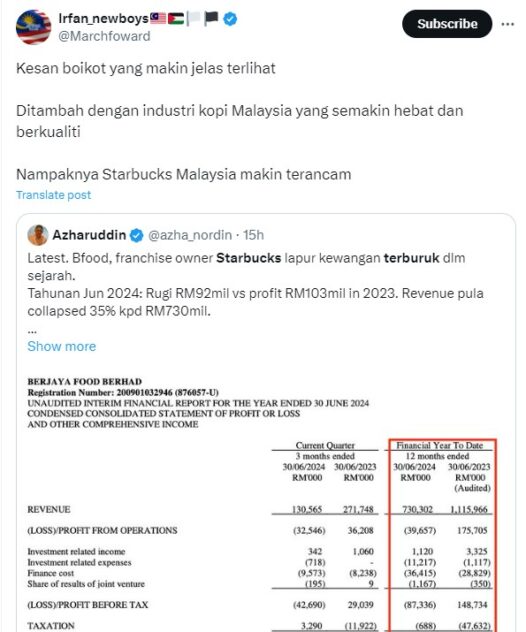

FINFUENCER Azharuddin (@azha_nordin) who boasts a large follower base within the Malay-Muslim community is wondering how much longer Starbucks Malaysia can sustain the onslaught of boycott and competition with coffee connoisseurs having turned to home-grown premium coffee chains for their daily dose of caffeine.

“BFood (Berjaya Food Bhd), franchise owner of Starbucks has reported the worst financial results in history,” penned Azharuddin in a recent X post.

Latest. Bfood, franchise owner Starbucks lapur kewangan terburuk dlm sejarah.

Tahunan Jun 2024: Rugi RM92mil vs profit RM103mil in 2023. Revenue pula collapsed 35% kpd RM730mil.Starbucks kena hit 2 arah: Boikot & Competition.

How much longer will this last? Apakah strategy? pic.twitter.com/gYTJS03e4E— Azharuddin (@azha_nordin) August 27, 2024

“For its FY6/2024, BFood incurred a net loss of RM92 mil vs net profit of RM103 mil in FY6/2023. Its revenue collapsed 35% to RM730 mil (FY6/2023: RM1.12 bil). How much longer can this last? What is the strategy?”

Azharuddin’s tweet was quickly picked up by social media influencer Irfan_newboys🇲🇾🇵🇸🏳️🏴(@Marchfoward) who is fascinated with “the outcome of boycott which is getting more obvious”.

“Plus, the Malaysian coffee industry is getting strong and oozing with quality. It seems that Starbucks Malaysia is increasingly under threat.”

While many boycotters have hailed home-grown Zus Coffee as a worthy Starbucks Malaysia replacement, local research houses Maybank IB Research and Hong Leong Investment Bank (HLIB) Research have retained their “sell” call on BFood with a target price of 30 sen and 20 sen respectively.

“BFood’s operating challenges are likely to continue as long as geopolitical tension remains,” envisages Maybank IB Research’s analyst Jade Tam in a results review.

“Also, with strong competition from domestic retail coffee chain players, BFood’s Starbucks’ brand equity may have eroded over a prolonged period. We project for a net loss of RM4 mil (previously profit) for its FY6/2025E.”

Meanwhile, HLIB Research shared that Starbucks still made up a big chunk of revenue for BFood’s 4Q FY6/2024 by having contributed c.89% with 8% coming from Kenny Rogers Roasters (KRR).

With the tough business condition, BFood has decided to take a pause on business expansion which resulted to no new stores opened for the quarter.

All in all, FY6/2024 registered a total of 408 Starbucks stores with three stores permanently closed in the quarter due to the end of tenancy agreements. Additionally, the group has also decided to temporarily close 25 inactive stores.

“Despite strong brand equity and active promotions, we opine the boycott headwinds will stay – at least for the near term – which will greatly drag earnings,” projected analyst Syifaa’ Mahsuri Ismail.

At 11.32am, BFood was down 4.5 sen or 8.91% to its 52-week low with 2.19 million shares traded, thus valuing the company at RM896 mil. – Aug 28, 2024