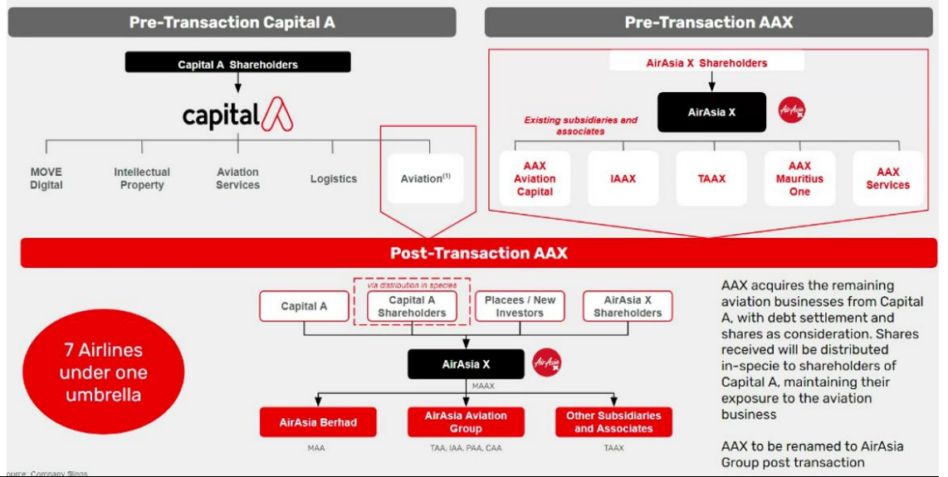

BURSA Malaysia has approved Capital A’s (CapA) proposal to dispose AAAGL (Indonesia, Thailand, Philippines and Cambodia operations) for a consideration of RM3bil.

“This is to be satisfied by new share issuance by AAX (to be renamed as AirAsia Group or AAG) for 2.3bil shares based on RM1.30/share),” said Hong Leong Investment Bank (HLIB) in the recent Company Update Report.

Also, the disposal of AAB (Malaysia aviation operation) for a total consideration of RM3.8bil (to be satisfied by AAG assuming CapA’s debt); and distribution of 1.7bil shares of AAX (from the proceeds of AAAGL disposal) to entitled CapA shareholders.

The group will conduct an Extraordinary General Meeting (EGM) on 14 October 2024 for shareholders’ approval.

Prior to the exercise, AAB’s existing 57.1mil shares in AAX will be transferred to CapA for RM106.7mil based on RM1.87 per share.

Post restructuring, CapA will still retain ownership of the four major business segments namely:

(i) Capital Aviation Services

(ii) Logistics

(iii) MOVE digital

(iv) CAPI

CapA will tentatively still own a 18.48% stake in AAG, which management guided will be fully distributed via dividend-inspecie to entitled shareholders within the next 1-2 years.

Management intends to continue to scale-up the 4 major business segments and eventually monetise their valuation via listing exercise.

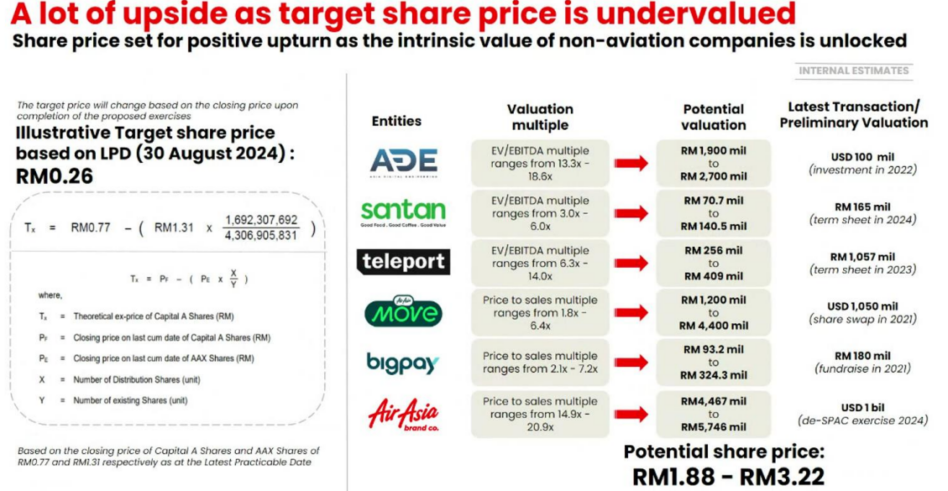

CapA’s equity position is expected to return to a positive position of RM649.4mil to RM2bil, effectively allowing it to exit the PN17 status.

In the subsequent stage, CapA will acquire back GTR ground handling services from AAG.

Post restructuring – acquiring 100% of AAB and AAAGL from CapA – AAX will consolidate the aviation operations for all short, medium and long hauls, and rename itself as AirAsia Group (AAG).

Prior to the acquisition, AAG will first issue free warrants to existing shareholders based on 1 warrant for existing 2 shares and undertake a private placement exercise to raise RM1bil in order to strengthen the group’s balance sheet.

Post completion, AAG’s share base will be enlarged to 3,639.7mil shares with 223.5mil warrants.

CapA will own 18.5% stake in AAG, while shareholders of CapA will own 46.3% and private placement subscribers will own 24.6%.

AAG will also be granting share options to Garynma investment to subscribe 12% of the total enlarged share base (up to 450.6mil shares) via 3 Subscription Options of 4% each.

CapA and AAX will need to get approval from shareholders (including Redeemable Convertible Unsecured Islamic Debt Securities holders) and relevant regulators as well as financiers/lenders.

The exercise is expected to be completed by quarter one financial year 2025.

“We are overall positive on the exercise mainly on the streamlining of the aviation segments to be consolidated under AAG, in strengthening the business model for long haul–short haul integration, with a new medium haul segment as the intermediary, by leveraging onto the new A321 fleets,” said HLIB.

AAG will be in a much stronger position to compete effectively against the established full service carriers such as SIA, Emirates, JAL and others.

Shareholders of CapA will benefit from it exiting PN17 status. CapA’s new focus will be on the growth of the aviation support business segments, leveraging onto AAG’s growth and new shareholdings in AAG.

The group is currently riding on strong tailwinds of depreciation of USD, drop in global oil prices and continued strong demand for regional air travel.

HLIB reiterates their BUY recommendation with target price: RM1.68 based on implied RM6.8bil valuation on the aviation business and conservative RM2.15bil valuation on its airline support business.

The group is currently benefiting from USD depreciation, drop in oil prices and continued strong demand for air-travel, resulting in improving yields.

“We expect further potential upside to our target price should the PN17 regularisation plan be successfully executed and investors start to appreciate CapA’s new structure,” said HLIB. – Sept 27, 2024

Main image: airasia