STRANGE bedfellows currently make up the unity government with Barisan Nasional (BN) and Pakatan Harapan (PH) component parties which were once at odds with each other now finding themselves seating on the same side of Dewan Rakyat.

With that in mind, AHAM Capital Asset Management Bhd (formerly Affin Hwang Asset Management Bhd) hoped that the new unity government – having commanded a two-third majority in Parliament – is able to close ranks and restore political stability to carry out the much needed fiscal and institutional reforms to attract foreign interest and invigorate the economy.

“These include broadening the country’s revenue tax base and rationalising a ballooning subsidy bill that is projected to hit RM80 bil this year,” AHAM Capital pointed out in a fundamental flash.

“If these reforms can be effectively carried out, we could see a reversal of foreign fund flows and help revitalise the local equity market.”

While the unity government has yet to be unveiled, expectations are that there would be a much leaner Cabinet comprising a mix of technocrats and politicians that would help drive economic policies.

“It will be important to monitor key Cabinet roles such as finance which could set the policy tone for other ministries,” stressed AHAM Capital.

Favourable technical

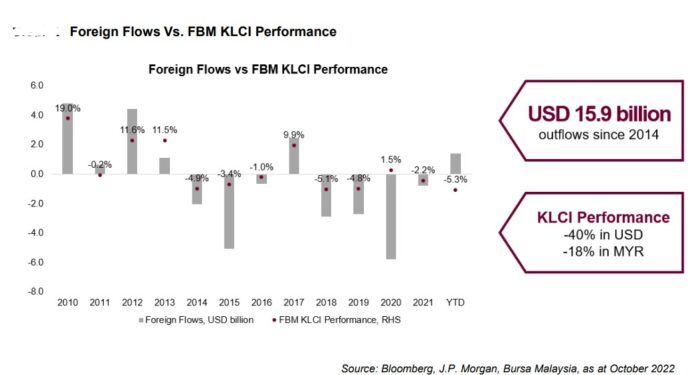

Mired by political instability, the local market has been stuck in the doldrums for the past few years. Since 2014 to-date, when 1MDB (1Malaysia Development Bhd) issues started hitting the market, the local equity market fell by over 18% in ringgit terms (40% in US$ terms) as US$15.9 bil worth of portfolio monies flowed out.

Foreign shareholding reached a 10-year low as political uncertainty dissuaded foreign investors from ploughing money. Domestic institutional funds have been also highly cashed-up as they sit on the side-lines.

“Crucially, if there is a return of political stability and a growth story, foreign inflow could drive our markets higher,” opined AHAM Capital. “In every year between 2010 and 2021, whenever there is net foreign buying, our market has been driven positively higher.”

With emerging clarity and successful execution of policies, however, AHAM Capital expects a gradual ascend for the local market to “as it climbs over walls of worry in the political sphere”.

“The first obstacle is when Prime Minister (PM) Datuk Seri Anwar Ibrahim tests his parliamentary majority through a vote of confidence on Dec 19 when Parliament convenes,” noted AHAM Capital.

“With low positioning and foreign funds underweight Malaysia, we could see as much as RM10 bil in terms of foreign inflows, should foreign investors neutralise their benchmark-weights in Malaysia as confidence grows with greater clarity.”

Nevertheless, AHAM Capital projected that while it is still early stage, “Malaysia could emerge as a prime growth destination for reinvestment and political stability in the region after being out of the radar for so long”.

“We’ve seen strong appetite for Malaysia as evidenced by the sharp gains seen in the local market when Anwar was appointed as PM which ended the political impasse,” observed AHAM Capital.

“The rally was broad-based across sectors and driven by both domestic and foreign inflows suggesting that investors are willing to re-look at Malaysia again for opportunities.” – Nov 30, 2022

Main photo credit: Concorde Hotel Kuala Lumpur