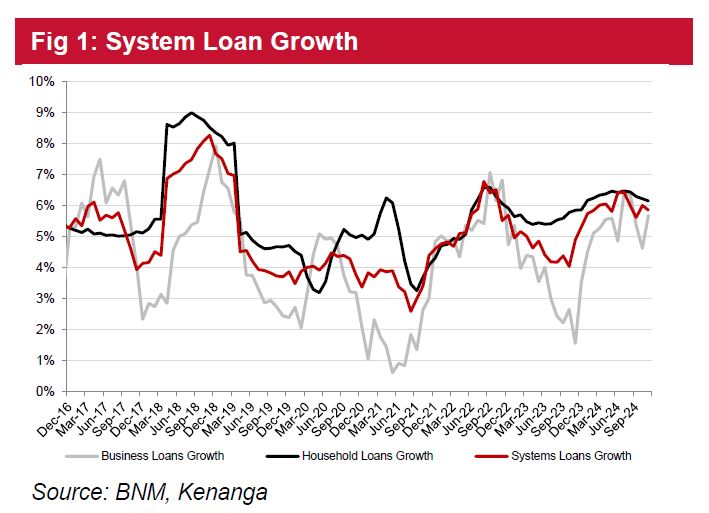

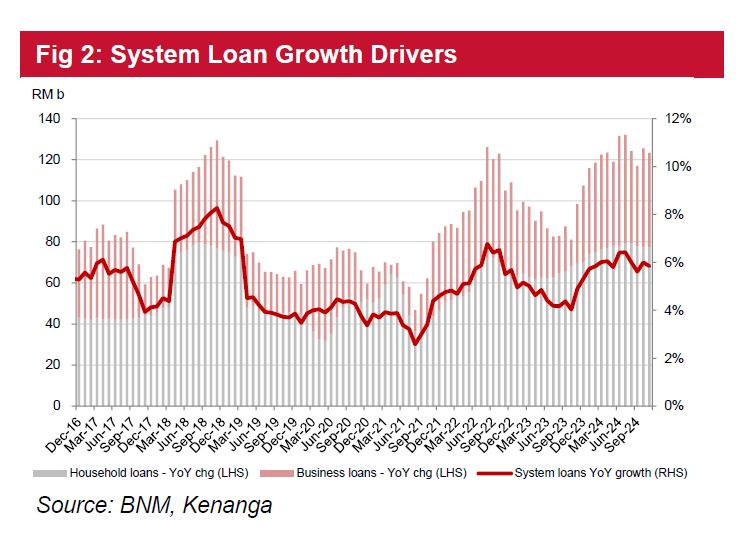

IN NOV 2024, system loans grew by 5.8% YoY (+4.7% YTD) which was within our 5.5%−6.0% target for CY24. Continued support from residential mortgages (+7.0%) and hire purchases (+8.7%) kept household loans afloat at +6.1%.

Meanwhile, business loans grew by 5.4% on financial service sectors (+16.5%) and working capital requirements (+5.9%).

On a MoM basis, business loan growth outpaced household loans at 0.7% and 0.5%, respectively, attributed to greater operating cash flow needs ahead of year-end festivities (refer to Tables 1−3 for breakdown of system loans).

While we did see overall applications increase by 12% YoY, it declined by 12% on a MoM basis owing to pent-up applications during Oct 2024.

We opine that business applications could remain relatively tepid in the following months as working capital self-sustains but will see growth in residential properties and hire purchases as homebuyers typically step up prior to CNY celebrations.

That said, we gather that the sequential decline in approval rates to 53.3% (Oct 2024: 53.6%, Nov 2023: 54.8%) could be relative due to the higher volumes processed during the month (refer to Tables 4−5 for breakdown of system loan applications and approvals).

Industry GIL continued to come in lower at 1.51% (Oct 2024: 1.53%, Nov 2023: 1.69%), which also came after most of the banks fully utilised their pandemic-related overlays to suggest a more organic asset quality environment with industry LLC staying stable at 91.2% (Oct 2024: 91.2%, Nov 2023: 92.9%).

Channel checks with the banks do not indicate the desire to relax lending approval standards as the emphasis on sustainable earnings and book quality remains.

There are several factors which we believe the banks are watching as potential threats to asset quality, being:

(i) unfavourable trade policies introduced in the Trump administration;

(ii) tighter-than-expected RON95 subsidy rationalisation; and

(iii) setbacks in data centre development (refer to Tables 6−7 for breakdown of system impaired loans).

Nov 2024 deposits grew by 3.6% YoY (+0.9% MoM, +2.3% YTD) with an uplift in CASA ratio to 28.7% (Oct 2024: 28.4%, Nov 2023: 28.4%).

This supported an industry LCR of 147.9% (Oct 2024: 146.8%, Nov 2023: 149.6%). The rise in demand deposits could be tied to the same abovementioned festivities backed by cash transactions.

While there is typically an inclination towards fixed deposit products during the year-end season, with rates appearing to be much less attractive (up to 2.60% among large cap banks), we opine that depositors may continue to opt for liquidity.

The sector is expected to see fewer negative surprises to fundamentals with previously distortive provisions and writebacks from pandemic overlays out of the picture, and positive turns hinging on clarity on the Johor-Singapore Special Economic Zone to bolster domestic industries and FDI injections there that are also spilling over to residential developments.

That said, pending global developments that will steer our economic trajectory, we see banks deploying varying strategies to enforce operational resiliency and sustain earnings.

Going into CY25, we project for industry loan growth to come in at 6% and the OPR to be steady state at 3.00%.

Within our coverage, we like AMBANK on the back of a more solid ROE backbone as the group focuses on stronger earnings drivers as opposed to gaining market share in less profitable segments.

Following its recent transition into FIRB, the group’s newly acquired CET-1 levels of c.15% could lead to more generous dividend payouts and make AMBANK one of the leaders in yield prospects (c.6%).

This is premised on our anticipated dividend payout of 50% against the group’s more gradual step-up of 45% (from 40%).

Among the large cap banks, we favour MAYBANK as despite its leading market share, it still holds better-than-industry asset quality with earnings growth expected to outpace its counterparts. —Jan 3, 2025

Main image: mytechmag.com