BOUSTEAD Plantations Bhd (BPlant) was listed on Bursa Malaysia in 2014 under the plantation sector.

The group today co-own or leases a total of 48 oil palm plantation estates and 10 palm oil mills in Malaysia. Its total landbank stands at circa 98,200 hectares. Out of this total, the area under oil palm cultivation is around 79,400ha.

Among the listed plantation companies on Bursa Malaysia, BPlant is ranked sixth in terms of the total acreage of oil palm planted areas.

Performance

For its 1H FY2021, the group achieved revenue of RM415 mil compared to RM328 mil for the same period last year. Its net profit for the period under review was RM60 mil compared to a net loss of RM8 mil for the same period of 2020.

The half yearly results are in contrast to the past eight years of performance as can be seen from the Performance Index chart. For the chart, three metrics were tracked: revenue, net profit and gross profitability – relative to the levels in 2013 (the year before its public listing).

Gross profitability is measured by gross profits to assets. According to Professor Robert Novy-Max, it has roughly the same power as book-to-market in predicting the cross-section of average returns.

The analysis showed that revenue and gross profitability from 2014 to 2020 were below the 2013 levels, while net profit had been volatile.

Although cumulatively the group made profits since its listing, the bulk of the profits were not from the operations.

- From 2014 to 2020, the group achieved a cumulative net profit of RM800 mil.

- From 2014 to 2020, the gain from the disposal of land and/or estates amounted to RM900 mil. The land sales were carried out in 2015 to 2017, and 2019.

This meant that the plantation operations incurred cumulative losses since its 2014 listing.

