Fund (4.7%) and the World Bank (4.5%), as well as Bloomberg’s median consensus (4.7%).

Although BNM sets a range, its actual point forecast of 4.9% is slightly above MoF’s 4.8%.

“BNM credits the outlook to strong domestic demand, backed by ongoing employment and income growth, robust investment, Budget 2025 measures, and a diversified economy,” said Kenanga in the recent Economic Viewpoint Report.

Risks are balanced. Downside risks primarily stem from external uncertainties, tighter trade policies and subsequent retaliatory measures, and escalating geopolitical conflicts that could disrupt global trade, investment and spending.

Commodity production disruptions may also affect the growth outlook.

Conversely, BNM also outlined potential upside risks, including higher external demand from successful trade negotiations and pro-growth policies in major economies, greater spillovers from the global tech upcycle, robust tourism, and faster implementation of new and existing investment projects.

“We broadly concur with BNM’s assessment that exports will continue to outpace imports, bolstered by stronger spillovers from global tech upcycle and sustained demand for AI-related products,” said Kenanga.

The tourism outlook is upbeat, with projected arrivals of 31.0 mil (2024: 27.3 mil) and robust receipts, potentially shifting the services account into surplus and reinforcing the CA balance.

A firmer ringgit against the USD could further boost the value of foreign investment earnings upon conversion, indirectly supporting the CA surplus.

Additionally, government-led investment initiatives, such as the Johor-Singapore Special Economic Zone and stable domestic capital markets may attract more foreign inflows and bolster the surplus.

Nonetheless, resilient domestic demand, supported by broad-based wage increases, could drive higher imports of intermediate and capital goods, tempering the overall surplus.

Trade policy uncertainty, particularly regarding Trump’s tariff stance, presents another risk. On balance, Kenanga forecast a CA surplus of 1.9% of GDP in 2025, aligning with the midpoint of BNM’s projection.

Despite speculation of an OPR cut in late 2025, Kenanga expect BNM to hold its policy stance given stable inflation and resilient economic growth.

While Trump’s tariff policies pose risks of inflationary shocks and reduced global trade, Malaysia appears relatively insulated due to strong domestic demand, a robust labour market and diversified exports.

Compared with regional peers, the economy is better positioned to withstand external pressures, reducing the urgency for monetary easing.

For now, BNM is likely to prioritise policy stability over pre-emptive adjustments, ensuring that inflation remains anchored while sustaining growth momentum. —Mar 26, 2025

Main image: New Straits Times