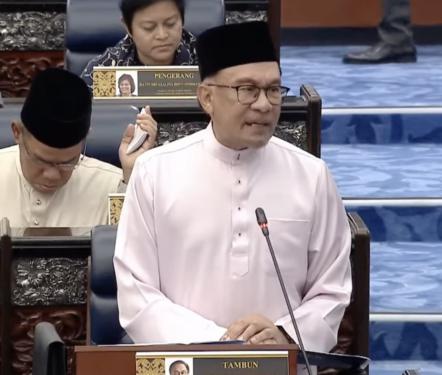

PRIME Minister and Finance Minister Datuk Seri Anwar Ibrahim presented the eagerly anticipated Budget 2024 which totalled RM393.8 bil, indicating a substantial increase of RM5.8 bil compared to the previous year’s allocation of RM388 bil.

Operational expenditure will constitute the majority with RM303.6 bil (77%) dedicated to essential government functions, while a significant sum of RM90.1 bil is earmarked for crucial development projects.

These allocations are part of the unity government’s strategic approach at achieving optimal governance for efficient services, revitalising the economy for accelerated growth and enhancing the quality of life for the people.

Key highlights of the 2024 budget include:

- Increase in service tax from 6% to 8%, exempting the food and beverage as well as telecommunication industries.

- RM18 mil for legal reforms.

- Government Procurement Act to be tabled next year.

- Allocation of RM2.4 bil for the construction and maintenance of government quarters.

- RM10 mil to combat profiteering by MyCC and the Domestic Trade and Consumer Affairs Ministry.

- Government to continue rationalising electricity subsidies.

- RM55 mil for electricity subsidies, benefiting hardcore poor individuals with up to RM40 per month.

- Removal of price ceiling for eggs and chicken.

- Implementation of targeted subsidies, with savings directed towards increasing Rahmah cash aid from RM8 bil to RM10 bil.

- Strengthened measures to combat smuggling of contraband.

- Mandatory use of e-invoice for taxpayers with annual income or sales exceeding RM100 mil from Aug 1, 2024.

- Planned implementation of a global minimum tax in 2025 for companies with a global income of at least €750 mil.

- Enactment of a 5% to 10% luxury tax, excluding foreign tourists.

- Consideration of a capital gains tax on specific stock market activities including IPOs with a 10% tax introduced from March 1.

- An allocation of RM2.8 bil is designated for the repair of federal roads and bridges

- RM150 mil is set aside for the maintenance and repair of public toilets across the country.

- RM100 mil is allocated to support non-governmental organisations (NGOs) aiding the people. The government aims to enhance stamp duty collection, bolster tax administration, expand social protection coverage, and revamp development financial institutions (DFIs).

- RM38 mil is dedicated to upgrading courts and training a larger number of judges.

- Tax incentives for investments in startups and angel investors are extended until Dec 31, 2026.

- MyCIF receives RM100 mil over three years to support food security initiatives.

- GLCs (government-linked companies) and GLICs (government-linked investment companies) will allocate RM1.5 bil to support startups in high growth, high-value areas.

- RM28 mil is allocated to establish MYStartup, serving as a comprehensive support center for startups.

- International Trade and Industry Ministry and Malaysian Investment Development Authority are working on improving the ease of doing business.

- A high-tech industrial park will be developed in Kerian, Perak.

- Special tax incentives are introduced for investments in Pengerang Integrated Petroleum Complex (PIPC).

- Tiered investment tax allowances of either 70% or 100% are offered to attract investments.

- RM200 mil is dedicated to catalyse the New Industrial Master Plan (NIMP) 2030, with 10% of future NIMP investments allocated for this purpose.

- The government supports the implementation of a hybrid solar energy project in southern Sabah.

- Negotiations are underway to transfer the Bintulu Port and rural airspace operations to Sabah and Sarawak.

- RM5.8 bil is allocated for Sarawak, and RM6.6 bil for Sabah.

- Bank Negara Malaysia is developing a national fraud portal by mid-2024.

- An additional RM10 mil is provided for the National Scam Response Centre.

- RM26 mil is allocated for social initiatives in rural areas, including mobile health and dental clinics and mobile court services.

- The government expands the second chance scheme to support youths with debts less than RM200,000.

- An extra RM10 mil is allocated to assist Malaysians victimised by overseas syndicates.

- RM50 mil is allocated to install smart traffic lights in congested and accident-prone areas.

- RM100 mil is allocated to replace street lamp bulbs with LED bulbs, with an additional RM50 mil for local councils to switch to LED street lamps.

