FINFLUENCERS – abbreviation for financial content providers on social media – are seemingly over the moon now that the ringgit has superseded not just the greenback in its climb but also other major currencies such as the British pound, euro and the Singapore dollar.

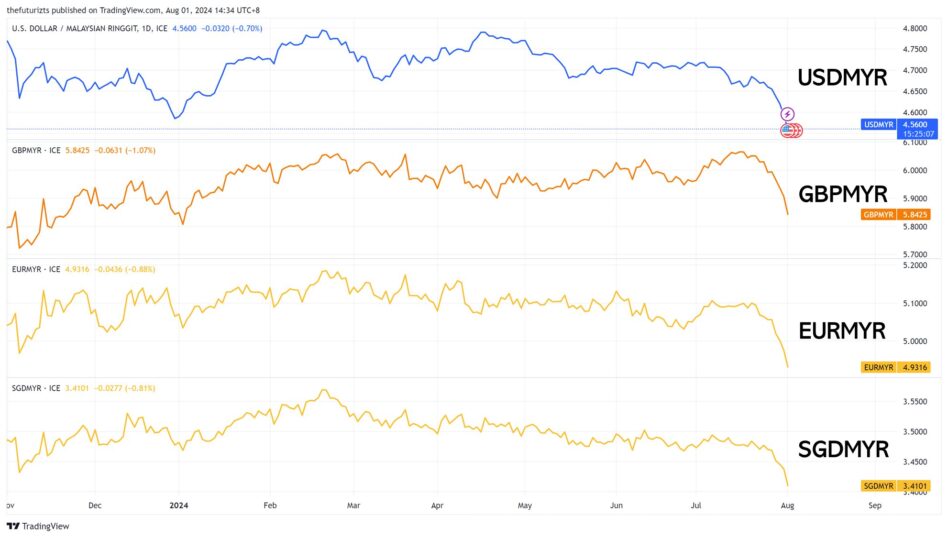

The Futurizts (@TheFuturizts) which prides itself as provider of “educational content for Malaysians to achieve financial literacy” reckoned that “something big is happening to the ringgit. 🤯” based on the latest performance of the local currency: :

- USDMYR: RM4.5600 (12-month high)

- GBPMYR: RM5.8425 (8-month high)

- EURMYR: RM4.9316 (13-month high)

- SGDMYR: RM3.4101 (12-month high)

Something big is happening to the ringgit. 🤯

It is strengthening against most major currencies, not just the US dollar.

USDMYR: RM4.5600 (12-month high)

GBPMYR: RM5.8425 (8-month high)

EURMYR: RM4.9316 (13-month high)

SGDMYR: RM3.4101 (12-month high)

In the past two weeks,… https://t.co/0yPrlhZgRe pic.twitter.com/JozjEXKxxs

— The Futurizts (@TheFuturizts) August 1, 2024

“In the past two weeks, the ringgit has rallied by 2%-3% versus these four currencies,” observed The Futurizts in a post on the X platform.

“The ringgit has strengthened by almost 2% against the US dollar this week. 😮 At RM4.5555 (as of Aug 1), it is now at its highest level since August last year. Analysts’ target of RM4.50 is well in sight. 🚀”

Another popular finfluencer Azharuddin (@azha_nordin) credited Bank Negara Malaysia (BNM) for the ringgit to be “in a ‘terrorising’ mood these two to three days”

“Why has the ringgit risen so much lately vs the greenback, British pound, euro, Aussie dollar or the yuan? But the baht, rupiah, peso or even Singapore dollar have not risen much?” asked Azharuddin on the X platform. “The answer is because BNM has done a terrific job.”

Ringgit “mengganas” 2-3 hari ni.

Kenapa ringgit naik begitu banyak lately vs USD, £, €, A$, Yuan. Tapi matawang Baht, Rupiah, Peso or even SGD tidak naik sangat.

Jawapan: Because Bank Negara (BNM) did a great job. Keep reading to find out why. @BNM_official

— Azharuddin (@azha_nordin) August 1, 2024

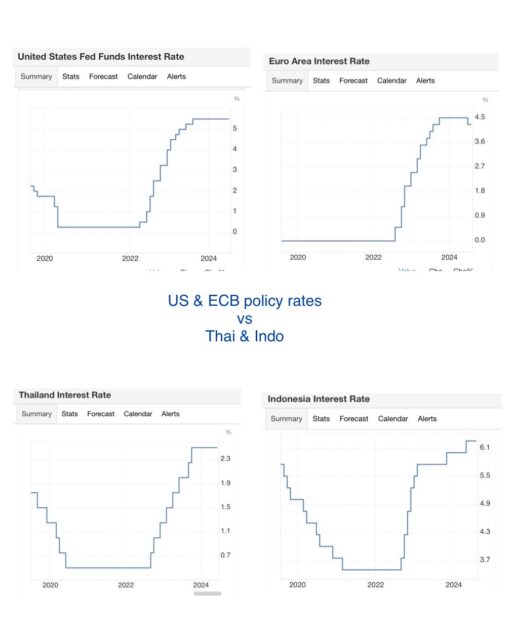

While global central banks raised interest rates between 2022-2023, Azharuddin recalled that the hikes imposed by the US Federal Reserve were aggressive – in fact the highest in 20 years – which promoted the greenback “to skyrocket”.

“BNM raised rates from 1.75% to 3.0% in May 2023, about the level before the COVID pandemic in 2019. Then BNM paused at what we call the normal level of 3.0%,” explained the finfluencer.

“Other countries mirrored the US initiative because they want to defend their currency (in addition to control inflation) and did derive benefit by falling less in 2023.”.

Bit what is happening currently is that the European and Central Bank (ECB) and the Bank of England (BOE) have started rate cuts while the US Fed is expected to cut its interest rates in September

While other ASEAN countries are expected to follow suit in for they now have “room” for their interest rates to normalise, “BNM doesn’t need to act”.

“It’s true that fundamental factors also play a role in the ringgit’s uptrend today but the key is BNM,” opined Azharuddin, alluding to the following five factors:

- Economy: Advance GDP (gross domestic product) estimated at 5.8% for 2Q 2024

- Inflation: Headline is low, running at 2%

- Infrastructure projects: Initiatives such as he Johor-Singapore Special Economic Zone (JSSEZ), data centres and Corporate Renewable Energy Supply Scheme (CRESS)

- Manufacturing: Strong recovery aided by exports estimated >6% in 2024

- Political stability: Current government has been in power for about two years.

Interestingly, the views by both The Futurizts and Azharuddin are parallel to the foreign exchange outlook of Standard Chartered Global Research.

“We maintain our view that the ringgit will remain the region’s outperformer. YTD (year-to-date), the ringgit is the only Asian currency that has appreciated against the US dollar,” noted the research house.

“The authorities’ engagement with relevant bodies to encourage repatriation, convert and hedge their foreign currency proceeds has been the trigger for this outperformance. But we note that underlying fundamentals have also been ringgit positive.” – Aug 2, 2024