FOREIGN investors continued to mop up equities on Bursa Malaysia with the local bourse having posted a net inflow of RM786.1 mil for the week ended Feb 23, marking the fifth consecutive week of net purchases.

This is 2.2 times higher than the net inflow amount of RM352.9 mil the week before, according to MIDF Research.

“Similar to the previous week, foreign investors net bought during every trading day,” the research house pointed out in its weekly fund flow report. “The net buying streak has gone on for 16 consecutive trading days – something not seen since February 2022.”

The highest net inflow came on Tuesday (Feb 20) at RM413.8 mil, the day the ringgit fell to RM4.80/US$ or inching closer its all-time low of RM4.885/US$ at the height of the 1998 Asian Financial Crisis (AFC).

The sectors with the highest net foreign inflows were financial services (RM287.2 mil), utilities (RM235.8m) and energy (RM76.9 mil) while the sectors with the highest net foreign outflows were REITs (-RM18.6 mil), plantation (-RM12.4 mil), and construction (-RM4.4 mil).

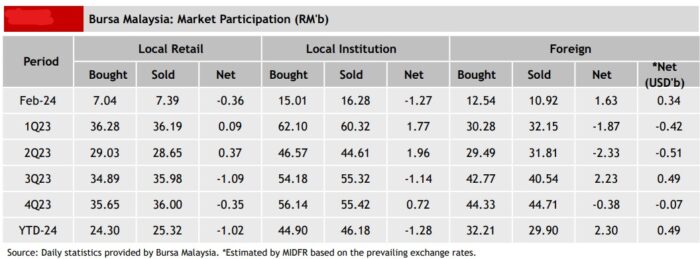

As opposed to foreign investors, local institutions continued their trend of net selling domestic equity-s for the fifth consecutive week at -RM596.6 mil or 2.1 times higher than the week before at -RM277.5 mil.

For the third consecutive week, local retailers also stuck to their pattern of net selling domestic equities with net outflow reaching -RM189.6 mil from the week prior.

In terms of participation, there were increases in average daily trading volume (ADTV) across all investor classes. Local retailers saw an increase of +29.9% while local institutions and foreign investors saw increases of +26.6% and +21.6% respectively.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Thailand recorded net foreign inflow of US$249.0 mil after two weeks of net outflows with Indonesia continued to post foreign bet buying for the fourth consecutive week at US$65.5 mil followed by the Philippines at US$30.1 mil (marking its fifth consecutive week of inflow).

On the contrary, Vietnam encountered its fourth consecutive week of foreign fund net outflow at -US$59.5 mil.

The top three stocks with the highest net money inflow from foreign investors last week were YTL Power International Bhd (RM139.0 mil), Malayan Banking Bhd (RM110.7 mil) and Public Bank Bhd (RM99.7 mil). – Feb 26 2024