- RM30 mil is provided for district engineers to handle minor repairs and maintenance of federal roads, with each engineer receiving an allocation of RM200,000.

- Extension of social visit passes for foreign students after completing studies to bolster skilled workforce supply.

- Introduction of a visa liberalisation plan, easing employment pass approvals for strategic investors in vital sectors.

- Allocation of RM20 mil for Think City to preserve Kuala Lumpur’s cultural heritage.

- RM80 mil dedicated to conserving UNESCO heritage sites in Sarawak, Kedah and Perak.

- RM20 mil earmarked for upgrading selected tourism spots in Perlis, Pahang and Negri Sembilan.

- RM350 mil funding to promote Malaysia as a top tourism destination, supporting initiatives like the Visit Malaysia 2026 programme, cultural performances, charter flights and Islamic tourism.

- Target of 26.1 million tourist arrivals for Visit Malaysia Year in 2026.

- Allocation of RM47 mil to improve passenger facilities and extend the runway at Tioman airport.

- RM20 mil in matching grants for upgrading the Malaysia Maritime Single Window (MMSW).

- RM50 mil in matching grants to maintain Port Klang roads.

- RM10 mil to support franchises with export markets.

- RM27 mil to support the Buy Malaysian campaign.

- RM50 mil for developing 4,000 new trading spaces with six months of free rent.

- RM10 mil to upgrade 10,000 food stalls and warungs nationwide.

- RM110 mil for upgrading hawker centers and public markets across the nation.

- Extension of RM2,000 tax break for upskilling courses until 2026, now covering language, photography, and sewing courses.

- Allocation of RM17 mil for tahfiz Technical and Vocational Education and Training (TVET) programme.

- RM180 mil in TVET study loans benefiting 12,000 individuals.

- RM30 mil incentives for companies to train local workforce.

- RM70 mil for the Academy in Industry programme supporting skills training.

- Utilisation of 15% of levies collected by HRD Corp for retraining and reskilling of entrepreneurs, ex-convicts, disabled individuals, senior citizens and retirees.

- RM100 mil to support TVET certification.

- RM6.8 bil budget for TVET programmes.

- RM40 mil for the Shop Malaysia Online initiative.

- RM900 mil in loans from BNM to help SMEs digitalise and automate.

- RM100 mil to support digitalisation efforts of 20,000 SMEs.

- RM100 mil for cooperatives through the Cooperative Commission of Malaysia.

- RM100 mil for Amanah Ikhtiar Malaysia to eradicate poverty.

- RM20 bil for Syarikat Jaminan Pembiayaan Perniagaan Bhd to guarantee loans for SMEs in green economy, technology and halal sectors.

- RM44 bil in loan and financing facilities for micro SMEs, including RM1.4 bil for micro loans from BSN, RM330 mil in loans from Tekun Nasional, RM720 mil for women and youth entrepreneurs and RM30 mil for Indian businesses.

- RM500 mil in loans for developing wakaf lands nationwide.

- RM25 mil in matching grants for producing entrepreneurs under the i-TEKAD initiative.

- Acceleration of halal certification process from 51 days to 30 days.

- Five-year tax exemption for Labuan companies involved in Islamic finance.

- Tax exemption for participants in Islamic securities selling and buying.

- Financial institutions directed to allocate RM200 bil in loans to support industries in reducing carbon emissions.

- Allocation of RM2 bil to back the National Energy Transition Roadmap (NETR).

- Increase in rubber production incentive from RM2.70 to RM3 per kg, with an allocation of RM400 mil.

- Expansion of tax incentives for automation to encompass the commodities sector.

- Allocation of RM90 mil for RISDA and FELCRA to encourage optimised land use among settlers.

- RM70 mil to support sustainability programmes in the palm oil industry.

- RM100 mil allocated for palm oil replanting benefiting 7,000 smallholders.

- Allocation of RM2.4 bil for FELDA, FELCRA and RISDA.

- RM76 mil allocated to support the research and development (R&D) ecosystem.

- Introduction of income tax rates up to 10% for film production companies, foreign actors and crew filming in Malaysia.

- Allocation of RM510 mil for R&D under the science, technology and innovation as well as higher education ministries.

- Implementation of a 10% reduction in entertainment duties for international acts and a 5% reduction for theme parks.

- Local artistes exempted from entertainment duties.

- Revision of entertainment duties in Federal Territories.

- Allocation of RM160 mil to support the creative industry, including funds for local films.

- Relaxation of Malaysia My Second Home (MM2H) programme conditions.

- Simplification of visa-on-arrival processes and introduction of multiple entry visas for tourists and investors from India and China. – Oct 13, 2023