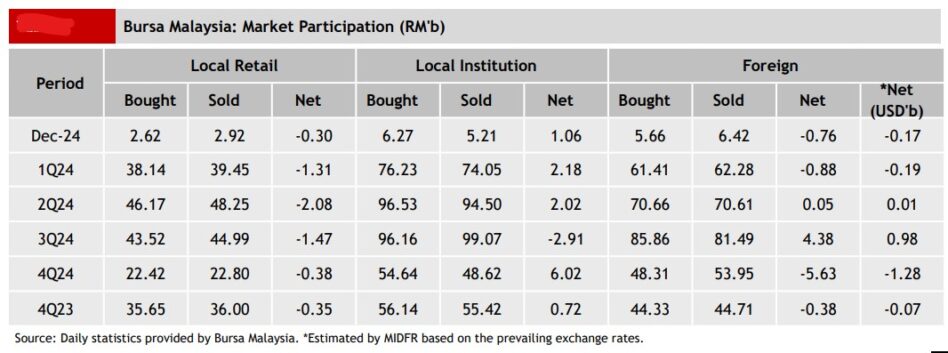

FOREIGN investors continued to sell on Bursa Malaysia for the seventh consecutive week (Dec 2-6) at an elevated outflow rate of -RM761.4 mil (from -RM259.8 mil in the previous week), leading to the second-highest single-week outflow in the last five weeks.

Every trading day experienced a net foreign outflow with the heaviest outflow having occurred on Monday (Dec 2) at -RM248.8 mil, according to MIDF Research.

“This was, followed by Tuesday (Dec 3) at -RM218.6 mil, Friday (Dec 6) at -RM143.9 mil, Thursday (Dec 5) at -RM121.6 mil and Wednesday (Dec 4) at -RM28.5 mil,” observed the research house in its weekly fund flow report.

The top three sectors that saw net buying activities by foreign investors were healthcare (RM238.0 mil), plantation (RM93.1 mil) and industrial products & services (RM72.8 mil).

The top three sectors that saw net selling activities by foreign investors were financial services (-RM594.1 mil), utilities (-RM475.9 mil) and transportation & logistics (-RM53.8 mil).

On the contrary, local institutions were once again the primary supporters of the local bourse by registering a net inflow of RM1.06 bil. There were no outflows in the entire week from this investor class with Monday (Dec 2) and Tuesday (Dec 3) seeing the highest inflows at RM245.6 mil and RM284.1 mil respectively.

However, local retailers remained as net sellers last week with outflows totalling -RM299.9 mil which was almost 30 times more than the previous week’s outflows.

Every trading session saw an outflow from this investor group except for Monday (Dec 2) which recorded an inflow of RM3.2 mil. The heaviest outflow was posted on Wednesday (Dec 4) at -RM125.7 mil.

The average daily trading volume (ADTV) showed a reduction across all investor categories except local retail investors. Foreign investors and local institutional investors recorded a decrease of -25.7% and -6.6% respectively while local retail investors saw an incline of +8.9%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, only Indonesia saw a positive shift in investor sentiment last week with a notable net foreign inflow of +US$66.8 mil to reverse a six-week streak of outflows.

Elsewhere, net foreign outflow in the Philippines extended to a seven-week streak to reach -US$32.6 mil while Thailand saw a second consecutive week of net foreign outflows amounting to -US$39.9 mil.

Vietnam experienced a net outflow of -US$6.3 mil last week to end the single-week inflow of US$39.3 mil in the previous week which was spurred by the strong recovery sentiment post Typhoon Yagi.

The top three stocks with the highest net money inflow from foreign investors last week were Public Bank Bhd (RM121.8 mil), KPJ Healthcare Bhd (RM90.0 mil) and 99 Speed Mart Retail Holding Bhd (RM78.3 mil). – Dec 9, 2024