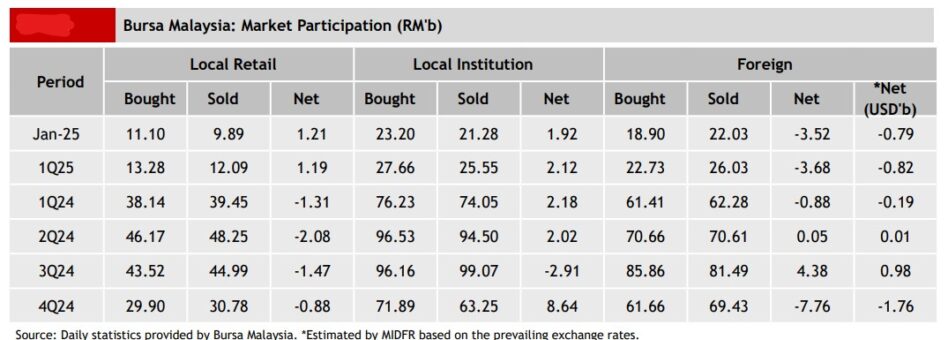

FOREIGN investors continued to sell equities on Bursa Malaysia for the 16th consecutive week during the Feb 3-9 trading period although the pace of outflows slowed substantially to -RM169.4 mil from the previous week’s -RM503.3 mil.

They were net sellers on every trading session except Friday (Feb 7) with Monday (Feb 3) experiencing the largest outflow at -RM151.9 mil, according to MIDF Research.

“On Tuesday (Feb 4), Wednesday (Feb 5) and Thursday (Feb 6), the outflows amounted to -RM18.5 mil, -RM65.1 mil and -RM27.1 mil respectively,” observed the research house in its weekly fund flow report.

“Friday (Feb 7) experienced a net inflow of RM93.2 mil, thus ending a 24-day consecutive streak of net foreign outflows.”

The top three sectors that recorded net foreign inflows were financial services (RM117.2 mil), construction (RM111.0 mil) and technology (RM77.6 mil) while the top three sectors with highest net foreign outflows were utilities (-RM181.4 mil), industrial products & services (-RM92.7 mil) and energy (-RM61.2 mil).

In contrast, local institutions continued to support the local bourse for the sixteenth successive week with net purchases totalling RM194.2 mil in domestic equities.

They net bought on three out of the five trading days last week with net inflows on Monday (Feb 3), Wednesday (Feb 5) and Thursday (Feb 6) totalling RM130.8 mil, RM85.4 mil and RM35.3 mil respectively.

However, local retail investors ended their buying streak of four weeks in a row on Bursa Malaysia with a net outflow of -RM24.8 mil – their second net selling in CY2025.

The average daily trading volume (ADTV) saw inclines across the board last week with the exception of foreign investors. Foreign investors saw a decrease of -8.7% but local institutions and local retailers saw a surge of +7.8% and +1.0% respectively.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Thailand recorded the highest net inflow last week at US$74.0 mil to reverse five weeks of outflows.

This was followed by the Philippines which posted a modest net foreign inflow of US$28.3 mil to extend its streak of net purchases to two weeks.

However, Indonesia experienced a net outflow of -USD233.1 mil last week which extended its streak of net outflows to three weeks while Vietnam saw a reversal of fortunes last week with a net outflow of -USD167.8 mil to end its two-week streak of net foreign purchases.

The top three stocks with the highest net money inflow from foreign investors last week were CIMB Group Holdings Bhd (RM232.1 mil), Gamuda Bhd (RM56.0 mil) and IJM Corp Bhd (RM42.3 mil). – Feb 10, 2025