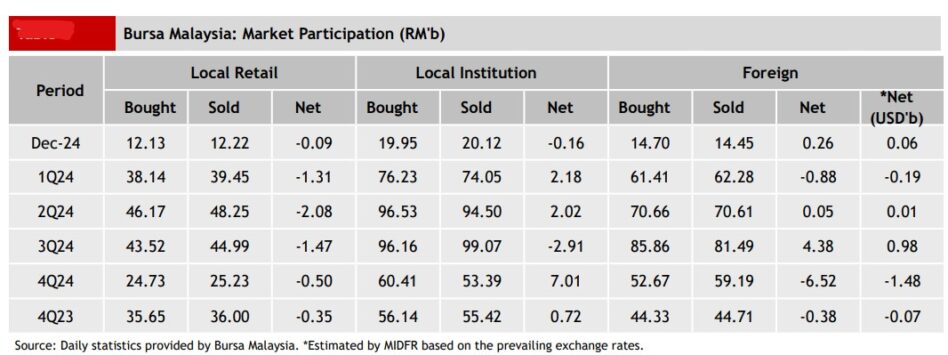

FOREIGN investors’ selling streak on Bursa Malaysia stretched to an eighth consecutive week for the Dec 9-15 period with net outflows totalling -RM882.4 mil (previous week: RM761.4 mil), leading to a second-highest single-week outflow in the last six weeks.

Every trading session experienced a net foreign outflow with the largest occurring on Thursday (Dec 12) at -RM351.2 mil, according to MIDF Research.

“The heaviest outflow was recorded on Thursday (Dec 12), followed by Wednesday (Dec 11) at -RM273.2 mil, Tuesday (Dec 10) at -RM120.4 mil, Monday (Dec 9) at -RM90.9 mil and Friday (Dec 13) at -RM46.7 mil,” observed the research house in its weekly fund flow report.

Based on data available up until Dec 12, the only sectors that recorded net foreign inflows were construction (RM50.0 mil), healthcare (RM17.5 mil) and property (RM10.0 mil).

In contrast, the sectors that recorded the highest net foreign outflows were financial services (-RM318.1 mil), utilities (-RM234.4 mil) and technology (-RM76.7 mil).

Local institutions were once again the primary supporters of the local bourse with an inflow of RM995.5 mil.

There were no outflows in the entire week from this investor class with Wednesday (Dec 11) and Thursday (Dec 12) seeing the highest net inflows at RM264.0 mil and RM352.2 mil respectively.

However, local retailers remained as net sellers last week with net outflows totalling -RM113.1 mil which was 2.65 times less than the previous week’s outflows.

Every day saw a net outflow from this investor group, except for Wednesday (Dec 11) which recorded an inflow of RM9.2 mil while the heaviest outflow was posted on Friday (Dec 13) amounting to -RM83.0 mil.

The average daily trading volume (ADTV) showed a reduction across all investor categories last week. Foreign investors and local institutional investors recorded a decrease of -20.5% and -8.3% respectively while local retail investors saw a decline of -14.4%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, all posted net foreign outflows led by Thailand following a third successive week of stock disposal amounting to -US$174.4 mil or 4.35 times more than the previous week.

Elsewhere, Indonesia saw a negative shift in investor sentiment last week with a notable net foreign outflow of -US$168.7m which reversed a single-week streak of inflows.

Vietnam experienced a net outflow of -US$44.8 mil last week to extend the previous week’s outflows to a second week while the net foreign outflow in the Philippines extended to eight weeks in a row with -US$4.3 mil last week.

The top three stocks with the highest net money inflow from foreign investors last week were Gamuda Bhd (RM67.9 mil), Nationgate Holdings Bhd (RM40.2 mil) and Top Glove Corp Bhd (RM40.0 mil), – Dec 16, 2024