FOREIGN investors continued to be net buyers of domestic equities for the sixth consecutive week with an inflow of RM271.5 mil into Malaysia last week (Sept 17-20). For the record, this amount is slightly bigger than the inflow of RM217.6 mil the week prior (Sept 9-13).

It was nevertheless a shortened trading week as the market was closed on Monday (Sept 16) in observance of Malaysia Day and Maulidur Rasul.

“Foreign investors net bought RM167.7 mil on Tuesday (Sept 17), RM122.9 mil on Thursday (Sept 19) and RM57.0 mil on Friday (Sept 20) while they net sold -RM76.1 mil on Wednesday (Sept 18),” observed MIDF Research in its weekly fund flow report.

The research house attributed the latest interest to Malaysia’s August 2024’s exports figures which exceeded expectations, driven by strong demand for electronics and a significant increase in shipments to the US and other major trading partners.

Exports grew by +12.1% year-on-year (yoy) to reach RM129.16 bil while gross imports amounted to RM123.49 bil, reflecting a +26.2% yoy growth.

The sectors that recorded the highest net foreign inflows were financial services (RM352.2 mil), healthcare (RM211.9 mil) and property (RM55.0 mil) while the sectors with the highest net foreign outflows were utilities (-RM172.3 mil), technology (-RM85.3 mil) and consumer products & services (-RM49.7 mil).

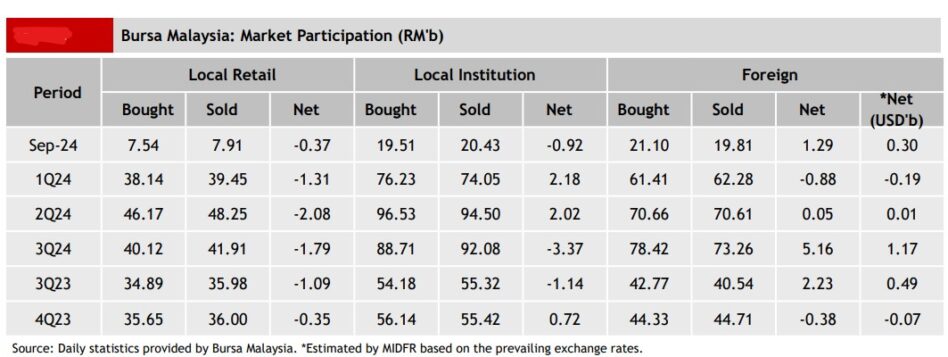

Local institutions continued to support the local bourse with net purchases amounting to RM38.7 mil last week, marking their second consecutive week of net inflow. However, local retailers remained net sellers for the second week in a row with RM310.2 mil.

The average daily trading volume (ADTV) surged +10.9%, +4.9% and +42.9% among local retailers, local institutions and foreign investors respectively.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Indonesia posted its 13th consecutive week of net foreign inflow with US$308.9 mil for the week.

Elsewhere, Thailand recorded a net foreign inflow of US$177.1 mil – extending its streak to four consecutive weeks – while the Philippines marked its sixth week of net foreign inflows with US$84.5 mil and Vietnam ended its four-week streak of net foreign selling with an inflow of US$ 49.7 mil.

The top three stocks with the highest net money inflow from foreign investors last week were CIMB Group Holdings Bhd (RM242.5 mil); Top Glove Corp Bhd (RM93.3 mil) and Public Bank Bhd (RM71.0 mil). – Sept 23, 2024