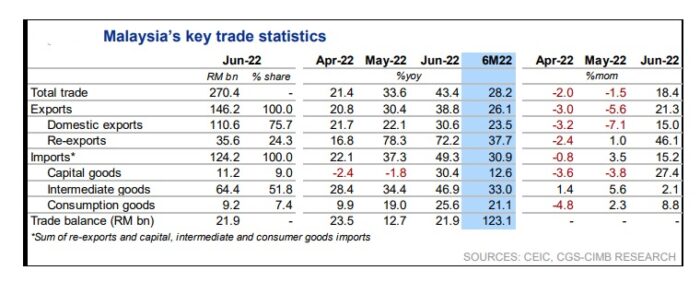

MALAYSIA’S trade surplus rebounded to RM21.9 bil in June, lower than our forecast (CGS-CIMB Research) but ahead of consensus expectations. The surplus was an improvement from April’s surplus of RM12.7 bil.

Exports expanded strongly by 38.8% year-on-year (yoy) – the steepest increase since May 2021 – while imports expanded by a record 49.3% yoy, marking the strongest expansion since February 1998.

On a month-on-month (mom) basis, exports rose 21.3%, surpassing the 15.2% expansion in imports.

June exports were largely driven by oil & gas (O&G)-related products, owing to the strong commodity prices. Products including crude petroleum, refined petroleum products as well as liquefied natural gas (LNG) all recorded stellar growth on a yoy and mom basis as reflected by the peaking of Brent crude and natural gas prices in June.

Meanwhile, agriculture products’ shipments rose 46.8% yoy (May: 43.9%), largely driven by a sharp rise in exports of ‘others’ while shipments of palm oil moderated slightly.

Among manufactured goods, electrical & electronics (E&E) growth came off slightly albeit remained high on a relative basis.

Meanwhile, imports remained strong, indicating robust domestic demand conditions. The demand for consumption goods rose 25.6% yoy (May: 19.0%), driven by durable and semi-durable goods.

This was followed by intermediate goods (46.9% yoy; May: 34.4%) due to strong demand for fuel & lubricants and industrial supplies. Capital goods’ imports were strong amid a sharp rise in the import of transport equipment.

Palm oil exports could face tougher competition

While exports remain robust, factors that supported June trade performance may not last.

Shipments of palm oil (which account for 6.5% share of total exports) will face stiffer competition from Indonesia which recently lowered the export levy for crude palm oil (CPO) to zero from US$200/metric tonne (MT).

This is due to the state’s efforts to pare down the high palm oil inventory as a result of the three-week palm oil export ban in May.

Based on our plantation analyst’s estimates, it may take up to three months for Indonesia to lower its inventory to the long-term average which may imply that Malaysian palm oil exports could face downward pressure until August.

According to Palm Oil Registration and Licensing Authority (PORLA), Malaysia’s palm oil shipments on a volume basis already turned negative in June at 15.8% yoy (May: +8.5%) indicating that growth has been driven by price factor.

In mining, the strong increase seen in June exports was a result of the high crude oil and LNG prices which peaked during the month.

As O&G-related products’ exports mimic the crude oil prices movements, we think the O&G shipment values are likely to follow the downward trend in prices. Meanwhile, June exports for E&E products were still among the highest.

However, we think shipments will start to come down in the quarters ahead. Global semiconductor sales which indicate the boom-bust cycles of the sector, are pointing at lower growth indicating a more normalised demand in the E&E space.

Weaker trade balance in 2Q 2022

With June trade data released, 2Q 2022 trade balance appears to be lower at RM58.1 bil vs RM65.0 bil in 1Q 2022.

However, the border re-opening from May and the subsequent arrival of foreign tourists could offset the weakened trade balance given that there are more inflows into the services account.

For now, we maintain our current account surplus forecast for the year at 1.7% of gross domestic product (GDP) (2023F: 2.1%). – July 21, 2022

Nazmi Idrus is chief economist at CGS-CIMB Research.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.