MALAYSIAN vehicle sales will slow for the remainder of 2022 as the ongoing global semiconductor shortage limits the ability of automakers to ramp up production to meet robust demand.

Nevertheless, Fitch Solutions Country Risk & Industry Research expects demand for vehicles to remain high despite the low inventory for new vehicles from Malaysia’s two largest automakers by volume – Perodua and Proton – to continue limiting total sales.

“We anticipate Malaysia’s automotive industry to remain in a challenging environment for the remainder of 2022,” the research house which is independent of Fitch Ratings pointed out in an automotive sector commentary.

“Lockdowns in mainland China due to the ongoing COVID-19 pandemic and the associated potential supply chain disruptions of various vehicle components (which include semiconductor devices) will continue to pose challenges for Malaysia automakers.”

Supply chain constraints to delay Malaysia’s vehicle sales recovery

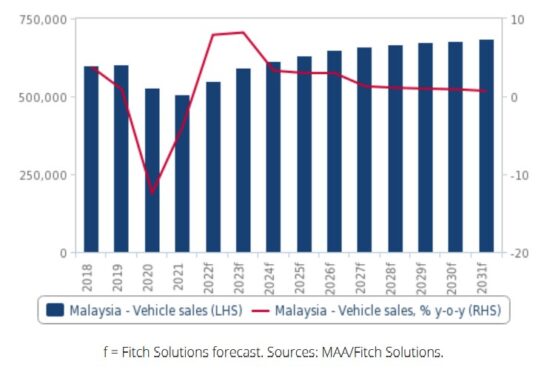

Malaysia: Total Vehicle Sales (2018-2031F)

The research house said the pending expiration on the Sales and Service Tax (SST) exemption due to expire in June 2022 will add further downside risks to its vehicle sales outlook.

“The exemption has also led to relative stability vehicle prices amid rising input costs for automakers from higher prices in key raw materials such as steel,” observed Fitch Solutions. “Indeed, the resumption of the SST on vehicles will result in some level of demand destruction as higher vehicle prices squeezes some willing buyers out of the car market.”

For that reason, the research house said it has also made a downward revision to Malaysia’s total vehicle sales by expecting sales to rise by 7.9% from its previous forecast of a 12% increase.

Total sales will thus reach 549,227 units which is still below pre-pandemic levels of 604,287 units posted in 2019.

Moreover, Fitch Solutions said upside risks to its outlook remains present as the Malaysian economy recovers from a pandemic-induced contraction. In this regard, the research house noted that its country risks team has forecast Malaysia’s GDP growth for 2022 to come in at 5.6% following a 3.6% rise in 2021.

Growth in private consumption, investment, an expansionary fiscal budget and the Malaysian economy benefiting from strong investment momentum into its domestic semiconductor industry are noted as the key drivers in rising economic activity.

“Indeed, Foxxcon is set to build a semiconductor manufacturing plant capable of producing 40,000 wafers per month for 28nm and 40nm. The spillover effects could translate into sustained vehicle demand despite the expiration of the SST exemption on vehicles,” projected Fitch Solutions.

“This could result in consumers opting for vehicle brands that have adequate inventory levels to meet demand resulting in a decline in market share of the top two national car brands.”

All-in-all, the research house said it holds a more positive outlook for vehicle sales in 2023 in line with the potential easing of supply chain disruptions.

“As a result, we forecast total vehicle sales to expand by 8.2% to reach a total of 594,020 units as vehicle inventory levels recover to meet consumer demand. Over our 2022-2031 forecast period, sales will expand by annual average growth rate of 3%,” added Fitch Solutions. – May 26, 2022