MALAYSIA loses billions of ringgit annually due to economic crime which is an act in violation of criminal law designed to bring financial reward to the offender. Economic crime also involves illegal business activity.

The United Nations (UN) and World Economic Forum (WEF) estimate the global cost of corruption at 5% of the world’s gross domestic product (GDP).

With a 2024 GDP of US$115 tril, this equates to US$6 tril per annum of global stolen funds. This figure is higher than the annual GDP of Japan, the world’s third-largest economy.

Malaysia lost RM277 bil to corruption. between 2018 and 2023, according to the Malaysian Anti-Corruption Commission (MACC). This translates to about RM55 bil/year or RM1,608 for every Malaysian.

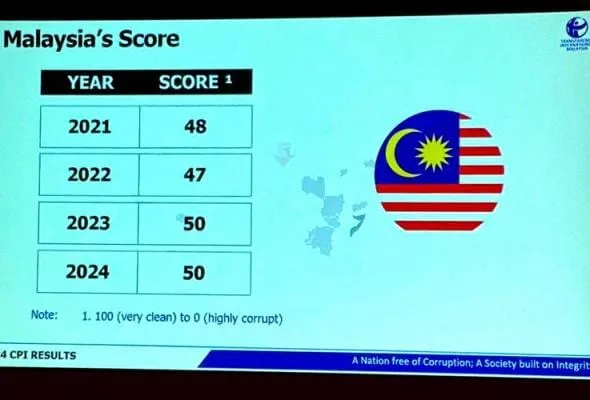

In the latest Corruption Perception Index (CPI) released by Transparency International, Malaysia’s score remained unchanged at 50 out of 100 whereby 100 is defined as very clean and 0 highly corrupt.

All in all, Malaysia is ranked 57th out of 180 countries globally surveyed in the 2024 results.

Shadow economy

Apart from corruption, another significant contributor to economic crime in Malaysia is the shadow economy.

Also known (for obvious reasons) as the underground economy, it is a significant cause of tax revenue losses with some estimates suggesting the value being as high as 30.2% of the Malaysian GDP.

Shadow economy operates in a murky environment that often goes undetected, notably failure to comply with laws, regulatory reporting requirements and association with criminal activities.

Examples of shadow economy activity include smuggling of weapons, tobacco and drugs, prostitution, tax evasion, illegal and online gambling, passport fraud and human trafficking. However, its scope does not end there.

Beyond that, shadow economy also encompasses unregistered formal sectors and unreported income from the production of legal goods and services such as unlicensed businesses, freelancers, part-time workers and the cash economy.

This includes the substantial income from informal work that is generated by those who have permanent employment. In some cases, informal income can be larger than one’s permanent income.

Money laundering

The UN Office on Drugs and Crime estimates that between 2% and 5% of global GDP or about US$800 bil to US$2 tril is laundered each year.

Based on these figures, we can estimate that Malaysia’s economic cost of money laundering is about RM55 bil per year.

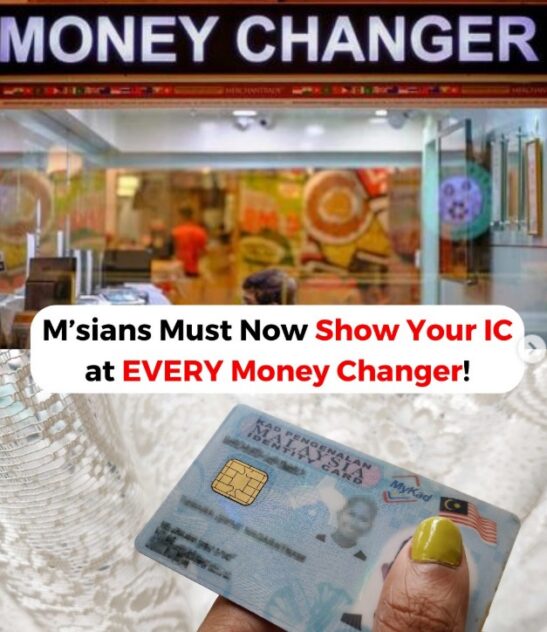

Money changers are the ideal conduit for money laundering activities as they deal in hard cash and tend to work in cohorts with their foreign counterparts.

Hawala – a popular and informal value transfer system based on the performance and honour of a huge network of money brokers – is set to become the largest illegal trade in Malaysia by overtaking narcotics and other illegal activities

Businesses with minimal activities such as restaurants, laundromats, hair salons and car wash act as the front companies for these illegal activities.

Last year alone, Bukit Aman’s Commercial Crime Investigation Department reported of 41,701 commercial crime cases involving more than RM3 bill in losses. The overall debts arising from this case is a staggering RM48.8 bil.

Crucial action

How is Malaysia faring in terms of tackling economic crimes and reining in corruption?

If we look at the illegal tobacco trade, Malaysia has been losing RM5 bil in tax revenue every year. The Customs director-general has adopted a no-nonsense, no-forgiveness approach to fighting corruption which has resulted in a reduction of smuggled or illicit cigarettes.

In 2024, this firm action enabled the Customs to collect RM65.57 bil in revenue or RM9.57 bil more than the projected RM56 bil.

With regard to the 1MDB case, criminal trials are on-going. Efforts to recover stolen assets have resulted in RM29.75 bil being returned to the Malaysian government as reported by MACC.

However, are these actions and results sufficient? Can we afford to lose so much money to these illegal activities?

How is this impacting Malaysia’s economic and social development? A cursory check of the ministries’ budgets shows that RM1 bil could build four district hospitals or four-lane roads stretching 50km or 5,000km of kampung roads

At the end of the day, the authorities must enforce the law; ensure enforcement agencies are well led; ensure transparency and accountability; and stand firm in sanctioning offenders.

It goes without saying that economic crime poses a significant barrier to Malaysia’s development and prosperity, thus hindering progress and eroding public trust in government and institutions. – March 25, 2025

Datuk Seri Dr Akhbar Satar is the Malaysia Integrity and Governance Society (MIG) president.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.

Main image credit: AzerNews