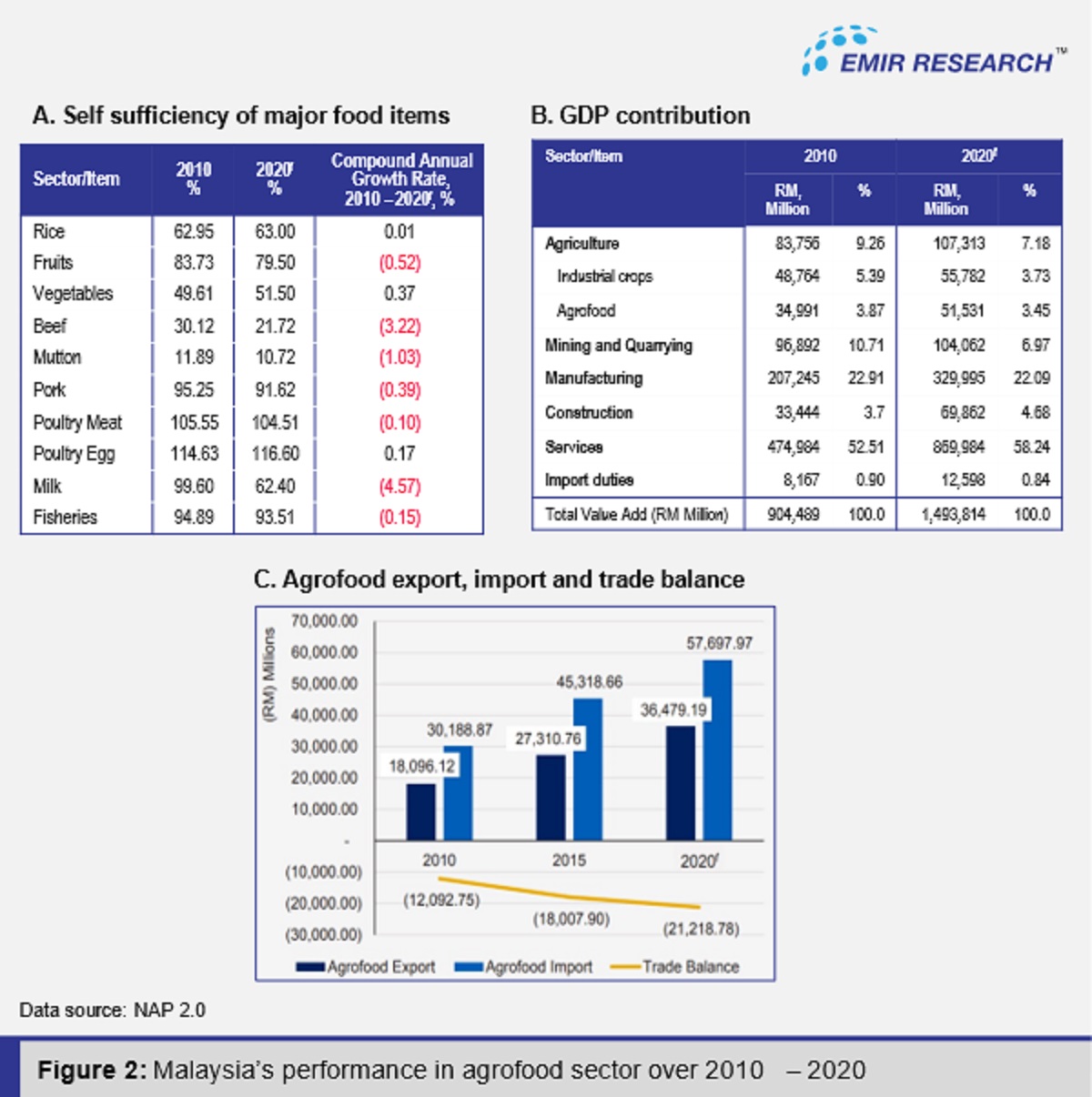

Plantation Industry performance

Were the challenges faced by BPlant an industry issue?

To answer this, I compared BPlant performance relative to the industry. The industry in this context is all the companies under the Bursa Malaysia plantation sector except for five.

The chart below shows that while there has been some decline in revenue since 2013, the industry decline for the industry is less severe than those experienced by BPlant.

Despite the sale of land and/or estates since its 2014 listing, there were only two times that the returns for BPlant outperformed the industry. This is looking at it from an ROE (return on equity) and well as a ROA (return on assets) basis. Without the gains from the sale of land, the returns would have been much lower.

Even from a plantation operations perspective, BPlant has performed badly. The table below shows the key production metric for the top five plantation companies compared to BPlant.

BPlant’s yield in terms of metric tonnes of fresh fruit bunches (FFB) per hectare is the lowest among the panel. Of course, the yield also depends on the age of the plant and the location of the estates.

What business is BPlant in?

The answer is in where the earnings are coming from. In BPlant’s case, it’s easy to conclude that it is not in the plantation business.

Referring to the source of the profits since its listing in 2014, there has been significant contribution from sale of land and/or estates. These comprises:

- 2015: Sale of 121ha of quarry land and government acquisition of 9ha. Both were in Johor.

- 2016: Sale of an estate with about 1,200ha under cultivation and 231ha of quarry land in Johor.

- 2017: Sale of 678ha land in Seberang Prai (Penang).

- 2019: Sale of two parcels of land in Seberang Prai (Penang) totalling 139 acres.

BPlant has been selling land and/or estates for half of the duration of the company being listed to generate returns for its shareholders. This is in contrast to what is claimed on its website:

“…we are principally involved in the ownership and management of oil palm plantations, cultivation of oil palm and harvesting of its fresh fruit bunches (FFB) and the production and sale of crude palm oil and palm kernel. We also sell oil palm FFBs and provide mill design and consultancy services…”

Since its listing in 2014, the returns to shareholders came from the sale of land and/or estates. If there was no such sale, its RM2.2 bil equity (on listing) would have been reduced by about half.

So, is BPlant in the plantation business or in the business of selling land?

Does the positive results for 1H 2021 meant that BPlant has passed the selling of land stage? Only time will tell. – Aug 30, 2021

Datuk Eu Hong Chew was on the board of i-Bhd from 1999 till 2020. As Group CEO, he led its transformation from a digital appliance manufacturer into the developer of i-City, the Selangor Golden Triangle.

The data for this article was extracted from the article that was first published under “Is BPlant one of the better Bursa Malaysia stocks?” on i4value.asia.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.