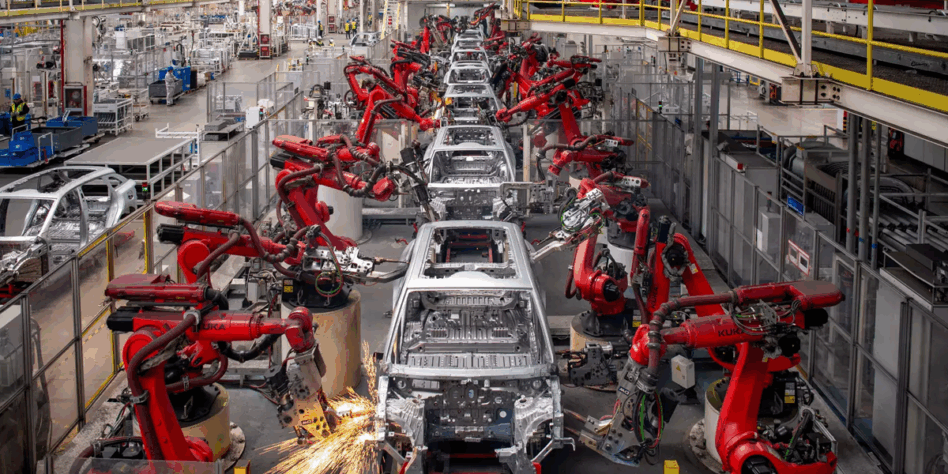

ECONOMISTS chimed in to say that Malaysia must increase its domestic investment and bolster consumer spending to offset the tepid exports expected in 2023.

They said that with the global headwinds on the horizon, no country will be spared from the effects of an economic and Malaysia must insulate itself against the vagaries of the external environment.

Sunway University school of business Professor of Economics Dr. Yeah Kim Leng told FocusM that the external decline in external demand could be offset by boosting domestic demand, especially in promoting domestic and private investments.

Yeah said that the government through its spending is also a key policy lever that is applied to support domestic demand, It could prioritise spending and development activities in those sectors facing global headwinds.

Yeah also added the decline in external demand can be offset by diversifying exports to countries less affected by the global recession and through opportunities presented by Malaysia’s membership in new regional trade blocs.

According to economists, with recession risks looming in developed economies such as the United States and European Union (EU), and China’s economy moderating, global demand for goods and services is expected to decline in 2023, which could weigh on Malaysia’s export growth.

Export growth last month accelerated to 15.6% year-on-year (yoy), underpinned by increases in shipments of electrical and electronics (E&E) and petroleum products, from 14.9% yoy in October. Import growth, on the other hand, continued to moderate to 15.6% yoy from 29.1% yoy in October.

On a monthly basis, November exports declined 1%, following a contraction of 8.8% in October, while imports fell 4.9% in November after a 1% increase in October.

Malaysian Institute of Economic Research senior fellow Dr. Shankaran Nambiar agrees that Malaysia concentrates on domestic production and growing SMEs

He said that emphasis on domestic investment and increasing consumer spending was imperative as Malaysia would have difficulty achieving growth momentum next year as exports have already started to soften and are expected to weaken going into the first quarter of 2023.

An economist in the public sector said that greater priority must be given to incentivise SMEs to step up their game and to help them bolster investments in the country to offset the weakening external demand as Malaysia’s traditional trading partners such as China and the US appears to be all slowing down.

He said that the recent contraction in China’s trade and manufacturing activity will also further exacerbate global trade demand fragility, risking Malaysia’s exports to China, which accounts for roughly around 15% of Malaysia’s total exports adding that a sharp recession is also underway in the US.

As part of the efforts to increase consumer spending, the government should go on a drive to increase agricultural output and increase food production as this would help bring down the prices of food and agricultural products that form the bulk of the expenditure of consumers, especially after the spike in its prices following COVID-19.

“If food prices are brought down through increased production, then consumers would have more money in their hands for other things and this will invariably bolster consumer spending and private investments, ” he said. — Dec 24, 2022