QUARTER three financial year 2024 results were mixed, with 30% of companies under Kenanga Research (Kenanga)’s coverage exceeding expectations and an equal proportion underperforming.

Weak macro developments weighed on mid-downstream players such as MISC, PCHEM, and PETRONM, while upstream services counters like ARMADA, VELESTO, and WASCO outperformed on stronger-than-expected profit margins. This underscores the resilience of the upstream services segment amid global macro uncertainties.

“As 2025 approaches, we recommend a more selective approach within the upstream services space, focusing on maintenance-driven sectors,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

VELESTO’s guidance for weaker rig utilisation following HESS contract cancellations suggests a softening in drilling rig demand, though daily charter rates (DCR) remain healthy at USD90,000-110,000 per day.

Additionally, greenfield capital expenditure (capex) by Petronas and other producers is unlikely to see material growth given ongoing Petronas-PETROS uncertainties, though we believe the downside has been priced into valuations.

The Malaysian offshore support vessel (OSV) sector, particularly the accommodation workboat segment, remains bullish due to persistent vessel supply tightness from years of underinvestment.

Unlike the drilling market, the local OSV market benefits from a captive structure as the cabotage policy restricts foreign vessels, while Malaysia’s requirements for younger fleets (currently allowing vessels age cap of 20 years for tenders, from the cap of 15 years earlier) add to the supply constraints.

With an average fleet age of 14 years, the sector is nearing a critical point for fleet renewal to sustain long-term operational efficiency. These dynamics, coupled with strong demand, position the OSV sector for continued growth and robust charter rates.

“If the demand sustains in the coming years, we might see a pick-up in demand for OSV newbuilds, which could potentially benefit SYGROUP,” said Kenanga.

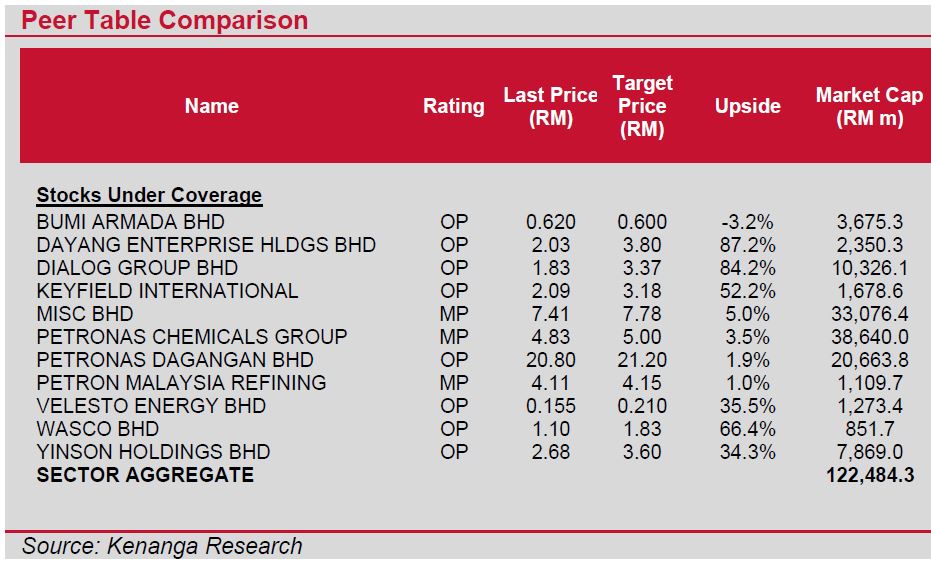

Kenanga maintains their sector call at OVERWEIGHT with the same emphasis placed on upstream service providers and midstream players due to a favourable macro-outlook.

“However, we have decided to turn more selective on our picks within the upstream service provider space as certain higher beta sub-segments appear to have shown signs of earnings peaking, for instance jack-up drilling,” said Kenanga.

Post recent sell down, Kenanga believes that the risk-reward is superior in the upstream maintenance space, particularly after recent major awards for the umbrella contracts.

That aside, in a space with slightly more capital expenditure uncertainty than before, possibly due to PETROS and Petronas issue, upstream maintenance still gains priority over greenfield capital expenditure-driven jobs. —Dec 6, 2024

Main image: storageterminalsmag.com