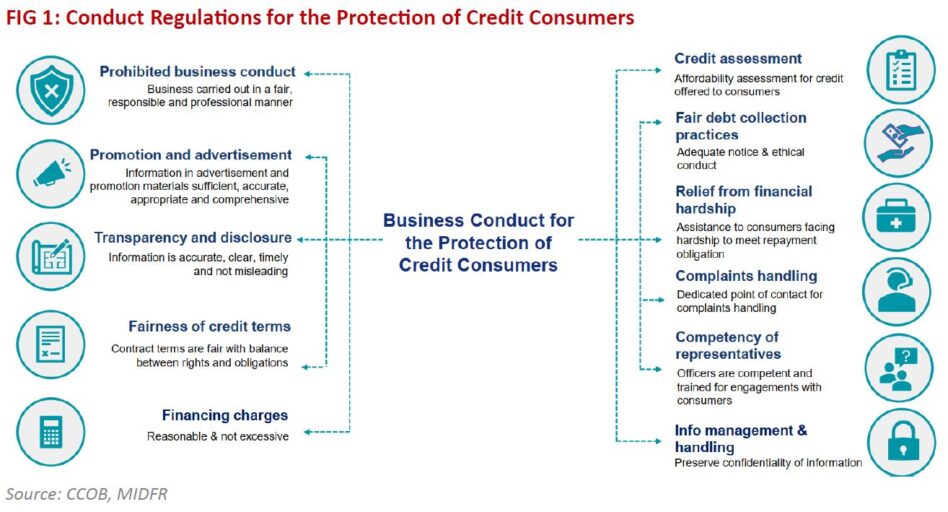

THE CCOB Task Force, led by the Ministry of Finance, Bank Negara Malaysia (BNM) and Securities Commission, is driving the Consumer Credit Bill (CCB) and preparing to establish the Consumer Credit Commission.

The CCB introduces a comprehensive framework aimed at strengthening the credit landscape in Malaysia, largely focusing on non-bank lenders.

Currently, a large proportion of credit providers and credit service providers are not regulated under any law.

The rise in consumer credit in Malaysia has brought about a host of challenges, including rising levels of indebtedness, predatory lending practices, and insufficient consumer understanding of credit terms.

The CCB aims to promote and regulate non-bank credit providers, a fast-growing industry.

Non-bank credit providers deal with borrowers of lower creditworthiness, usually with individuals and businesses that do not meet the tight underwriting standards of banks.

The lack of standard business practices and regulations imposed on non-bank credit providers allows them to implement more predatory lending practices on a more vulnerable population subset.

CCB intends to rectify this by closing the gap between the “wildwest” regulatory landscape of non-bank credit providers with the risk-averse, highly scrutinised nature of banks.

This bill will largely affect non-bank lenders, while banks to see zero to minimal impact.

“We expect this to negatively affect non-bank lenders such as Aeon Credit (Not rated), RCE Capital (Not rated), and ELK-DESA (Not rated),” said MIDF.

While one of the CCB’s core aims is to promote non-bank credit as a whole, limitations brought about by conduct regulations should negatively impact these companies, as restrictions on recovery methods, advertising, and financing charges will affect the bottom line.

“On the other hand, we don’t expect much impact on Malaysian banks. BNM already has already been very diligent in enforcing fair and responsible market practices of banks for quite some time. Any impact will only take place in Phase 3 (Beyond 2030),” said MIDF.

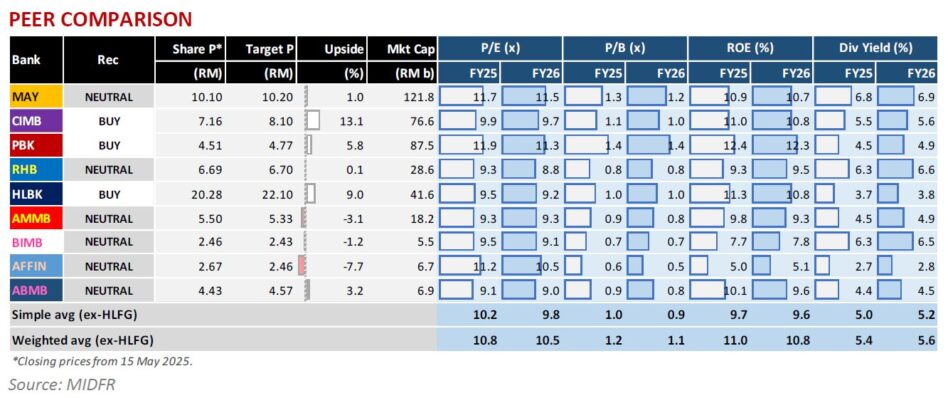

MIDF continues to maintain the neutral call. Top downside risks include economic downturn reducing growth prospects and worse-than-expected asset quality deterioration. —May 16, 2025

Main image: Dreamstime.com